“Money is gold, nothing else,” J. P. Morgan famously said in 1912.

The US investment bank, JP Morgan Chase, named after its founder is following this mantra after announcing plans to deliver US$4 billion of gold bullion to New York ahead of the expiry of futures contracts traded on Comex.

JP Morgan Chase is one of many bullion market players that have increased deliveries to the US ahead of potential import tariffs. This activity has seen Comex gold stocks risen by 14Moz, an increase of over 76% in the first month of the year.

These delivery notices are the second largest ever in the bourses history, over US$39 billion worth of gold, increasing the value of gold stocks in New York Warehouses to over US$84 billion.

It’s not just the US that is seeing an uptick in activity around gold. The UK’s Royal Mint has seen gold bullion sales rose 153 per cent in the final quarter of 2024. During January the time required to withdraw bullion stored in the Bank of England’s vaults has risen from a few days to between four and eight weeks.

With the US is looking to add tariffs of 25% on Canadian and Mexican goods, 10% now in place on China, and the threat of similar measures on the UK and EU has driven demand for the safe heaven metal. The Chinese, Mexican and Canadian Governments have in return threatened retaliatory measures on the import of US goods or services adding momentum to the migration to safe heaven investments such as gold.

The gold price has surged 7% in January, reaching its highest level ever, and many investment banks are suggesting the gold price could continue to rise to US$3,000/oz.

Gold equities are starting to see the translation of a higher gold price into higher share prices with the S&P/TSX Global Gold Index up 16% since the start of the year, this index consisting of 41 top gold mining companies.

It’s not just gold miners that are performing well, the Global X Gold Explorers Index (GOEX) is up 14% since the start of the year. GOEX covers a broad range of companies involved in the exploration of gold deposits.

Below we look a series of gold exploration companies, from more advanced exploration to initial reconnaissance stage, that are well positioned to take advantage of a rising gold price environment.

Sitka Gold – Advanced Stage Exploration

Sitka Gold (TSXV:SIG) (FSE:1RF) (OTCQB:SITKF), announced a sizable resource upgrade at its RC Gold Project, located in the Yukon, Canada, earlier this year.

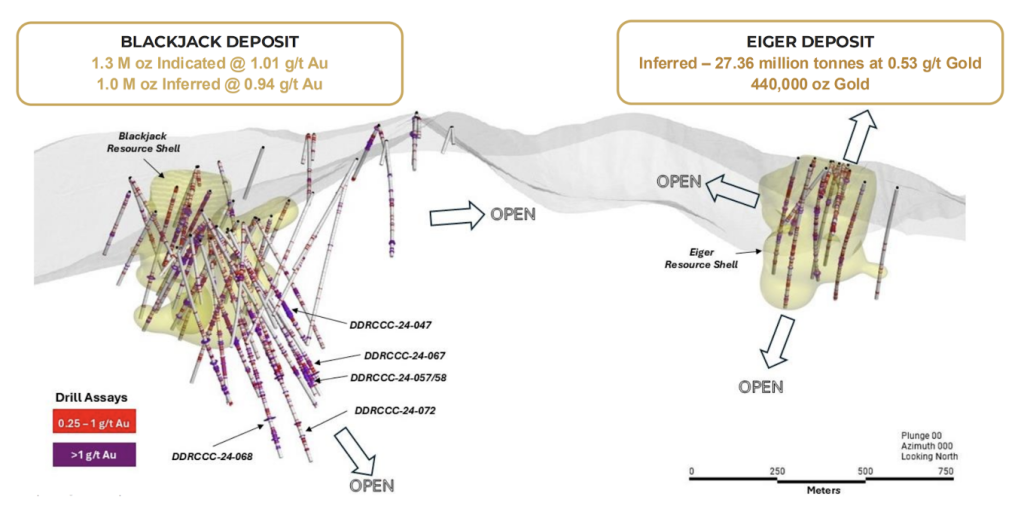

This updated resource estimate defined 2.8 million ounces of gold, from the Blackjack and Eiger deposits (Figure 1) and was a 2.5 times increase in the size of the resource base at the Blackjack Deposit, and rather impressively also increased the deposit’s average grade.

This latest resource estimate is far from definitive, as the RC Project, offers a lot of potential for further expansions both locally around the exiting resource bases and more regionally.

Blackjack Deposit has been defined with drilling from surface to a depth of 660m but it remains open in all directions, while drilling at the Eiger Deposit, located 2km away, has been much shallower and this also remains open in all directions.

Figure 1: Exploration Potential at the Blackjack and Eiger Deposits

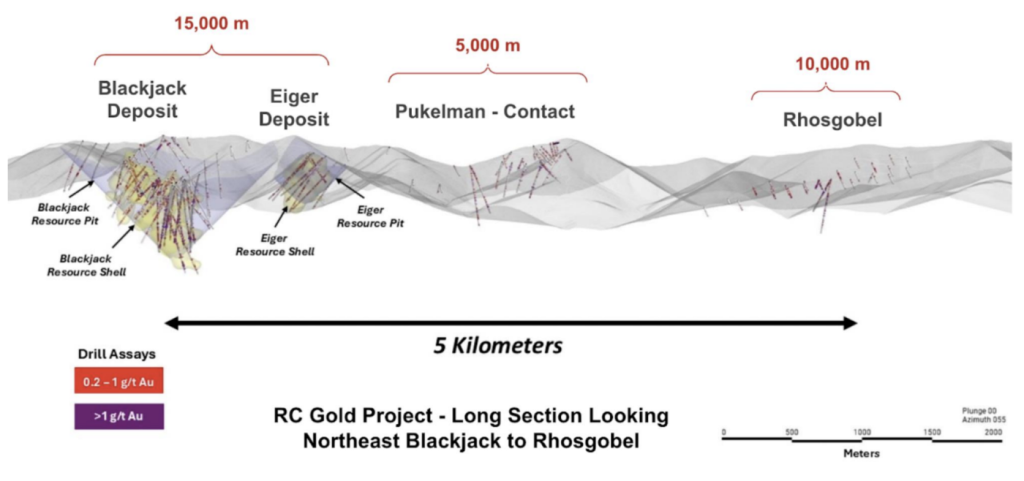

In addition to the near deposit exploration potential, there two other targets that have been drill tested and shown to contain significant gold mineralisation, Pikelman and Rhosgobel, located just 5 km from the Blackjack Deposit (Figure 2).

Figure 2: Local Exploration Potential at the RC Gold Project

At Pikelman, initial results include 343m at an average grade of 0.34g/t Au and 154m at 0.31g/t Au. While drilling at Rhosgobel returned 350.1m at an average grade of 0.4g/t Au and 119m at 1.05g/t Au.

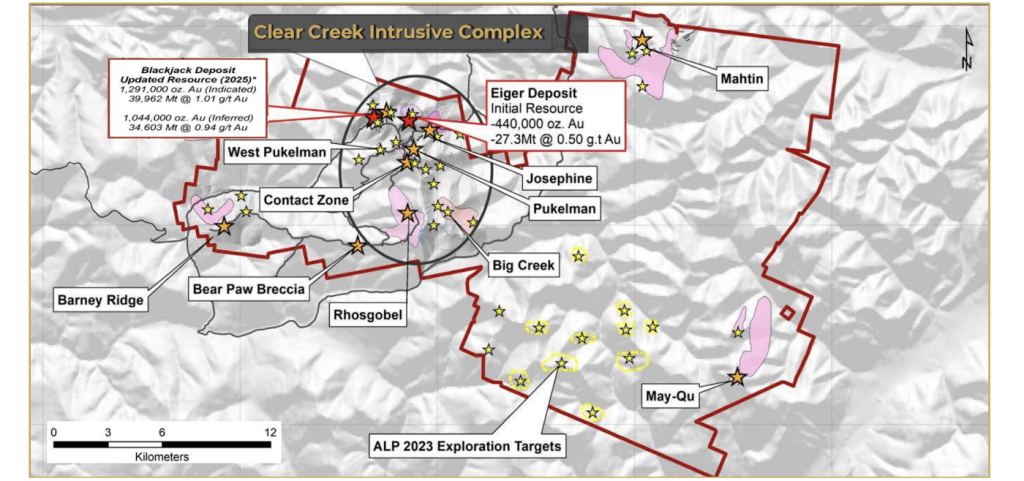

More regionally, the company has defined over 45 prospective targets for follow up exploration (Figure 3), making the RC Gold Project a stand out asset for junior company to own.

Figure 3: Regional Exploration Potential at the RC Gold Project

Initial metallurgical studies on the gold at Blackjack show it is not refractory and that it has high recoveries of up to 94%, boding well for future production.

Sitka plans an additional 30,000m of diamond drilling in 2025 (Figure 3), given that the company has only completed a total of 25,136m todate, there is a lot more to come from this company in 2025.

Ramp Metals – Early-Stage Exploration

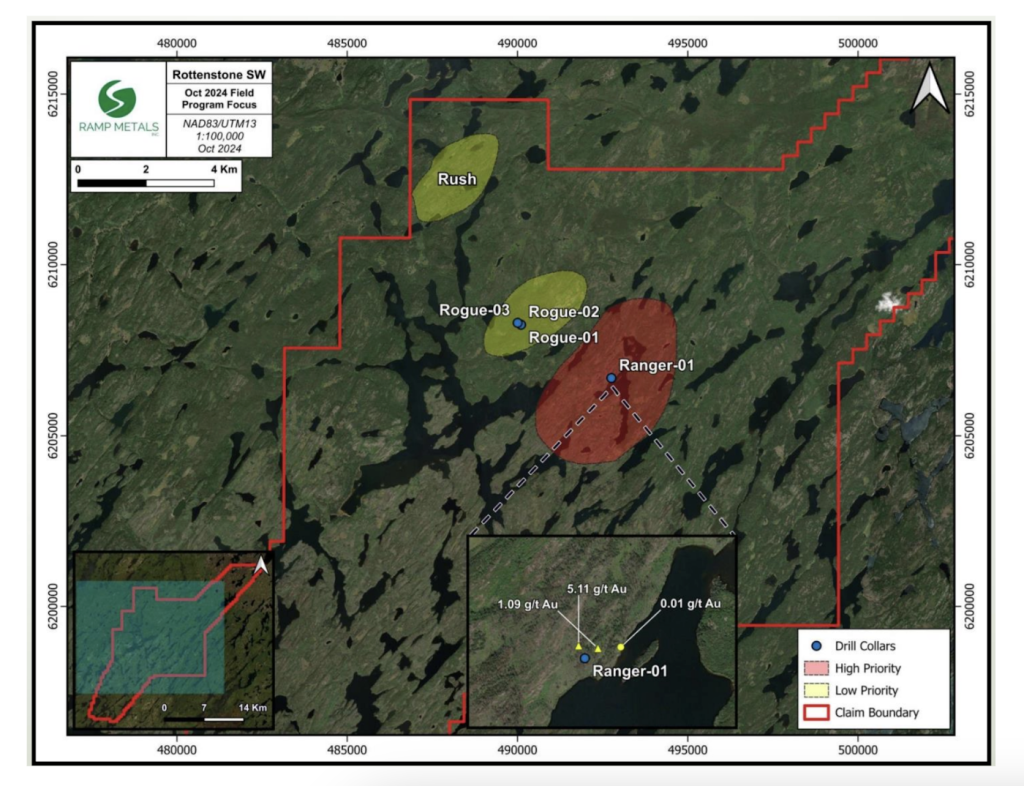

Ramp Metals (TSXV: RAMP) recently discovered large intersections of high-grade gold mineralisation at the Rottenstone SW Project, located in Northern Saskatchewan, Canada.

Ramps maiden drill programme consisted of just four initial holes totalling 1,180 meters (Figure 4), but despite being in an area that had never been drilled before all four holes returned significant intersections of anomalous gold, including 7.5 m at an average grade of 73.55 g/t gold from 227 m (Ranger-01).

Figure 4: Initial Drilling at Ramp Metals’ Rottenstone SW Project

The exciting initial results attracted the attention of Eric Sprott and EarthLabs, who supported a C$4.9 million placing at the end of last year, ensuring the company is well funded to complete follow-up exploration.

Ramp is currently planning a programme of geophysics to define drill targets in the winter drill programme.

Fairchild Gold – Reconnaissance Stage

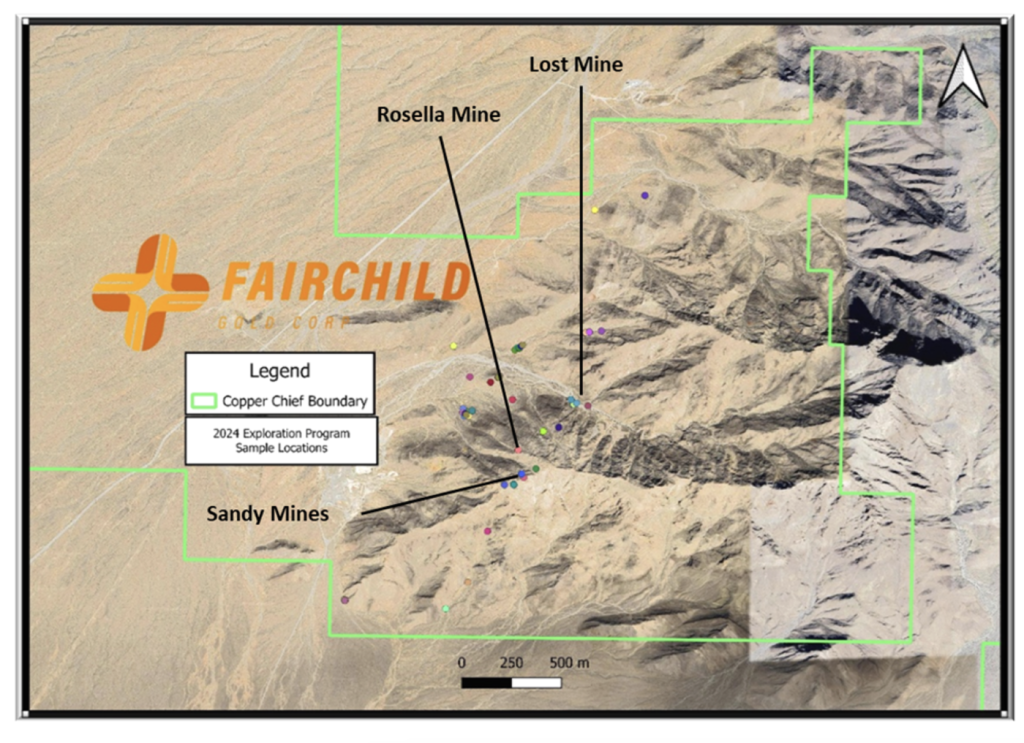

Fairchild Gold Corp. (TSXV: FAIR) is in the early stages of exploration at its Copper Chief copper and gold project, located 35 km Southwest of Las Vegas, Nevada.

Initial surface sampling at the project defined high-grade copper, gold and silver as well as widespread anomalous platinum and palladium between the Sandy Mines and the Lost Mine (Figure 5). These results come from within a wider target area that covers a 2.9km by 1.7 km zone of historic workings and anomalous samples.

Figure 5: Location of the Copper Chief Property

The assay results include:

- 8.90% Cu and 1.1g/t Au from the Sandy South Mine

- 1.35% Cu from the Sandy North Adit

- 0.61% Cu and 0.5g/t Au from the Lost Mine

- 0.49% Cu and 515g/t Ag from the Rosella Mine

- 0.37% Cu and 0.6g/t Au from the Sandy Southwest Adit

Fairchild is now preparing to follow up on these interesting results with initial exploration at the Copper Chief and Copperside Mines targets, alongside a helicopter-supported regional mapping and sampling programme to assess some of the project’s more remote targets at the end of January and beginning of February.