After a sharp selloff in equity markets triggered by Trump-initiated trade wars, a glimmer of optimism emerged last Friday, as stocks staged a rebound. The catalyst? A combination of cooling inflation data and unexpectedly soft retail sales figures, which together hint that the U.S. Federal Reserve might pivot toward rate cuts sooner than expected. With trade tensions still simmering, investors are navigating a landscape shaped by macroeconomic shifts and monetary policy speculation. Let’s dive into the latest developments, explore their implications, and highlight trends for investors to watch.

Inflation Takes a Breather, Easing Pressure

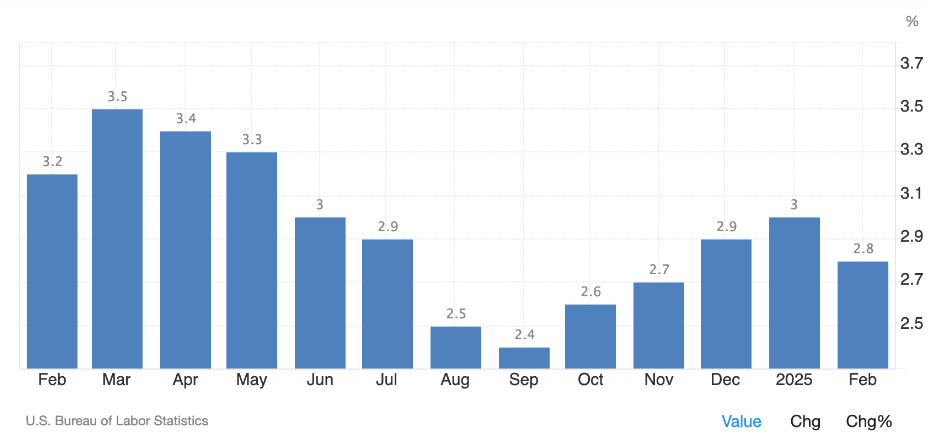

Inflation in the U.S. showed signs of retreat in February, offering a reprieve for markets rattled by persistent price pressures. The Consumer Price Index (CPI), as reported by the U.S. Bureau of Labor Statistics, dropped to 2.8% YoY, down from 3% in January, and slightly below the market’s expectation of 2.9%. On a monthly basis, CPI edged up by 0.2%, a marked slowdown from January’s 0.5% rise. This cooling suggests that the Fed’s previous rate hikes are starting to tame inflation, potentially opening the door for a more accommodative policy stance.

Source: U.S. Bureau of Labor Statistics via tradingeconomics.com

The easing of inflation is a positive signal for equity markets. Investors may find this environment more supportive for growth-oriented sectors.

Retail Sales Disappoint, Signaling Caution

Consumer spending, a key driver of economic growth, came in weaker than anticipated. February retail sales rose by a modest 0.2%, a rebound from January’s 1.2% decline but missing the consensus forecast of a 0.7% increase. This sluggish performance reflects growing caution among consumers, likely exacerbated by fears of a recession fueled by Trump’s tariff initiatives and escalating trade war risks. While the equity market’s recent uptick suggests some optimism, the softness in retail sales underscores lingering economic fragility that investors can’t ignore.

Weak retail sales highlight potential cracks in consumer confidence, which could weigh on sectors reliant on discretionary spending, such as retail and luxury goods. We believe consumer spending may remain subdued in the near term as trade uncertainties persist, but a potential Fed rate cut could bolster confidence later in 2025, encouraging a gradual recovery in retail activity.

*This article and research coverage is paid for and commissioned by issuers. See the bottom of this article for other important disclosures, rating, and risk definitions.