PyroGenesis Inc. (TSX: PYR, OTCQX: PYRGF), a Montreal-based advanced plasma technology company focused on sustainable industrial solutions, has finalized a non-brokered private placement loan totaling up to $5.75 million. This financing arrangement is with P. Peter Pascali, the company’s President and CEO, marking a related-party transaction.

The loan has a non-refundable upfront fee of $300,000, and will be disbursed in up to three tranches, with the final tranche expected no later than June 16, 2025. It carries a structured interest rate of 5% annually for the first year, increasing to 18% per annum thereafter, with monthly interest payments. PyroGenesis has the option to prepay the loan balance at any time with five days’ prior written notice. The loan matures three years after the effective date.

In addition to the loan, PyroGenesis has issued share purchase warrants to Mr. Pascali, allowing subscription for up to 12,554,585 common shares at a price of $0.458 per share. This price reflects the volume-weighted average trading price of PyroGenesis shares on the Toronto Stock Exchange over the ten trading days preceding the loan agreement. The warrants will expire four years from the loan’s effective date and are subject to a hold period of four months and one day, in line with securities regulations.

The loan is secured by a hypothec covering all movable and immovable property owned by PyroGenesis, providing the lender with collateral protection. The Toronto Stock Exchange has conditionally approved the loan and warrant issuance, pending customary post-closing conditions.

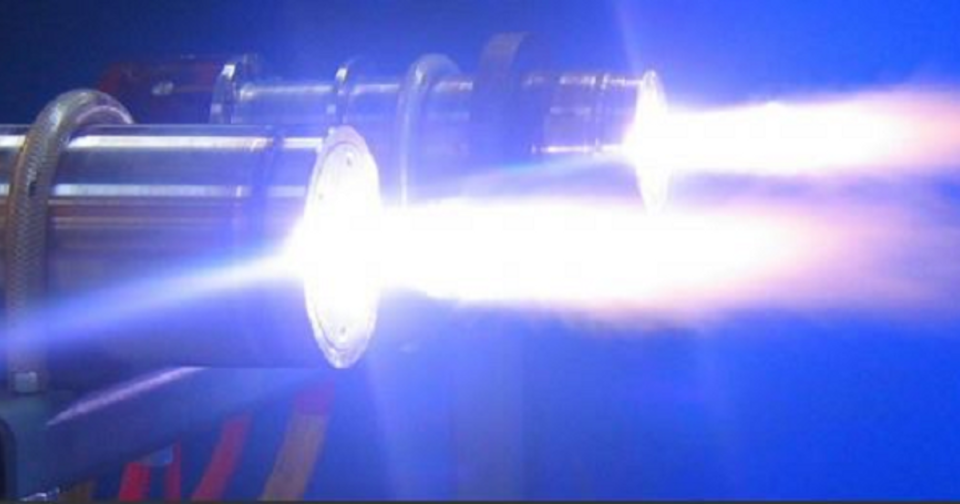

PyroGenesis plans to deploy the net proceeds from this financing primarily for working capital and general corporate purposes. The company’s advanced plasma technologies are aimed at supporting heavy industries in their transition to cleaner energy, emission reduction, commodity security, and waste remediation.

With a focus on innovation, PyroGenesis develops proprietary plasma solutions that serve multiple large markets including iron ore pelletization, aluminum production, waste management, and additive manufacturing. Operating out of its Montreal headquarters, the company maintains certified manufacturing facilities and a team of engineers and scientists dedicated to advancing sustainable industrial processes.

The loan and warrant issuance reflect PyroGenesis’ strategy to strengthen its financial position while continuing to commercialize its cutting-edge plasma technologies. This financing structure aligns management’s interests with those of shareholders, as the CEO’s involvement as lender and warrant holder underscores confidence in the company’s growth prospects.

PyroGenesis continues to position itself at the forefront of sustainable industrial technology, leveraging advanced plasma processes to deliver economically attractive alternatives to traditional, environmentally harmful methods. The company’s ongoing financing efforts aim to fuel growth and innovation in sectors critical to global energy transition and environmental stewardship.