Stillwater Critical Minerals is strategically focused on advancing the Stillwater West project with a primary goal of expanding the mineralization outlined in the 2023 Mineral Resource Estimate (MRE). The 2025 drilling campaign will test new targets identified through the updated 3D geological model across a 12-km-long anomaly. The updated 3D model has significantly advanced the geological understanding of the lower Stillwater Igneous Complex, effectively doubling the strike length from 9.5 to over 20 kilometres.

The 2023 MRE was based on five Platreef-style sulphide deposits delineated within the original 9.5 km core area. Building on this, the 2025 drill campaign, launched in June 2025, is targeting the mid- to high-grade polymetallic sulphide zones both within the existing five deposits and in adjacent, untested extensions along the extended strike zone. We believe that the doubling of the strike coverage (from 9.5 km to 20 km) increases the potential for resource expansion and supports an updated MRE, which is expected to be larger than the 2023 MRE.

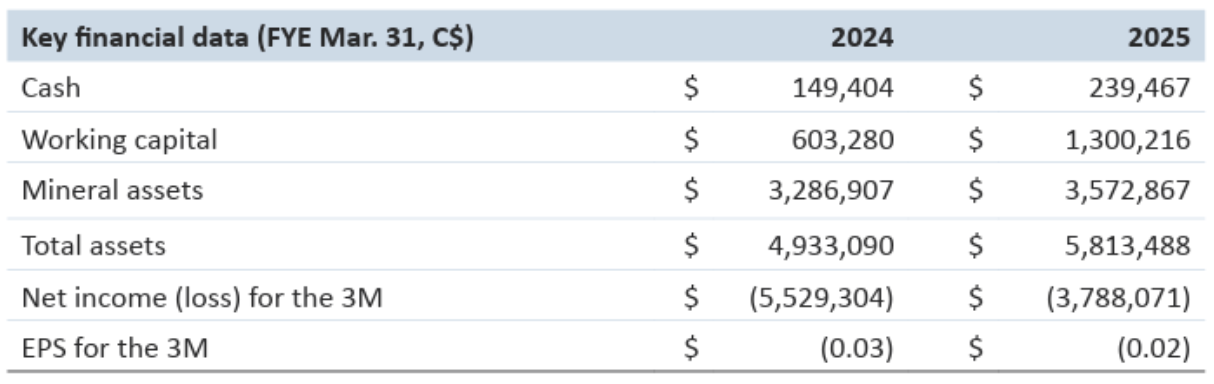

The recent C$7 million capital raise ensures sufficient liquidity to fund the 2025 drill program. Glencore exercised its rights to participate in the funding, further reinforcing its confidence in Stillwater’s exploration upside. Glencore’s support de-risks the project, providing confidence that the 2025 drill program will be fully executed as planned.

Furthermore, Stillwater is exploring the potential for carbon sequestration and geological hydrogen production as part of its commitment to sustainability, with the prospect of integrating these elements into upcoming mining plans. These endeavours position Stillwater as a leading U.S. company in meeting the growing demand for critical minerals and supporting the green energy transition.

Investment Highlights

- Stillwater Critical Minerals Corp. (TSX-V: PGE) (“PGE”, or “Company”) is a junior mining company with a focus on battery metals, via its flagship asset, Stillwater West in Montana, USA.

- 2025 drill program targets resource expansion: The 2025 drilling campaign will test new targets identified through the updated 3D geological model across a 12-km-long anomaly. The updated 3D model has significantly advanced the geological understanding of the lower Stillwater Igneous Complex, effectively doubling the strike length from 9.5 to over 20 kilometres.

- Glencore’s support signals confidence in Stillwater’s growth potential: Glencore holds a 15.4% equity interest in PGE, positioning it as an anchor investor and a key technical partner. Glencore has invested $7.04 million to date and retains the option to maintain or increase its stake with additional funding. We note that Glencore exercised its rights to participate in the recent $7.0 million financing raised by PGE, further reinforcing confidence in Stillwater’s exploration upside. Glencore’s support de-risks the project, providing confidence that the 2025 drill program will be fully executed as planned.

- Potential for geologic hydrogen production: Stillwater is advancing carbon sequestration and geological hydrogen production, with the prospect of integrating these elements into upcoming mining plans. These endeavours position Stillwater as a leading U.S. company in critical minerals and the green energy transition.

- Based on our analysis and valuation models, we are maintaining our BUY rating and updating our fair value per share estimate to $0.45 per share, from $0.23 per share.

This report has been prepared by an analyst on contract with or employed by Couloir Capital Ltd. The analyst certifies that the views expressed in this report, which include the rating assigned to the issuer’s shares as well as the analytical substance and tone of the report, accurately reflect his or her personal views about the subject securities and the issuer. No part of his / her compensat ion was, is, or will be directly or indirectly related to the specific recommendations. Couloir Capital, its affiliates, and their respective officers, directors, representatives, researchers, and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Couloir Capital may have provided, in the past and may provide, in the future, certain advisory or corporate finance services and receive f inancial and other incentives from issuers as consideration for the provision of such services. Couloir Capital has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate, but cannot be guaranteed. This document does not consider the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g., prohibitions to investments due to law, jurisdiction issues, etc.) that may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before making an investment. Couloir Capital will not treat recipients of this document as clients by virtue of having viewed this document.