Experian (LSE: EXPN), a global leader in data and technology, has integrated Incode Technologies, Inc. into its Ascend Platform, boosting its fraud prevention and identity verification capabilities. This collaboration aims to deliver faster, more accurate identity validation to Experian’s extensive network of over 1,800 clients worldwide, spanning industries such as financial services, automotive, healthcare, and digital marketing.

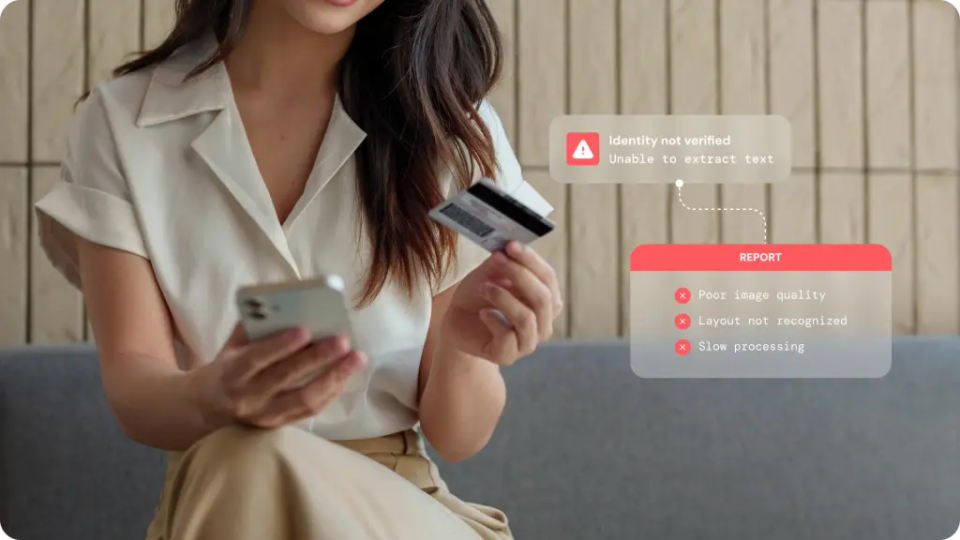

The integration brings Incode’s AI-powered identity verification technology into Experian’s CrossCore Document Verification suite, initially available in North America, with plans to expand globally. Incode leverages advanced AI to verify identity elements including government-issued IDs, facial recognition, liveness detection, and real-time metadata analysis. This addition strengthens Experian’s ability to fight increasingly sophisticated fraud tactics like synthetic identity and application fraud while maintaining a smooth and secure user experience.

Experian’s Ascend Platform itself is a cloud-based technology hub designed to unify various analytical and fraud prevention tools under one interface. It simplifies decision-making for businesses by combining data, AI, and machine learning to enhance credit strategies, marketing, and risk management. The integration of Incode’s technology enhances these tools by adding an extra layer of precision and speed to identity verification processes.

Marika Vilen, Senior Vice President of Global Partnerships and Commercialization at Experian, emphasized the importance of this partnership, noting that the addition of Incode’s cutting-edge technology allows organizations to make decisions with greater speed and confidence. She highlighted that the collaboration enables companies to tailor their fraud and risk strategies with a level of agility that wasn’t previously possible.

For its part, Incode brings over a decade of experience in AI-driven biometric authentication to the table. Founder and CEO Ricardo Amper pointed out that combating fraud today requires solutions that can keep pace with rapid advancements in AI-driven fraudulent activities, including deepfakes and agentic AI. He expressed enthusiasm about the partnership’s ability to address major fraud risks while maintaining an intuitive user experience.

This partnership reflects broader trends in cybersecurity where businesses must continuously evolve their defenses in response to increasingly complex identity fraud methods. The combination of Experian’s broad data ecosystem and Incode’s AI verification tools represents a significant step forward in this fight.

Beyond fraud protection, Experian’s mission involves simplifying financial decisions and enabling access to credit through data-driven solutions. The addition of Incode’s biometric capabilities to the Ascend Platform underscores Experian’s commitment to innovation in identity assurance, aiming to help both organizations and consumers achieve secure and efficient digital interactions.

Experian is headquartered in Dublin, Ireland, and operates globally with about 25,200 employees across 32 countries. As a FTSE 100 company, it provides services that span financial services, healthcare, automotive, agrifinance, and insurance sectors. Incode, similarly, works globally to deliver AI-powered identity verification, helping clients fortify their defenses against digital fraud.businesswire

This integration is a clear example of how technology companies are layering advanced AI solutions into existing platforms to tackle fraud with greater sophistication. For clients of Experian, the promise is faster, smarter identity verification processes that not only protect against fraud but also improve overall customer experience and operational efficiency.