Nvidia (NASDAQ: NVDA) has announced a $5 billion investment in Intel (NASDAQ: INTC), sending the chipmaker’s shares sharply higher in premarket trading. The investment, priced at $23.28 per share, is set to make Nvidia a roughly 4% stakeholder in Intel as both companies prepare to collaborate on developing chips for data centers and personal computers. Intel’s stock was up 27% at the open of the market before drifting back slightly.

This deal comes at a pivotal moment for Intel, a company once synonymous with Silicon Valley and personal computing dominance. Over the past decade, Intel struggled to keep pace with industry shifts, particularly the move to mobile computing and then the rapid surge in artificial intelligence that has fueled Nvidia’s remarkable rise. Nvidia, now a leader in AI chip technology, stepping in with this substantial investment signals renewed confidence in Intel’s turnaround under CEO Lip-Bu Tan, who took the helm earlier this year and has been focused on revitalizing Intel’s product strategy and capacity decisions.

Under the joint agreement, Intel will design custom CPUs for data centers that integrate Nvidia’s AI technology, specifically pairing Nvidia’s GPUs within Intel-based systems. For personal computing, Intel plans to build chips that incorporate Nvidia technology, aiming to create a more seamless experience between the two platforms. While Nvidia is not yet committing to have its chips manufactured by Intel, the alliance sets the stage for tighter integration in AI infrastructure, a field where both companies see major potential.

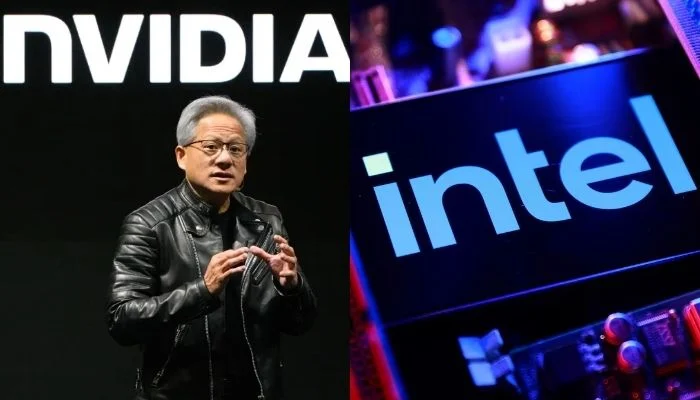

Nvidia CEO Jensen Huang described the collaboration as a “historic” fusion of two leading platforms, noting that the partnership will help lay groundwork for the next era of computing. Huang highlighted the complementary nature of Intel’s data center and client computing products combined with Nvidia’s AI and accelerated computing capabilities, suggesting the companies will expand their ecosystems together.

Intel’s stock had already attracted a boost recently when the U.S. government invested approximately $8.9 billion for about a 10% stake, aiming to strengthen the company’s position in the global semiconductor race. Nvidia’s investment builds on that momentum, providing another vote of confidence from a key industry player.

The stock surge reflects market optimism about Intel’s future as Nvidia’s backing could enable more competitive offerings against rivals like AMD (NYSE: AMD) and Taiwan Semiconductor Manufacturing Company (NYSE: TSM), which currently makes Nvidia’s leading processors. Intel’s new product designs for AI data centers and PCs combining Nvidia’s GPU expertise could become a compelling differentiator.

While regulatory approval is pending, the deal represents a significant moment in the chip industry. It acknowledges Intel’s ongoing challenges but also recognizes its enduring strategic value. More importantly, it demonstrates how the accelerating AI trend is reshaping tech partnerships, combining semiconductor prowess with specialized AI capabilities.