Fairchild Gold Corp. (TSXV: FAIR | FRA: Y4Y) has signed a Memorandum of Understanding to acquire a 100% interest in the Golden Arrow Project, located along the Walker Lane Shear Zone, Nevada. Golden Arrow is an advanced exploration project with established historic resources and workings.

We value the total consideration for the acquisition at US$5.0 million, or US$12/oz in the ground, based on the historic resource estimate of 420,000 ounces of gold.

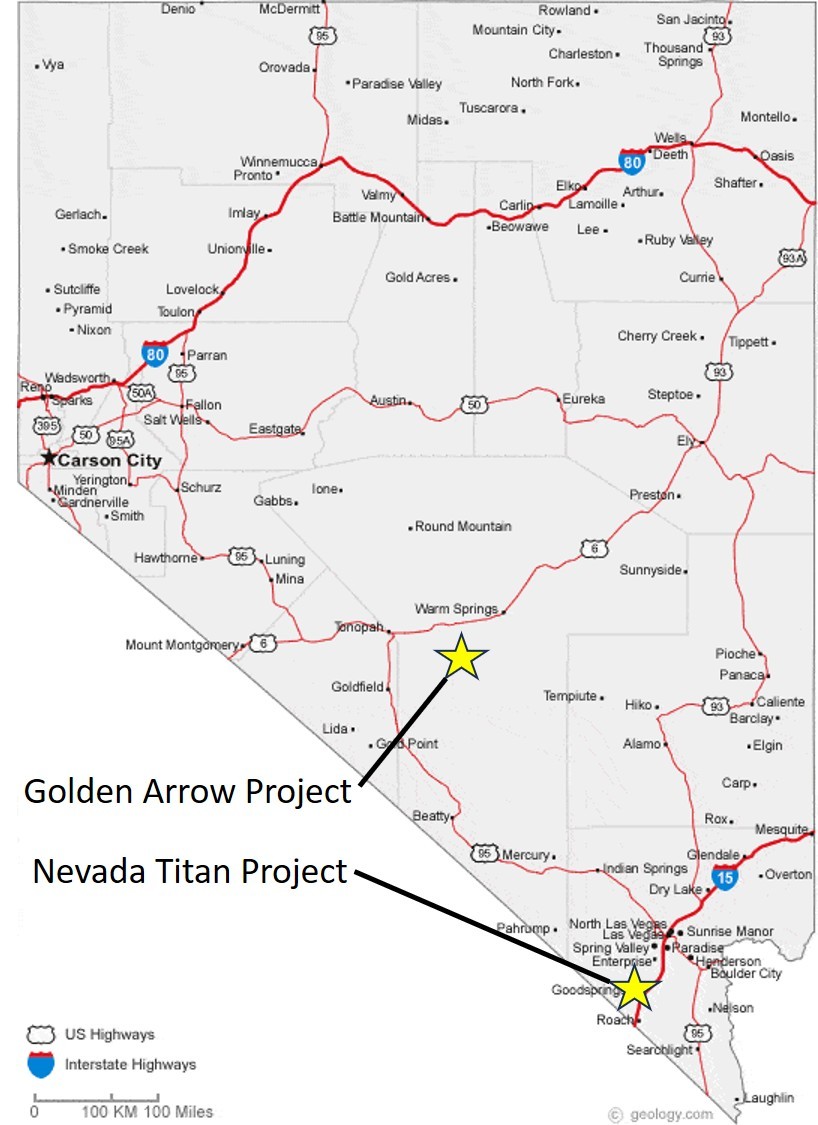

Once completed, this acquisition will increase Fairchild’s ground holding by 170% to 64.5km2 through the Gold Arrow and Nevada Titan Projects (Figure 1), giving the company a large footprint in one of the world’s most favourable mining districts.

Figure 1: Location of the Golden Arrow Project and Nevada Titan Project

Golden Arrow Project

The Golden Arrow Project covers an area of 40.5 km2 and is located approximately 64 km east of Tonopah, Nevada, and about 96 km east of Kinross Gold Corporation’s (TSX: K, NYSE: KGC) Round Mountain Gold Mine, which is estimated to have contained 28 million ounces of gold.

History

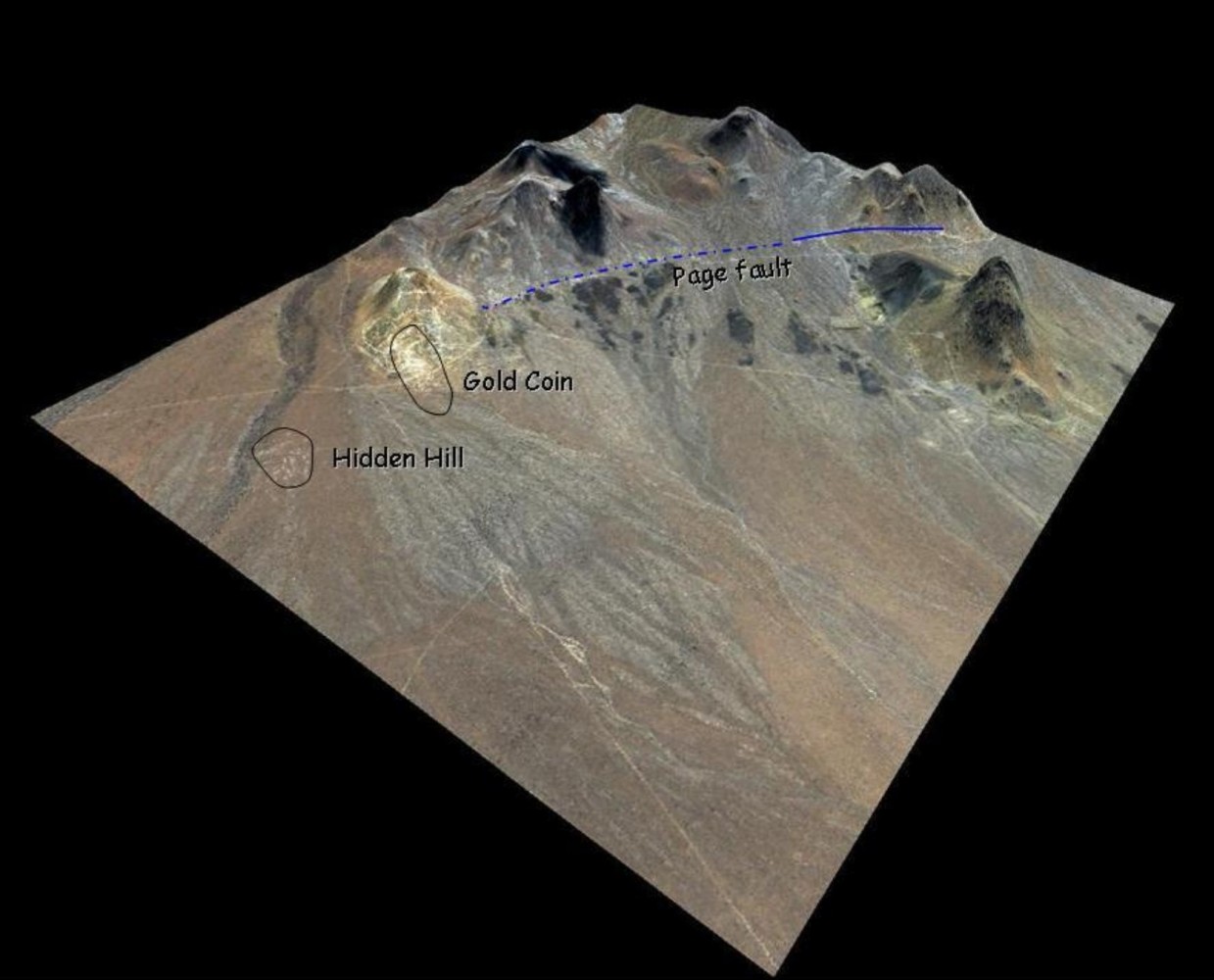

Gold was first discovered in this Golden Arrow area in 1905, and by 1917, gold was being extracted from the Hidden Hill, Gold Coin Deposits and along the Page Fault Zone (Figure 2). These operations focused on mining high-grade gold-quartz veins and tabular breccia bodies, with ore occurring in lenses and shoots, to depths of 150m.

Figure 2: The Gold Coin and Hidden Hill Deposits

| Source: Emergent Metals Corp.

Gold production in the area began to decline in the 1930s, and by 1942, mining activity had ceased. The amount of gold produced over this period is unknown.

Since 1981, 12 companies have conducted exploration programmes at Golden Arrow. Their work included geochemical and geophysical testing, geologic mapping, and diamond and reverse-circulation percussion drilling totalling 61,268 m (361 holes). Limited metallurgical testing has also been conducted.

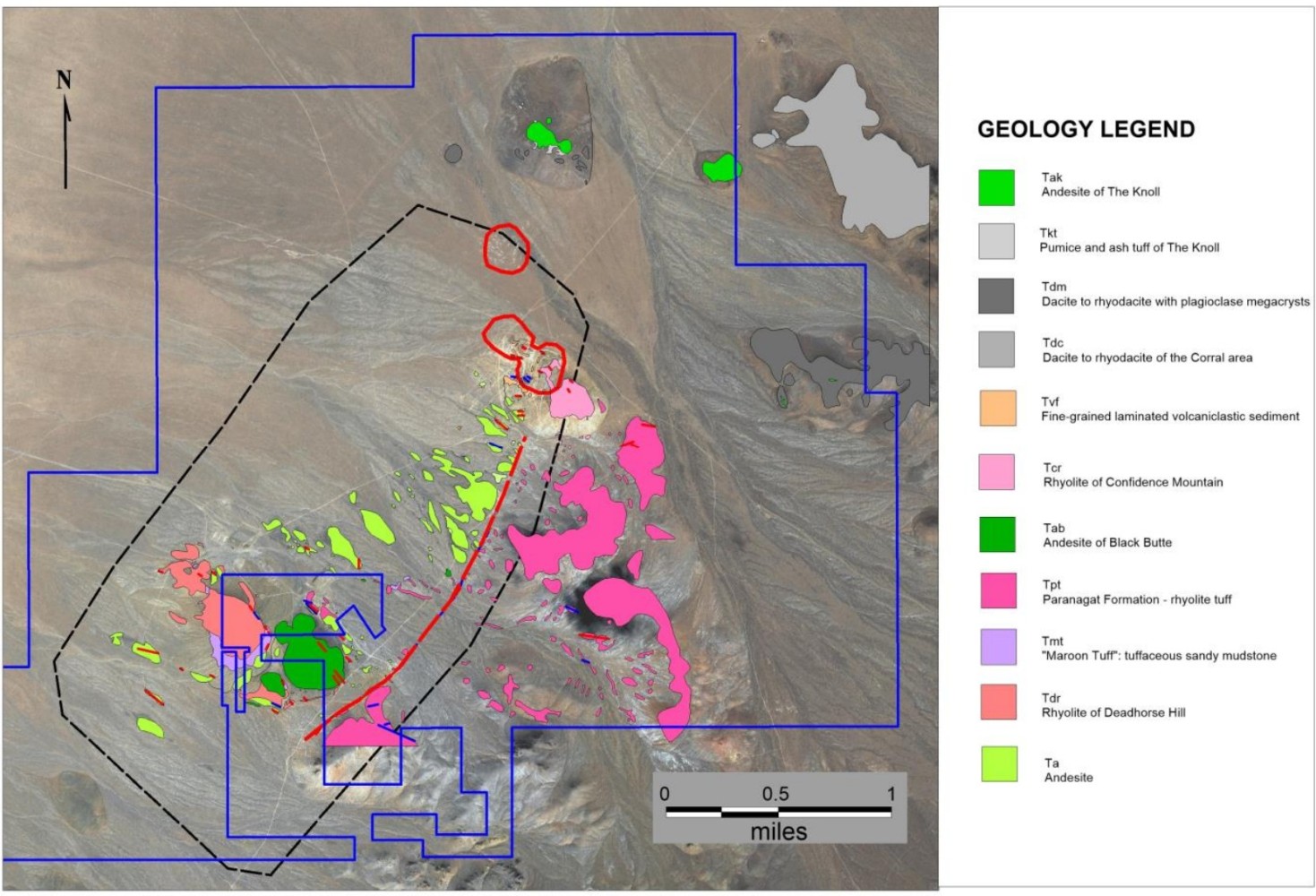

Geology

The Golden Arrow Project is underlain by andesitic to rhyolitic volcanic and volcaniclastic rocks (Figure 3). The most prominent structure visible in the surface geology is the Page Fault Zone, which extends across the property from a northeast to north trend, terminating at Confidence Mountain (Figures 2 & 3).

Numerous historic prospects and shafts exploited veins and mineralised breccia lenses along the Page Fault Zone. Gold was also historically extracted from two other areas, Hidden Hill and Gold Coin.

The gold-silver mineralisation at Golden Arrow is a volcanic-hosted low-sulfidation epithermal that appears to have been overprinted by a later high-sulfidation epithermal system. The historic drill results demonstrate that precious metals exist in both high-grade vein-hosted mineralisation and in more widespread, disseminated mineralisation within both the Gold Coin and Hidden Hill Deposits.

Figure 3: Geology of the Golden Arrow Project

| Source: Emergent Metals Corp.

Resource Base

The Golden Arrow Project contains a total historic mineral resource estimate of 420,000 ounces of gold at an average grade of 0.75g/t Au and 11.27g/t Ag that comes from both the Gold Coin and Hidden Hill Deposits.

Around 355,000 ounces at an average grade of 0.84g/t Au and 11.25g/t Ag are contained within the measured and indicated categories, and an additional 65,000 ounces at an average grade of 0.45g/t Au and 11.31g/t Ag are contained within the inferred category.

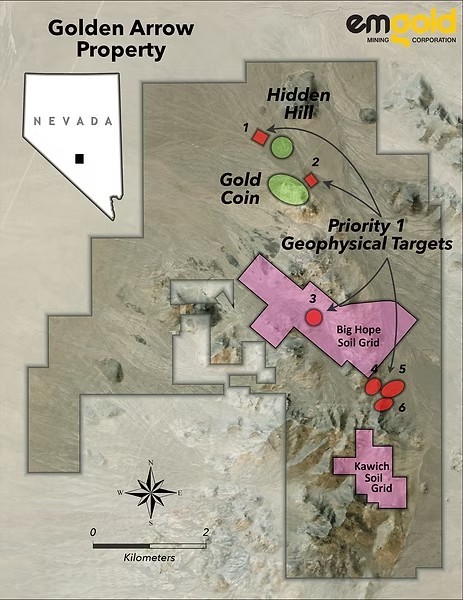

Exploration Targets

The previous operator of the project identified 34 prospective targets for follow-up exploration based on geophysics and a review of the historic data. These targets include six high-priority targets, 10 medium-priority targets, and 18 low-priority targets.

Two of the high-priority targets are in the vicinity of Gold Coin and Hidden Hill Deposits, and four high-priority targets are in the vicinity of the Big Hope and Kawich soil sampling targets (Figure 4).

Figure 4: Exploration Targets at the Golden Arrow Project

Transaction Terms

The Memorandum of Understanding (MOU) states that both Fairchild and Emergent Metals agree to negotiate and execute a Definitive Purchase Agreement within 30 days.

The US$5.0 million purchase of the Golden Arrow Project will be satisfied through US$250,000 payable upon signing of the MOU (paid, non-refundable) and US$350,000 payable upon receipt of approval from the TSX-V.

In addition, Fairchild shall also issue 12.5 million shares to Emergent Metals once regulatory and exchange approvals are received. Fairchild will issue a US$3.5 million senior secured note to Emergent Metals that carries an interest rate of 8.5%, payable semi-annually and matures 5 years from the date of the Definitive Agreement. Emergent Metals will also receive a 0.5% Net Smelter Return (NSR) Royalty over the project.

Appointment of Guy Lauzier

As part of the transaction, Fairchild will expand its Technical Advisory Board with the appointment of Guy Lauzier , who will act as Technical Director for the Golden Arrow Project.

Guy Lauzier is a seasoned mining engineer and consultant with decades of experience advancing major gold and base metal projects worldwide. Over his career, he has held senior technical and leadership roles with leading mining companies, including Barrick Gold, Newmont, Agnico Eagle, and Teck Resources, where he contributed to mine development, feasibility studies, and large-scale operations.

Disclaimer

This newsletter has been published by Mining and Metals Research Corporation (“the Company”). The information used to compile the article has been collected from publicly available sources and the Company cannot guarantee the 100% accuracy of those sources. This communication is intended for information purposes only and does not constitute an offer, recommendation, solicitation, to make any investments. Nothing in this communication constitutes investment, legal accounting or tax advice, a personal recommendation for any specific investor. The Company do not accept liability for loss arising from the use of this communication. This communication is not directed to any person in any jurisdiction where, by reason of that person’s nationality, residence or otherwise, such communications are prohibited. The Company may derive fees from the production of this newsletter.

MMRC holds 608,333 shares in Fairchild Gold Corp.