Think back a couple of years. TikTok burst onto the scene as this addictive video app that hooked everyone from teens dancing in bedrooms to brands chasing viral fame. Behind it all sat ByteDance Ltd., a Beijing powerhouse that built the platform into a global juggernaut. But in the U.S., that success hit a wall of worry. Lawmakers fretted over data flowing to China and algorithms possibly swaying public opinion. Congress stepped in with a tough law: sell the U.S. piece or face a nationwide ban.

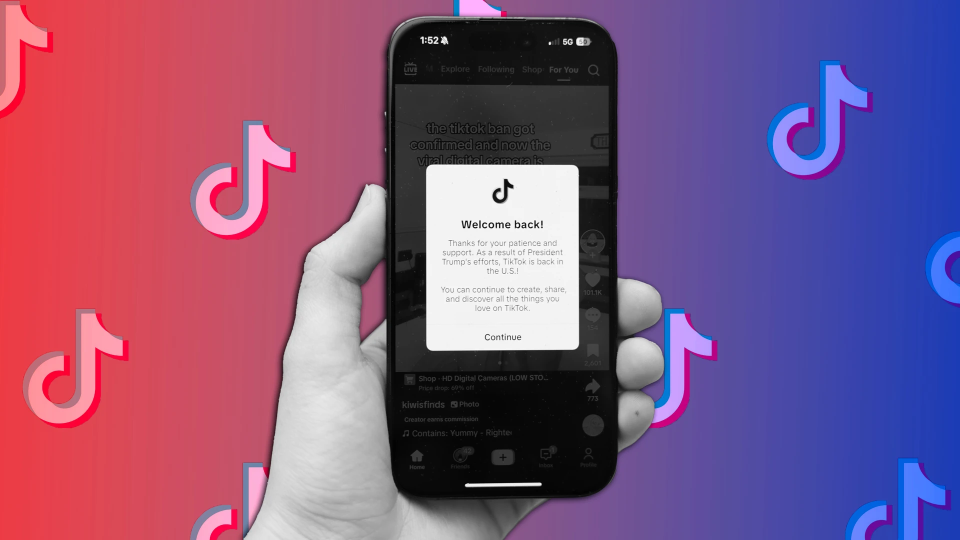

Fast forward to late 2025. President Trump, fresh off his re-election, threw his weight behind a fix. He talked it up with China’s leaders and signed an executive order greenlighting a sale that met security rules. Enter TikTok CEO Shou Zi Chew, who just sent a memo to staff announcing the deal was done. TikTok agreed to spin off its U.S. operations into a new joint venture called TikTok USDS Joint Venture LLC. The buyers? A mix led by Oracle Corporation (NYSE: ORCL), private equity player Silver Lake, and Abu Dhabi-based MGX. Together, they grab 45% ownership, with each holding 15%. Affiliates of ByteDance’s current backers take another 30.1%, while ByteDance keeps 19.9% to stay under the legal cap. Chew pegs the close for January 22, 2026, though more steps remain.

ByteDance Ltd. started in 2012 as a scrappy news aggregator in China. It exploded with apps like Douyin at home and TikTok abroad, pulling in over $155 billion in 2024 sales, much from international arms. The company values itself north of $330 billion these days. Yet U.S. regulators saw risks in its control over American user data and the famous recommendation engine. The new setup changes that. Oracle steps up to store U.S. data and retrain the algorithm solely on American info. Content moderation for stateside users falls to the joint venture too. Global ByteDance still handles e-commerce, ads, and marketing for the U.S. app, keeping some ties intact.

Numbers tell the real story here. Vice President JD Vance floated a $14 billion valuation for the U.S. unit back in September. That looks cheap next to analyst guesses of $30 billion to $40 billion, or even wilder $100 billion shots with the full algorithm baked in. TikTok U.S. already serves 170 million users and rings up over $10 billion yearly. Why the discount? Profit splits. ByteDance licenses the algorithm for a cut, maybe 20% of related revenue, plus its equity slice. Insiders say this nets ByteDance 50% or more of total U.S. profits post-deal, even with minority ownership. One ByteDance investor called it perfect: U.S. folks run the show, but cash flows back to Beijing.

Business angles sharpen the picture. For Oracle, this plugs into its cloud and data fortress, a bet on social media’s next wave. Silver Lake cashes in on tech turnarounds, while MGX brings Gulf money eyeing AI plays. They dodge a full algorithm handoff, which China likely blocked anyway. Geopolitics simmers underneath. Trump hailed Xi’s nod, framing it as mutual respect amid trade tensions. The law, dubbed PAFACA, targets apps tied to rivals like China. This deal threads the needle: America calms security fears, China keeps revenue streams, users keep scrolling.

Oracle retrains that addictive feed on U.S. data alone, easing spy worries. Yet questions linger. Will the app feel different without full ByteDance tweaks? Can new owners match the growth? TikTok proved apps can topple giants; now it tests if a hybrid model flies. Investors eye the close date closely. If it sticks, expect copycats in other hot sectors. For now, the saga shifts from ban threats to boardroom bets.