For much of the past decade, Mexican beer looked like one of the surest bets in the U.S. alcohol business, helped by changing demographics, a taste for imports, and marketing that made brands like Modelo and Corona household names. That story changed in 2025, when retail sales of Mexican beer in the U.S. slipped, and Dos Equis felt the chill more sharply than its rivals.

According to NIQ data shared by Bump Williams Consulting, retail sales of Dos Equis in the U.S. fell 8% in 2025, a meaningful decline in a category that had been associated with steady growth. Modelo and Corona, by comparison, each saw sales drop about 2%, which is still a setback but far less severe than what Dos Equis experienced. Those numbers raise a basic question for business readers, which is why Mexican beer lost momentum at all, and why this brand in particular took the hardest hit.

Several forces were working against Mexican beer in the U.S. in 2025. Higher prices across the beer aisle, driven by input costs and premium positioning, ran into consumers who were already stretched by broader inflation and were trading down to cheaper options, including domestic brands and value packs. At the same time, drinkers who wanted flavor or novelty increasingly wandered into hard seltzers, canned cocktails, and spirits, which chipped away at occasion after occasion where an imported lager might once have been the default choice.

Demographic and political currents also played a subtler role. The long rise of Mexican beer in the U.S. was closely tied to the growth and economic influence of Hispanic consumers, who helped popularize these brands and made them a staple for non-Hispanic drinkers as well. In recent years, however, immigration policy debates and shifting sentiment toward Mexico and the border have added a layer of cultural tension that can affect how some consumers relate to Mexican brands, even if they do not say so directly in surveys. That does not mean the political climate is the main driver of sales declines, but it is part of the background in which every marketing decision now lands.

Competitively, Dos Equis faces a tougher task than Modelo or Corona, which have become category leaders with dominant shelf space and strong mindshare. Modelo has captured attention as the top selling beer in America in recent years, while Corona still enjoys powerful brand recognition linked to leisure and summer, which helps cushion both from modest category downturns. Dos Equis, by contrast, sits in a more crowded middle ground, and an 8% drop in 2025 suggests that its identity has not been as clear or compelling to casual drinkers as that of its larger competitors.

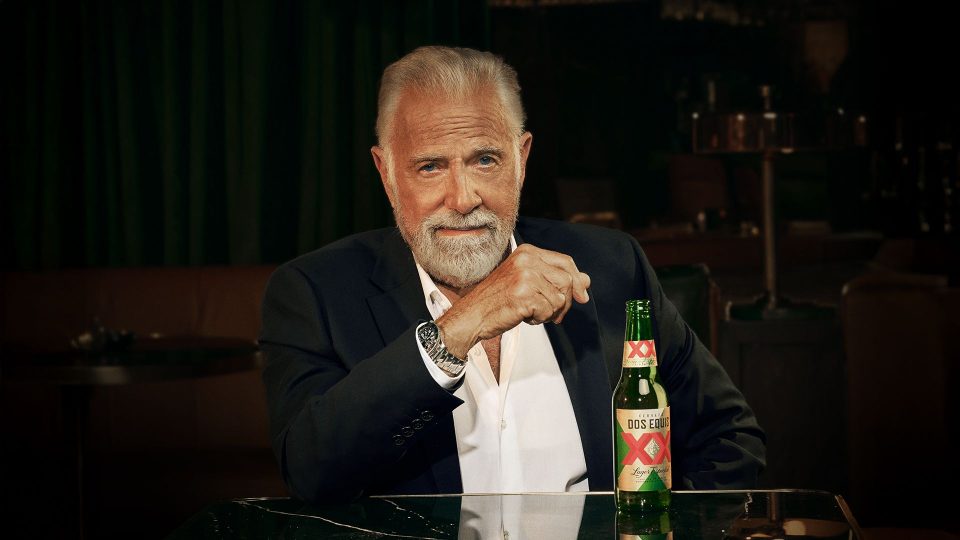

To address this slide, Dos Equis is returning to the campaign that once put it on the map, reviving “The Most Interesting Man in the World” after roughly a decade away from U.S. screens. First launched in 2006, the campaign featured a silver haired adventurer whose exaggerated exploits and deadpan tag line, “I do not always drink beer, but when I do, I prefer Dos Equis,” turned a relatively small import into a cultural reference point. The tone of those ads was self aware and witty, which helped them travel far beyond paid placements and into social media, late night jokes, and everyday conversations.

The commercial impact of that original run was significant. Industry reports and brand analyses describe how Dos Equis sales roughly doubled between 2006 and 2015, the period when the character anchored its advertising in the U.S. One review of beer category performance found that in 2009 alone, during the early years of the campaign, Dos Equis sales jumped around 22%, at a time when many other mainstream brands were flat or shrinking. For a company looking back at its own history, it is easy to see why this campaign feels like a proven lever rather than a nostalgic indulgence.

The decision to bring the most interesting man back in 2026 is therefore more than a creative choice, it is a response to a tougher U.S. market for Mexican beer and a recognition that brand storytelling can matter as much as price and distribution when consumers are reconsidering what they buy. Whether this move reverses an 8% sales decline will depend on how well the new version of the character connects with a younger generation that has far more options in its fridge, and whether Dos Equis can again stand out in a crowded field of imports, crafts, and canned cocktails.