Think about the last time spotty internet disrupted a work call or slowed data pulls from a remote site. Businesses and governments often face such frustrations in areas where traditional cables cannot reach. Satellite internet offers a way around those issues by sending high speed connections from space, and fresh competition now stirs the market. Blue Origin, backed by Jeff Bezos, enters with TeraWave, a network aimed at enterprise users, data centers, and government clients.

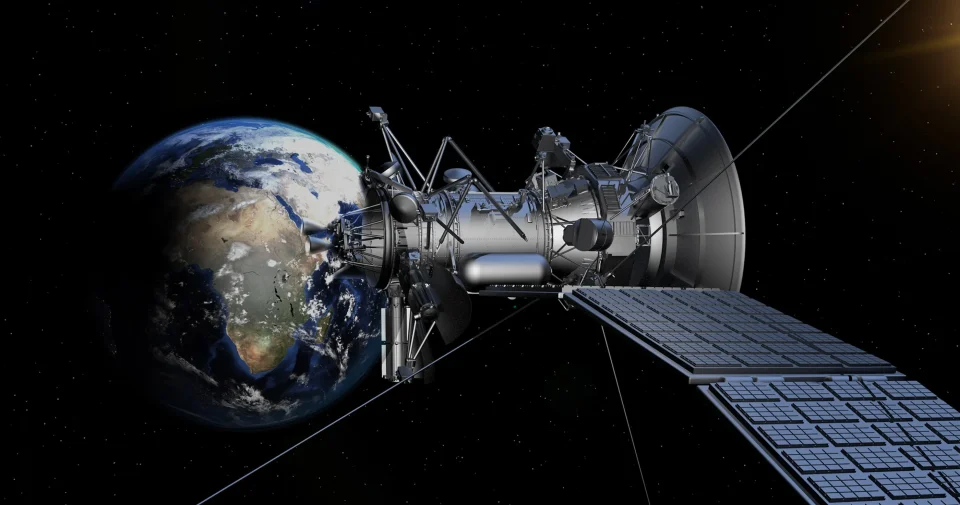

Satellite internet relies on groups of small satellites placed in low Earth orbit, between 300 and 1,200 miles above the planet. These satellites bounce signals from users on the ground to major internet hubs. Older satellites sat much higher, around 22,000 miles up, which caused delays in communication. New low orbit designs drop that wait time to under 100 milliseconds, much like fiber optic lines. Download speeds reach 100 to 500 Mbps or more, supporting video streams, cloud computing, and large file transfers.

Established players already shape this field. SpaceX operates Starlink with more than 9,000 satellites in orbit by early 2026, serving homes, ships, planes, businesses, and governments. Amazon.com, Inc. advances its Project Kuiper with thousands of satellites planned for broad coverage, while its newer consumer network, rebranded as Leo, targets around 3,000 satellites in low orbit. Eutelsat runs OneWeb, with roughly 650 satellites focused on business mobility and partnerships with phone carriers.

These systems address practical needs. Factories in rural areas send machine data without new cables. Offshore oil platforms or mines share sensor information instantly. Military outposts connect where wires fail. Starlink proved its worth in conflict zones and after disasters. Kuiper runs tests toward full service by late 2026. OneWeb blends its signals with ground networks for steady links. The industry pulled in over $8 billion last year, with projections to $20 billion by 2030 as AI and remote operations demand more bandwidth.

TeraWave brings a distinct approach. Blue Origin plans 5,408 satellites, with 5,280 in low orbit using radio links for up to 144 Gbps per user and 128 in medium orbit offering optical connections up to 6 Tbps. Deployment starts in the fourth quarter of 2027, launched by their New Glenn rocket. The focus falls on customers needing equal upload and download speeds, extra backup paths, and quick scaling. Data centers link global sites securely. Enterprises add space routes to avoid fiber outages from storms or cuts. Governments secure sensitive traffic.

More contenders prepare to join. Telesat in Canada readies Lightspeed, a smaller set of 198 satellites for priority business service. Viasat combines with Inmarsat to mix low and medium orbit coverage. China builds GuoWang toward 13,000 satellites for home and international use. AST SpaceMobile develops direct connections to cell phones without extra dishes. Prices fall as rivals multiply, with terminals dropping from thousands to hundreds of dollars and business plans under $100 monthly.

Obstacles remain. Crowded orbits raise concerns over signal clashes and debris. Solar activity can interrupt links. Terminals require clear skies and power. Regulators like the U.S. FCC allocate frequencies and watch for interference. Still, satellites excel where fiber or cell towers fall short, such as polar regions or open seas.

TeraWave tests a focused strategy against broader rivals. Blue Origin leverages its launch progress for reliable builds. Early enterprise contracts could secure steady income. Starlink leads in scale, Kuiper in reach, Leo in homes, yet high end niches open doors. Orbital networks grow from emergency tools to core connections for global business.