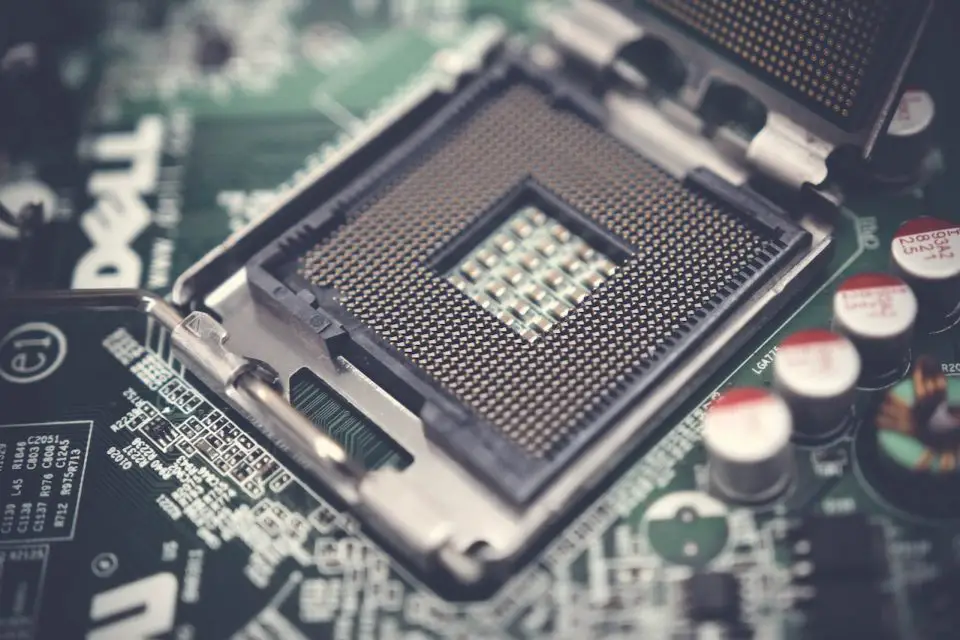

Nvidia, the tech giant known for its record revenue and remarkable year-over-year growth, finds itself at a pivotal juncture as its grip on the AI chips market faces threats from its competitors. While its stock prices surge and industry behemoths clamor for access to its latest chips, the likes of AMD and Intel are far from idle, actively building their own AI chips to challenge the dominance of Nvidia.

Notably, AMD and Intel, two long standing rivals, are determined to erode Nvidia’s lead in the burgeoning AI sector. With strategic efforts to bolster their AI endeavors, they aim to undermine Nvidia’s stronghold. Even the top-tier customers of Nvidia, including Google, Microsoft, and Amazon, are taking matters into their own hands by developing custom AI chips, aiming to reduce dependency on Nvidia’s offerings.

Though Nvidia’s position in the market remains strong, the recent stumble of Intel, once the pinnacle of advanced chip-making, serves as a cautionary tale. Industry experts caution that complacency could lead to a loss of supremacy. Forrester research director Glenn O’Donnell warns, “Things can change pretty dramatically in this industry,” drawing a parallel to Intel’s decline and emphasizing the potential vulnerability Nvidia faces.

Presently, Nvidia commands a significant market share estimated at 80% to 95% in AI chips. However, as rivals intensify their AI efforts, this dominance is projected to diminish. According to Moor Insights and Strategy CEO Patrick Moorhead, AMD and Intel are poised to introduce competitive AI offerings for both training and inference, potentially shifting the landscape. Even emerging players like Groq have showcased prowess in specific AI models and workflows.

Intel’s recent surge in demand for its AI products, especially its Gaudi line of AI chips, underscores the competitive landscape. CEO Pat Gelsinger noted the expanding pipeline of opportunities, exceeding $1 billion through 2024. Additionally, Intel’s Falcon Shores, a next-generation AI platform, aims to challenge Nvidia and AMD’s formidable systems, though its launch will now be delayed until 2025.

AMD, with its MI300 platform featuring combined CPU and GPU offerings, holds a promising position. Despite lacking significant customer announcements upon its June launch, both AMD and Intel are poised to directly challenge Nvidia. Research director Glenn O’Donnell remarks, “[AMD and Intel are] not going to overcome Nvidia, certainly not anytime in the next few years,” but acknowledges their capacity to make inroads into Nvidia’s market share.

Nvidia’s primacy faces multifaceted threats, including the rise of custom AI chips developed by major tech players like Microsoft, Google, Amazon, and Meta. These companies, equipped with their AI platforms, could potentially lessen their reliance on Nvidia’s offerings. Gene Munster, managing partner at Deepwater Asset Management, notes that the largest risk lies in these colossal cloud corporations seeking independent AI solutions.

However, Nvidia retains an advantage in its software capabilities, notably its proprietary CUDA programming model that leverages its chips’ parallel processing capabilities. This software-hardware synergy provides Nvidia an edge over rivals. According to Patrick Moorhead, this software realm remains a challenging puzzle for competitors to crack, forming a protective moat for Nvidia’s supremacy.

While Intel and AMD’s immediate threat might appear limited, Nvidia’s journey ahead demands unwavering innovation to sustain its leadership in the AI hardware landscape. As the market evolves and competitors sharpen their strategies, Nvidia’s continued success hinges on its ability to adapt and outpace the ever-growing competition.

Source: Yahoo Finance