TNR Gold Corp.

Royalties Ready to Pay Off Amid Rising Metal Prices

Published: Jan 21, 2026

Author: FRC Analysts

Disclosure: TNR Gold Corp. has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions.

Company Details

Sector – Research Report

Trading Information

Ticker & Exchange – TNR.V :TSXV

Report Highlights

- TNR is up 240% YoY, significantly outperforming the BetaShares mining royalty ETF, which is up only 17%.

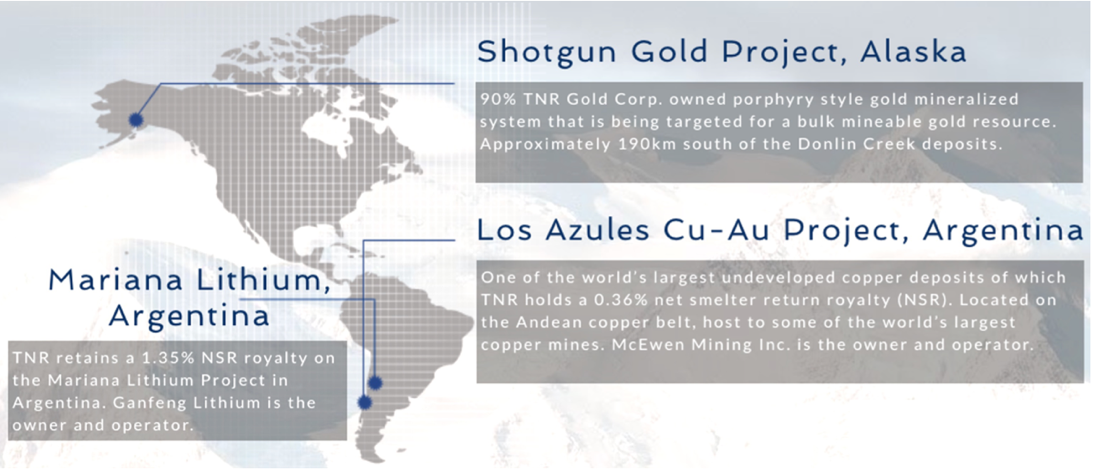

- The company is primarily a royalty business, which earns a percentage of revenue from projects operated by other mining companies. Its portfolio includes the Shotgun gold project in Alaska, and royalties on two advanced projects in Argentina: the Mariana lithium project owned by Ganfeng Lithium (SZSE: 002460, Market Cap $27B), and the Los Azules copper-gold project owned by McEwen Inc., a private company controlled by renowned mining executive Rob McEwen, and several institutions.

- TNR is awaiting its first royalty payment, expected this quarter, as Ganfeng began production at its Mariana lithium project last year. Based on current spot prices, we estimate TNR could earn US$1.60M annually in royalties. Receiving this first payment will be a major milestone, marking TNR’s transition into a revenue-generating royalty company.

- We believe the timing of these royalties is ideal, as lithium prices are rebounding strongly, up 109% YoY to US$23,000/t, though still below the 2022 peak of US$85,000/t. We expect the lithium rebound to continue as the market shifts from oversupply to deficit this year, with demand led by EVs, energy storage, and rapidly growing sectors like AI data centers, robotics, and automation.

- Regarding TNR’s second royalty, three recent developments increase confidence that McEwen will continue advancing the Los Azules copper-gold project, which is positive for TNR since production delays could affect revenue. First, McEwen completed a robust economic study (feasibility study). Second, the project was included in Argentina’s Large Investment Incentive Regime (RIGI), granting tax and export duty benefits. Third, copper prices are up 34% YoY to $5.82/lb, an all-time high.

- McEwen plans to begin construction in 2026, and start commercial production by 2029. We estimate TNR could earn US$5M annually in royalties at conservative copper prices, rising to US$8M at current spot prices.

- Upcoming catalysts include Mariana royalty payments, Los Azules construction, and development, and the possibility of a Shotgun JV partner.

Price and Volume (1-year)

| YTD | 12M | |

| TNR | 6% | 240% |

| TSXV | 10% | 77% |

| ETF* | 5% | 17% |

Royalties in two advanced-stage projects in Argentina+90% interest in the Shotgun gold project in Alaska100% owned by McEwen Inc. Located in the prolific Andes copper belt, 90 km north of Glencore’s (LSE: GLEN) El Pachon copper-molybdenum project Los Azules hosts one of the largest undeveloped copper resources in the world

Deposit size: ~4 km × 2.2 km × 1 km

Portfolio Summary

Source: Company

Los Azules Copper-Gold-Silver Project, Argentina ( TNR: 0.36% NSR) 2025 Resource Estimate (Exclusive of Mineral Reserves)

The opinions expressed in this report are the true opinions of the analyst(s) about any companies and industries mentioned. Any “forward looking statements” are our best estimates and opinions based upon information that is publicly available and that we believe to be correct, but we have not independently verified with respect to truth or correctness. There is no guarantee that our forecasts will materialize. Actual results will likely vary. The companies listed above are covered by FRC under an issuer-paid model, where fees have been paid to FRC to commission this report and research coverage. This creates a potential conflict of interest which readers should consider. Distribution procedure: our reports are distributed first to our web-based subscribers on the date shown on this report then made available to delayed access users through various other channels for a limited time. To subscribe for real-time access to research, visit https://www.researchfrc.com/plans for subscription options. This report contains “forward looking” statements. Forward-looking statements regarding the Company, industry, and/or stock’s performance inherently involve risks and uncertainties that could cause actual results to differ from such forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, continued acceptance of the Company’s products/services in the marketplace; acceptance in the marketplace of the Company’s new product lines/services; competitive factors; new product/service introductions by others; technological changes; dependence on suppliers; systematic market risks and other risks discussed in the Company’s periodic report filings, including interim reports, annual reports, and annual information forms filed with the various securities regulators. By making these forward-looking statements, Fundamental Research Corp. and the analyst/author of this report undertakes no obligation to update these statements for revisions or changes after the date of this report. Fundamental Research Corp DOES NOT MAKE ANY WARRANTIES, EXPRESSED OR IMPLIED, AS TO RESULTS TO BE OBTAINED FROM USING THIS INFORMATION AND MAKES NO EXPRESS OR IMPLIED WARRANTIES OR FITNESS FOR A PARTICULAR USE. ANYONE USING THIS REPORT ASSUMES FULL RESPONSIBILITY FOR WHATEVER RESULTS THEY OBTAIN FROM WHATEVER USE THE INFORMATION WAS PUT TO. ALWAYS TALK TO YOUR FINANCIAL ADVISOR BEFORE YOU INVEST. WHETHER A STOCK SHOULD BE INCLUDED IN A PORTFOLIO DEPENDS ON ONE’S RISK TOLERANCE, OBJECTIVES, SITUATION, RETURN ON OTHER ASSETS, ETC. ONLY YOUR INVESTMENT ADVISOR WHO KNOWS YOUR UNIQUE CIRCUMSTANCES CAN MAKE A PROPER RECOMMENDATION AS TO THE MERIT OF ANY PARTICULAR SECURITY FOR INCLUSION IN YOUR PORTFOLIO. This REPORT is solely for informative purposes and is not a solicitation or an offer to buy or sell any security. It is not intended as being a complete description of the company, industry, securities or developments referred to in the material. Any forecasts contained in this report were independently prepared unless otherwise stated, and HAVE NOT BEEN endorsed by the Management of the company which is the subject of this report. Additional information is available upon request. THIS REPORT IS COPYRIGHT. YOU MAY NOT REDISTRIBUTE THIS REPORT WITHOUT OUR PERMISSION. Please give proper credit, including citing Fundamental Research Corp and/or the analyst, when quoting information from this report. The information contained in this report is intended to be viewed only in jurisdictions where it may be legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations or which would require any registration requirement within such jurisdiction.