Exports of AI chips to China Halted

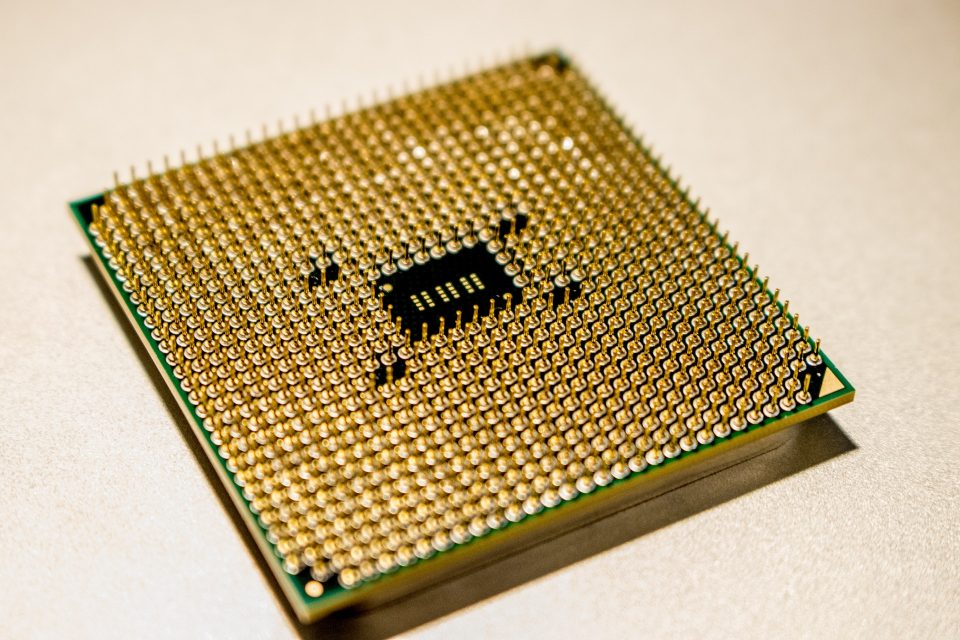

In a significant move to safeguard advanced US technologies and curb China’s military development, the Biden administration announced on Tuesday its decision to halt exports of artificial intelligence (AI) chips designed by companies like Nvidia and impose additional restrictions on chipmaking tools destined for China.

At the time of this publication, NVIDIA stock (NVDA) has witnessed a decline.

NVIDIA Corp

Current Value: $444.00

Change: -$16.95

Change Percentage: (-3.68%)

Trading Volume: 48.0M

Source: Tomorrow Events Market Data

The measures, unveiled by senior administration officials during a press briefing on Monday evening, aim to tighten controls on the exports of advanced AI chips and chipmaking tools to a range of countries, including Iran and Russia. Furthermore, two prominent Chinese chip designers, Moore Thread and Biren, have been blacklisted, further underscoring the administration’s commitment to limiting China’s access to cutting-edge technologies.

The new regulations signify a robust effort to close loopholes in existing policies released in October of the previous year. Commerce Secretary Gina Raimondo stated that the focus is on “advanced semiconductors that could fuel breakthroughs in artificial intelligence and sophisticated computers vital to (China’s) military applications.” The Biden administration is striving to strike a balance by preventing China from acquiring these technologies without causing significant economic harm.

Notably, last year’s regulations employed a dual assessment mechanism, evaluating chips based on their computing performance and communication capabilities. This approach enabled companies like Nvidia and Intel to create special chips tailored for the Chinese market that just slightly surpassed these limitations.

The newly issued rules, however, eliminate communication speed limits, placing more emphasis on computing performance. Consequently, the sale of Nvidia’s A800 and H800 chips for the Chinese market will come to a halt. Consumer chips used in laptops, smartphones, and gaming devices will generally be exempt from these restrictions, with some subject to licensing and notification requirements. The changes also include a prohibition on exporting chips to units of companies headquartered in countries like China, Macau, and others subject to U.S. arms embargoes.

In a move to prevent companies from circumventing restrictions, U.S. authorities introduced a new criterion for limiting chips based on “performance densities.” This criterion evaluates how much computing power can be packed into a specified area of silicon, with the aim of preventing companies from merging components called chiplets into a single chip that would otherwise violate the restrictions.

The regulatory landscape is expected to remain dynamic, with U.S. officials indicating that changes to the measures are likely to occur annually. This development exacerbates the ongoing technology conflict between the United States and China, intensifying tensions between the two global superpowers.

Prominent technology companies such as Nvidia, Intel, AMD, Moore Thread, and Biren are expected to be impacted by these rules and restrictions. However, Nvidia has expressed confidence that it will not face any “near-term meaningful impact on our financial results.” The company has been enjoying a surge in business since the October regulations were implemented. AMD has also outlined plans to employ a similar strategy to continue its operations in China.

The Biden administration’s primary objective, as reflected in these new regulations, is to shield U.S. technologies from Chinese access while avoiding significant economic repercussions. The implications of these changes will continue to unfold, but it is evident that the restrictions will remain in place for an extended period.

Source: Reuters