The stock market exhibited a subdued start on Tuesday, with cautious investors examining indicators suggesting the exuberant rally in November might be reaching its zenith.

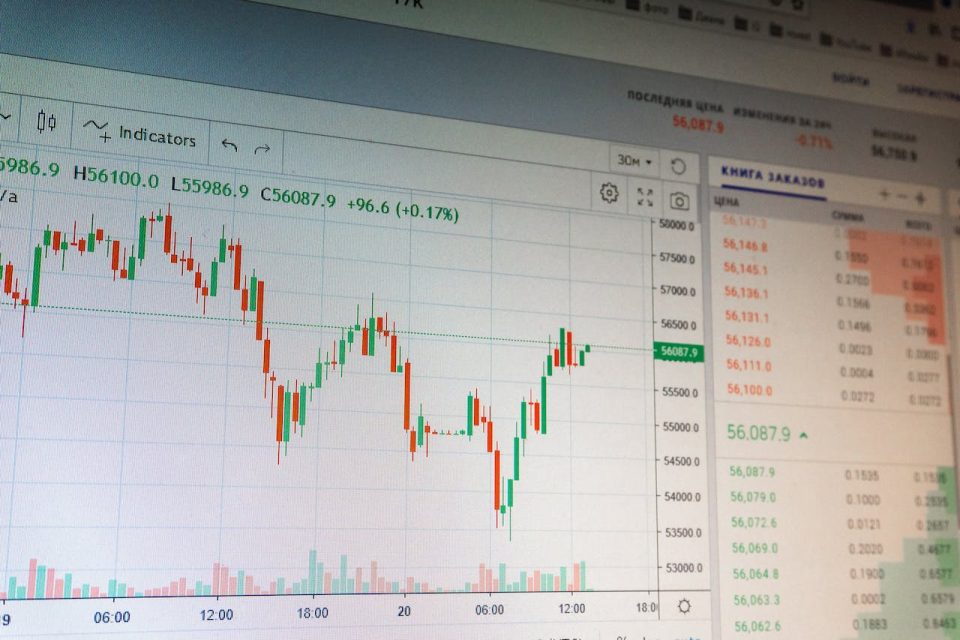

Major indices presented a mixed picture, as the benchmark S&P 500 (^GSPC) and the tech-centric Nasdaq Composite (^IXIC) experienced marginal declines of approximately 0.1%, while the Dow Jones Industrial Average (^DJI) remained relatively flat following a lackluster close at the beginning of the week.

As November draws to a close, market participants are contemplating the possibility of a pullback after an exceptional surge that has positioned stocks for their most impressive monthly performance in over a year.

The surge, driven by confidence that U.S. interest rates have reached their peak and the economy is robust, has propelled the S&P 500 to an over 8% gain in November. However, analysts are discerning signals that the bullish momentum may be waning, raising concerns about potential economic softness as market gains plateau.

Investors appear to be approaching the market with caution as they await two crucial sets of economic data later this week. Wednesday will bring an update on third-quarter GDP, while Thursday’s release of the Personal Consumption Expenditures (PCE) reading on consumer inflation, the Federal Reserve’s preferred gauge, is expected to shape expectations for the central bank’s future rate moves.

The forthcoming November report on consumer confidence, scheduled for release later on Tuesday, is anticipated to provide additional insights into consumer spending trends leading up to the PCE update.

Simultaneously, investors are closely monitoring the performance of retailers now that Black Friday has marked the commencement of the holiday shopping season. Cyber Monday is poised to conclude a record-setting five days of online shopping, according to data from Adobe.

In the retail sector, PDD (PDD) saw a notable surge of 15% after the e-commerce platform exceeded Wall Street’s expectations for quarterly revenue. Shares of the “buy now, pay later” provider Affirm (AFRM) continued their upward trajectory, adding to Monday’s 12% gain.

Turning to commodities, oil prices experienced a modest uptick of around 1% as the dollar weakened, thereby reducing prices for holders of other currencies. Additionally, anticipation grew for potential output cuts at this week’s delayed OPEC+ meeting. Brent crude futures (BZ=F) traded above $80 per barrel, while West Texas Intermediate (WTI) crude futures remained below $76.

In conclusion, as the month of November winds down, investors remain cautious, navigating the markets with a discerning eye in light of the unprecedented and robust rally that characterized the past weeks.

Source: Yahoo Finance