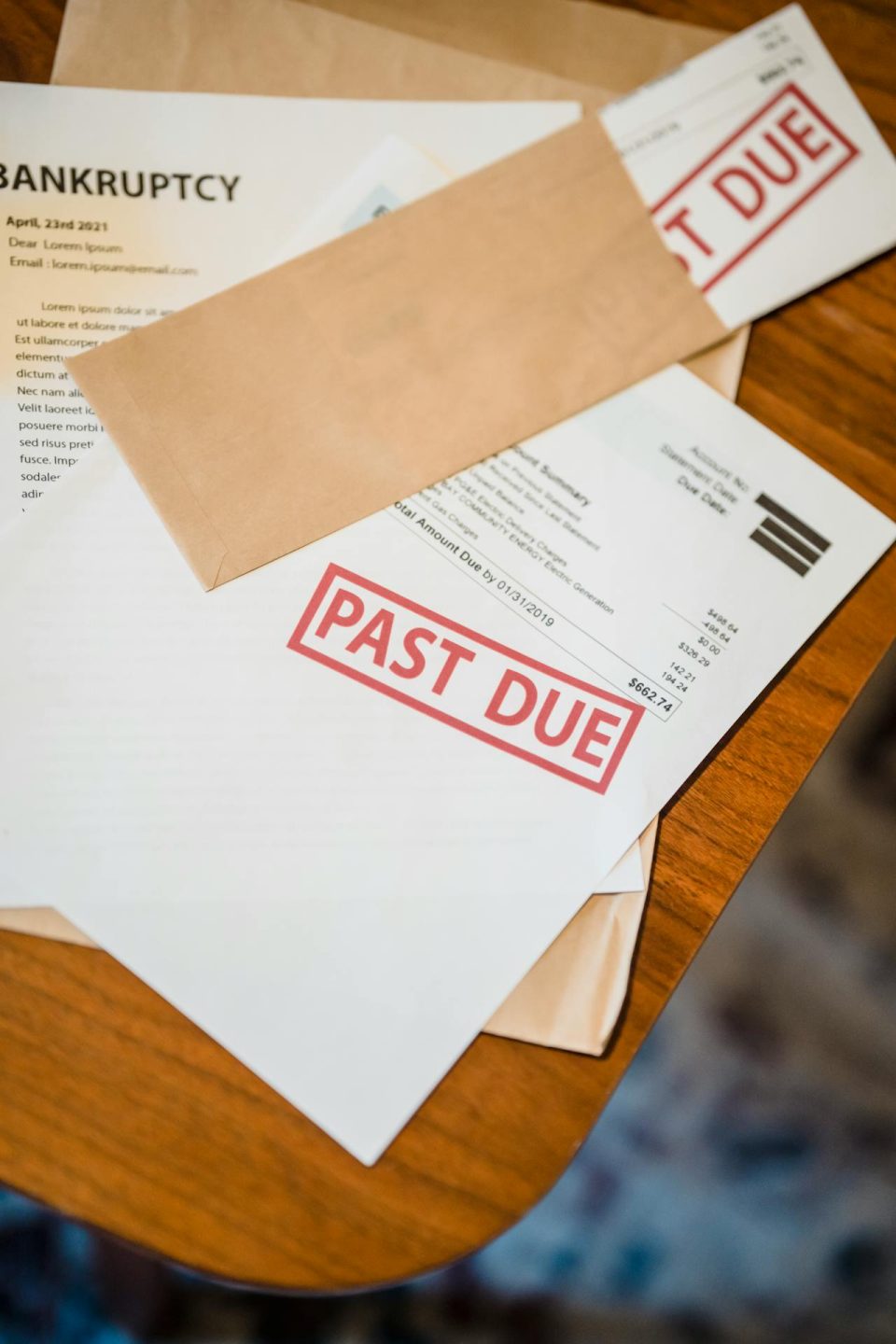

Troika Media Group Inc. is grappling with a downturn in its stock value as it navigates a pivotal moment—announcing its acquisition by Blue Torch Finance LLC amid Chapter 11 bankruptcy proceedings unfolding in the Southern District of New York. The stock’s descent began after Wednesday’s trading session, closing at $1.91 per share, only to plummet to $0.39 when Thursday morning’s market opened.

At the time of this publication, Troika Media Group Inc stock (TRKA) has witnessed a decline.

Troika Media Group Inc

Current Price: $0.69

Change : -1.22

Change (%): (-63.87%)

Volume: 13.7M

Source: Tomorrow Events Market Data

The acquisition unfolds through a strategic utilization of Chapter 11 bankruptcy proceedings, with Troika Media Group and certain affiliates voluntarily filing petitions for relief in the United States Bankruptcy Court for the Southern District of New York. To facilitate the acquisition and balance sheet restructuring, the company is seeking approval for a proposed stalking horse credit bid under section 363 of the United States Bankruptcy Code. This bid, subject to court-supervised auction, aims to secure the highest possible price for the company’s business.

Troika’s secured lenders are extending their support to the transaction, committing to providing $11 million in debtor-in-possession financing. The company anticipates that this financing, coupled with operational cash flow, will amply fund business operations throughout the sale process, projected to conclude in the coming months.

Grant Lyon, Troika’s Interim Chief Executive Officer, expressed optimism about the efficiency of the process, anticipating a short duration. Lyon also outlined expectations for the company’s emergence from Chapter 11 as a private entity, boasting a fortified balance sheet and with seasoned leaders Michael Carrano and Maarten Terry steering the Converge business.

In response to these developments, Troika Media Group has initiated customary first-day motions with the Bankruptcy Court. These motions seek authorization to sustain operations during the court-supervised sale process, ensuring uninterrupted payment of employee wages and benefits and continued payments to key vendors and suppliers. The company is hopeful that the Bankruptcy Court will swiftly greenlight these requests, mitigating potential disruptions for customers, employees, and stakeholders.

Legal counsel for Troika Media Group is provided by Willkie Farr & Gallagher LLP, with Jefferies LLC and Areté Capital Partners serving as the company’s investment banker and financial adviser. Meanwhile, Blue Torch is represented by King & Spalding LLP and Ankura Consulting Group, LLC, as legal counsel and financial advisor, respectively, in their capacity as collateral agent and administrative agent for affiliated secured lenders.