In a sharp contrast to the euphoria that marked the end of 2023, the stock markets stumbled out of the gate in the new year, as major indices experienced a downbeat start. The S&P 500, which concluded the previous year just shy of a new record high, witnessed a drop of nearly 0.6%, signaling a cautious tone among investors. Simultaneously, the Dow Jones Industrial Average struggled to maintain a flat position, and the tech-heavy Nasdaq Composite took the lead in the decline, losing close to 1.6%.

The setback on Friday marked a roadblock for last year’s impressive stock market rally, which persisted for two consecutive months. Despite this stumble, major indices reported robust annual gains, with the S&P 500 securing its ninth consecutive weekly victory. This unprecedented streak, the longest since 2004, inches the index closer to breaking its all-time closing high of 4,796.56.

The technology sector, however, faced headwinds as Apple shares plummeted nearly 4% following a downgrade by analysts from Barclays. The downgrade was fueled by concerns over the demand for the latest iPhones. Subsequently, other tech stocks followed suit, contributing to the overall decline.

Investor attention now turns to key economic updates scheduled for the week, notably the release of the December jobs report on Friday. Analysts suggest that this report could potentially influence the Federal Reserve’s policy decisions and shape investors’ expectations regarding interest rate cuts throughout the year. Such expectations have been a significant driving force behind the recent stock market rally.

Meanwhile, in the commodities market, oil prices experienced an uptick after Iran deployed a warship to the Red Sea in response to the US Navy’s sinking of three Houthi boats over the weekend. This move comes amid escalating tensions between the two nations, prompting both West Texas Intermediate and Brent crude futures to surge by over 1%.

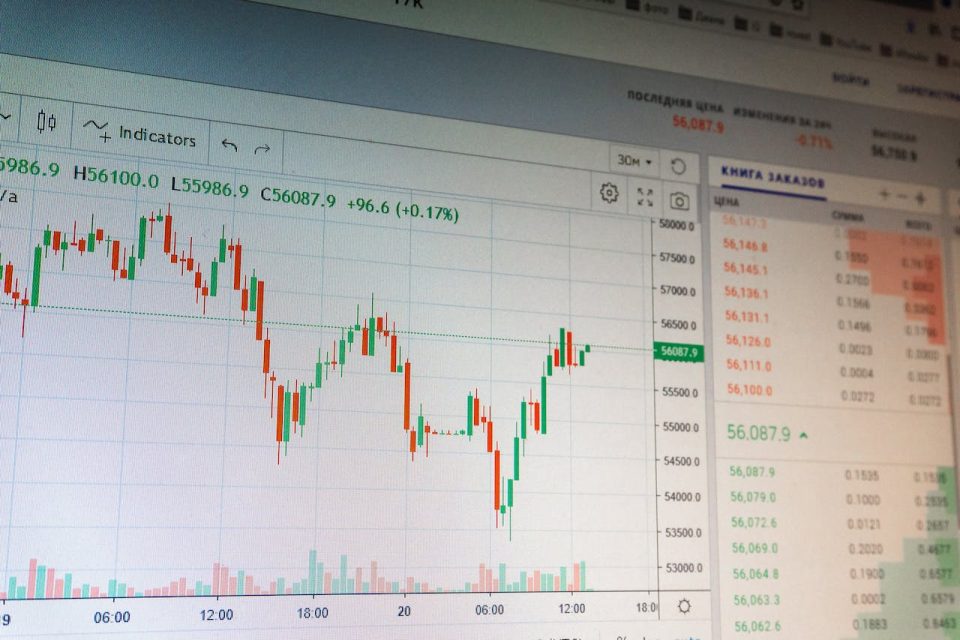

In the cryptocurrency realm, bitcoin prices observed a notable uptrend, jumping close to 3% and surpassing levels above $45,000 for the first time since early 2022. The surge is attributed to growing optimism surrounding the potential approval of a spot bitcoin ETF by the Securities and Exchange Commission (SEC).

Despite the prevailing market uncertainty, investors are reminded of the importance of maintaining a long-term perspective and monitoring economic indicators and news developments. This approach aids in making informed decisions about investments and managing potential risks.

In conclusion, the downbeat start of stock markets in 2024 sets a cautious tone, prompting investors to closely monitor and adapt to the challenges that may shape the financial landscape in the coming months. Investors are advised to tread cautiously and adapt to the evolving market conditions.

Source: Yahoo Finance