Nvidia Corp. shares saw a significant rebound on Monday, aligning with a strong day for the semiconductor sector and anticipation of upcoming earnings reports that could shed light on the pace of spending on artificial-intelligence hardware.

Nvidia’s stock (NVDA) rose 2.3% in morning trading Monday, following a 0.7% increase on Friday. This uptick comes after a three-session decline that had pulled shares down by about 9%.

The chip sector’s rally on Monday was spearheaded by automotive-chip company On Semiconductor Corp. (ON), which saw a 12.77% increase after posting strong profit figures early in the day, kicking off a busy week of earnings for the sector.

This week, several key reports are expected, including from Advanced Micro Devices Inc. (AMD), Western Digital Corp. (WDC), and Intel Corp. (INTC). Intel was the only decliner in the PHLX Semiconductor Index (SOX) early Monday, with the index as a whole up 1.9%.

AMD’s report is particularly noteworthy as investors are keen to see how the company is performing in its bid to become a viable alternative to Nvidia for AI graphics processing units. There have been concerns about potential order cuts for AMD following Nvidia’s GTC event earlier this year.

Wall Street will also be closely monitoring reports from outside the semiconductor sector to gauge Nvidia’s future trajectory. Updates from Microsoft Corp. (MSFT), Amazon.com Inc. (AMZN), and Meta Platforms Inc. (META) are expected this week and should provide insights into their capital spending plans on AI hardware.

A crucial consideration is whether these companies are seeing returns on their AI investments, which is pivotal for those betting on continued heavy spending by hyperscale cloud providers.

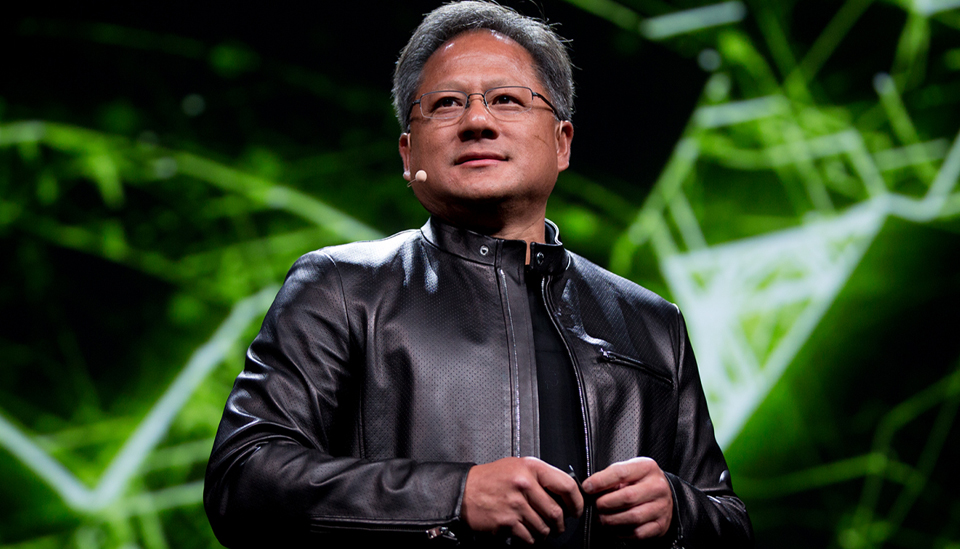

Additionally, Nvidia Chief Executive Jensen Huang is scheduled to participate in a fireside chat with Meta Chief Executive Mark Zuckerberg at 6 p.m. Eastern time on Monday, which could further influence market perceptions and expectations.