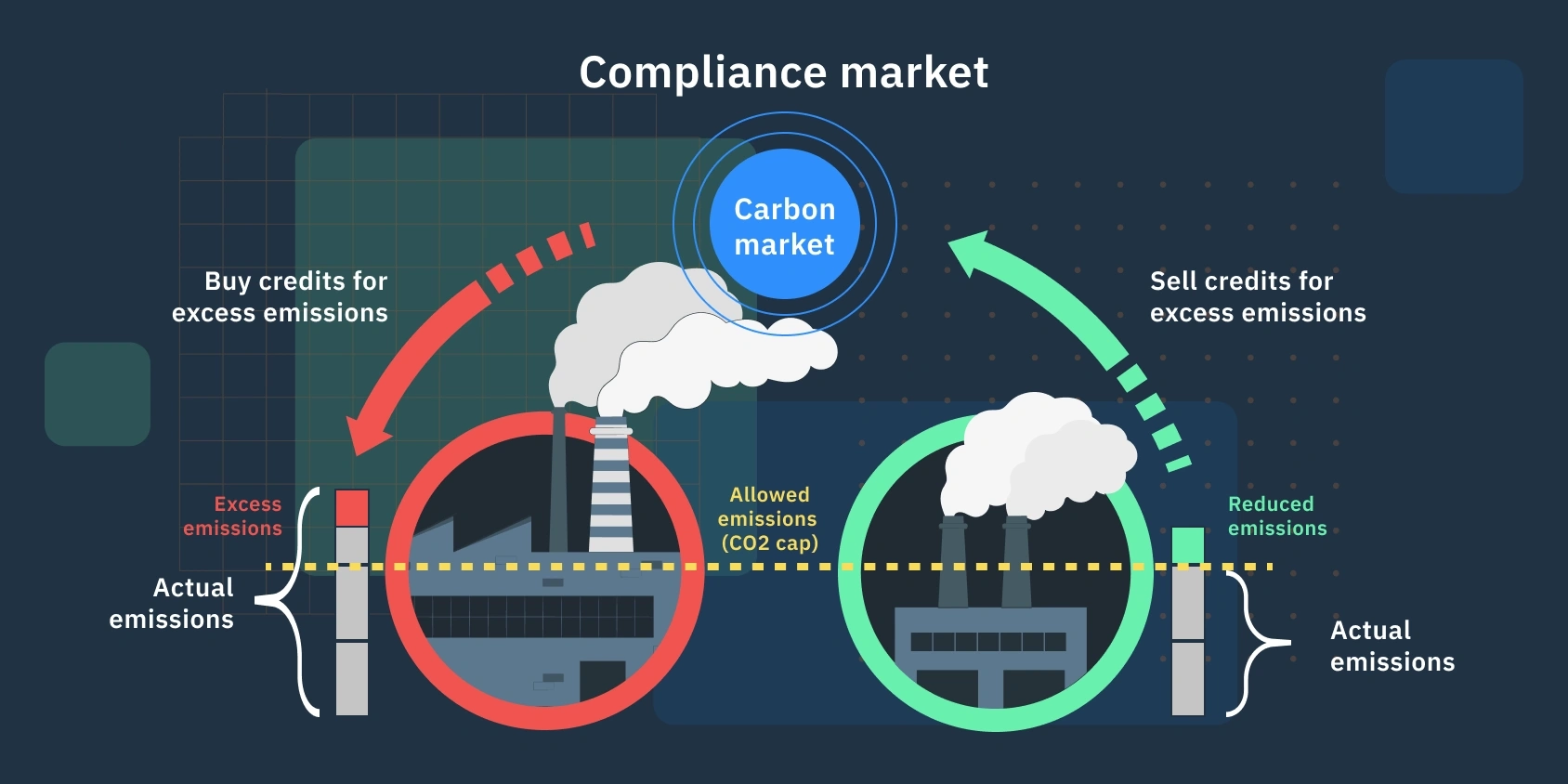

Carbon credits are financial instruments that allow the holder to emit one metric ton of carbon dioxide. These credits are central to efforts aimed at reducing global emissions and combating climate change. Emerging from international agreements such as the Kyoto Protocol and further strengthened by the Paris Agreement, carbon credits form part of cap-and-trade schemes that incentivize emission reductions. The basic premise is simple: companies that surpass their emission caps must purchase credits. Over time, the carbon credit industry has expanded to include both compliance-based mechanisms run by governments and voluntary markets driven by corporate sustainability goals.

As of 2025, the global carbon credit market is at a pivotal juncture. It is projected to grow significantly, with estimates placing its value anywhere from $45 billion to $250 billion by 2050, largely fueled by increasing regulatory pressure and a surge in corporate net-zero commitments. Although demand is rising, evident in the record 95 million credits retired in the first half of 2025 alone, challenges persist, most notably a lack of uniform regulatory standards and ongoing doubts about the quality and impact of many credits.

Despite these growth indicators, the market is still described as “stuck” in some respects, particularly the voluntary sector, where liquidity and credibility concerns have led to cautious participation. In contrast, compliance markets remain comparatively robust, driven by regulatory requirements and clearer oversight. New standards and innovations, such as tokenization and digital tracking, are beginning to address these hurdles by enhancing transparency and scaling the infrastructure needed for future expansion.

A primary issue undermining the carbon credit market is the perceived, and at times demonstrated, lack of integrity of many credits. Investigations have exposed examples where credits did not reflect actual emission reductions, either due to inflated claims or project double-counting. Instances have occurred where rainforest projects issued credits for protecting forests that were never at risk of being cleared in the first place, rendering the supposed climate benefit moot. Research from academics and independent organizations has found that upwards of 75% of some national credits, such as Australia’s ACCUs, are not “additional” or do not result in real emission reductions. Similar findings from international crediting programs suggest that 60-70% of credits may not accurately represent avoided emissions.

These reliability issues are not limited to a single country or credit type. Reviews of major registries and hundreds of offset programs regularly report that many projects, especially in the voluntary sector and forest management, fall short of best practices in carbon accounting, allowing the proliferation of “bogus” credits. Fraudulent or over-credited projects have tarnished the reputation of the market, contributing to skepticism among buyers and investors.

Another barrier is the lack of standardization, particularly in voluntary markets. Whereas compliance markets are tightly regulated, voluntary markets are fragmented, with varying standards and little to no legal oversight. With multiple independent verifiers, quality and credibility can differ drastically between credits. If a registry enforces strict standards, project developers may migrate to a more lenient body.

Among the most prominent organizations in carbon credit verification are Verra, Gold Standard, the Climate Action Reserve, American Carbon Registry, TÜV SÜD, and SCS Global Services. Verra manages the Verified Carbon Standard (VCS), the world’s most widely used greenhouse gas crediting program, alongside complementary standards addressing social and biodiversity impacts. Gold Standard aligns carbon offset projects with the United Nations’ Sustainable Development Goals, using digital tools to support credible verification. TÜV SÜD and SCS Global Services provide technical inspection and certification services globally, incorporating innovations like remote sensing and blockchain to enhance transparency. These organizations play a critical role not only in validating project claims but also in building trust within carbon markets by ensuring buyers that credits represent real and verifiable climate benefits.

The unreliability of many credits, coupled with reputational risks, has deterred broader adoption. Only about 36% of large companies engage in voluntary carbon offsetting, with the voluntary market covering less than 1% of global emissions. Many firms prefer to focus on direct emissions reductions internally, given the negative press and legal challenges associated with questionable offsets.

Types of Carbon Credits: Voluntary vs. Non-Voluntary; Reliable vs. Less Reliable

The voluntary market enables companies and individuals to offset their emissions by financing projects that claim to reduce or avoid emissions. Participation is discretionary, motivated by sustainability goals, pressure from stakeholders, or marketing. Voluntary credits tend to be more affordable, but quality varies widely due to less strict oversight. Independent standards like the Verified Carbon Standard (VCS) and Gold Standard attempt to enforce credibility, but risks remain.

The voluntary market enables companies and individuals to offset their emissions by financing projects that claim to reduce or avoid emissions. Participation is discretionary, motivated by sustainability goals, pressure from stakeholders, or marketing. Voluntary credits tend to be more affordable, but quality varies widely due to less strict oversight. Independent standards like the Verified Carbon Standard (VCS) and Gold Standard attempt to enforce credibility, but risks remain.

- Most Reliable: Voluntary credits issued by projects with rigorous, transparent methodologies and third-party certification (e.g., removals through direct air capture with robust monitoring).

- Least Reliable: Credits from projects with unclear baselines, inflated claims (such as forest protection where deforestation was never likely), or poor monitoring and verification.

Compliance or regulatory markets are government-run mechanisms (e.g., the EU Emissions Trading Scheme, California’s Cap-and-Trade) where emissions caps are imposed on specific sectors, and companies must purchase credits or allowances to cover excess emissions. These markets cover about 20% of global emissions and are considered more reliable due to mandatory participation, enforceable penalties, and higher regulatory scrutiny.

- Most Reliable: Regulatory credits under schemes with strict policing, centralized oversight, and strong methodologies.

- Least Reliable: Credits from older or poorly regulated schemes, or those granted via loopholes or with questionable additionality.

The pricing of carbon credits varies significantly according to the market and perceived quality. In compliance markets, prices have been more robust and transparent, whereas voluntary markets have historically seen lower prices but significant volatility.

- EU Carbon Permits (compliance market): Prices have fluctuated substantially in the past few years, peaking at $122.56 (105.73 EUR) in February 2023. As of August 2025, prices are in the $84.82 (73.21 EUR) range, with forecasts predicting a rise to approximately $93.33 (80.49 EUR) by mid-2026.

- Voluntary Carbon Market: The average price per credit increased 72.5% between 2021 and 2023, reaching $6.97 in 2023. However, higher-quality (removal-type) credits and those with stringent third-party verification can trade at much higher prices, sometimes exceeding $25–$30/tonne. There is a projected upward trajectory as demand for higher integrity credits increases and as companies aim to meet net-zero pledges by 2030 and 2050.

The universe of carbon credit buyers is diverse and increasingly sophisticated, with corporate giants and industry leaders shaping demand based on their specific industry needs, sustainability goals, and strategic motivations. These organizations often leverage carbon credits as part of broader decarbonization and ESG initiatives. Some key industries

Energy Sector – Shell is the world’s largest user of carbon credits, retiring 14.5 million credits in 2024 alone. The company primarily sources credits from large-scale forestry and land-use projects, which focus on protecting existing carbon stores, as well as renewable energy projects. Major oil and gas firms, facing both regulatory compliance and substantial reputational pressure, are among the most active buyers, sourcing credits from large-scale forestry, land-use, and avoidance projects.

Technology Companies – Microsoft leads technology sector purchases of high-quality carbon removal credits, focusing on innovative methods like direct air capture and durable forest management. In 2025, it committed to buying over 14 million tons of carbon removals through multi-year deals, including 4.8 million tons from forest projects with Anew Climate and 1.24 million tons of biochar credits with Exomad Green. These purchases represent nearly 94% of durable removals bought in Q2 2025, reflecting Microsoft’s strategy to offset emissions it cannot eliminate and strengthen its climate leadership. Unlike fossil fuel companies, Microsoft prioritizes credibility and innovation over just scale and cost.

Automotive Industry: Volkswagen illustrates the automotive sector’s embrace of carbon credits to meet climate targets, manage broad supply-chain risks, and demonstrate environmental stewardship. In 2023, it was one of the world’s leading credit purchasers, mirrored by several peers across the sector. In 2023 Volkswagen purchased about 9 million tonnes of carbon credits to help meet its climate targets, supporting renewable energy and nature restoration projects like forest and savanna protection. The company also plans to generate 40 million carbon credits annually by 2030 through its own projects to offset emissions from electric vehicle supply chains in Europe. These efforts are part of Volkswagen’s goal to halve greenhouse gas emissions by 2030 and achieve net carbon neutrality by 2050. Alongside buying credits, Volkswagen pursues aggressive emissions reductions and climate governance.

Aviation: Airlines are major buyers of carbon credits to claim carbon-neutral flights and prepare for Carbon Offsetting and Reduction Scheme for International Aviation’s (CORSIA) strict offset requirements starting in 2027. Delta Airlines purchased nearly 27 million credits in 2021 to offset its emissions. However, in 2022, Delta shifted away from heavy reliance on offsets, focusing instead on decarbonizing operations through sustainable aviation fuel (SAF), fleet renewal, and operational efficiencies.

American Airlines bought 10,000 tons of carbon removal credits from Graphyte, a startup specializing in carbon casting technology, to support its net-zero goals. Other airlines like British Airways, Singapore Airlines, and Cathay Pacific offer passenger offset programs funding projects such as rainforest preservation. Due to limited supply, CORSIA-approved credit prices are rising, impacting airline costs and ticket prices. Demand for high-quality, verifiable credits in aviation is set to increase sharply.

Finance, Retail, and Consumer Goods: Companies like Goldman Sachs, Disney, and Nike, and others buy carbon credits primarily to address value-chain emissions, fulfill sustainability pledges, and meet reporting requirements demanded by stakeholders globally. Retail chains often source these credits regionally, paying premiums for local environmental benefits and enhanced credibility.

Since 2009, Disney has implemented an internal carbon tax that funds efficiency projects and purchases carbon offsets. Their investments have reportedly reduced greenhouse gas emissions equivalent to removing 900,000 cars from the road.

The Motivations Behind Buying

Reputation and Pressure: Companies act under pressure from investors, regulators, and advocacy groups. Buying credits signals climate action, builds a positive brand image, and lessens activist scrutiny.

Reputation and Pressure: Companies act under pressure from investors, regulators, and advocacy groups. Buying credits signals climate action, builds a positive brand image, and lessens activist scrutiny.- Strategic Risk Mitigation: Proactive buyers use credits to hedge against coming regulations, align with science-based targets, and as insurance against economic or supply chain climate shocks.

- Competitive Advantage: Offsetting emissions is used as a competitive edge to enter new markets, satisfy customers, and build partnerships.

- Corporate Governance: Research indicates buyers of credits have stronger board-level climate governance and are more transparent in disclosing emissions data and strategies compared to non-buyers.

- Deep Decarbonization: Contrary to the “greenwashing” critique, carbon credit buyers tend to have more ambitious and effective emissions reduction programs, adopting renewable energy and energy efficiency at higher rates, and often implementing internal carbon pricing.

Approaches to carbon credit purchasing differ across industries, regions, and project types. Energy, finance, and technology remain leaders, but other sectors are joining, signaling wider mainstream adoption.

Preferences vary by industry: technology and finance often choose higher-cost, high-quality removal credits, while heavy industry prioritizes scalable, lower-cost avoidance credits.

Regional factors also shape decisions. Many companies seek credits that match their operational footprint, for instance, European retailers pay premiums for locally sourced credits that align with their sustainability goals.

Surveys indicate a growing willingness to pay significantly more for credits with rigorous third-party GHG ratings, marking a shift from price-driven choices to quality-focused ones.

By 2024, over 6,500 companies across nearly every sector were purchasing carbon credits, reflecting record market breadth and the normalization of their use in corporate climate strategies.

The carbon credit industry is both a critical climate mechanism and a market at a crossroads, challenged by issues of credibility, fragmented oversight, and inconsistent quality. The sector is evolving under pressure from regulators and corporate buyers, with a shift towards quality, transparency, and real impact. Today’s most active purchasers are not only offsetting emissions, they’re shaping the standards and integrity of the market as a whole, driving continuous improvement.

Looking forward, the industry’s growth and effectiveness depend on resolving integrity challenges, improving governance, and distinguishing truly impactful credits. With ongoing innovation and reform, carbon credits could move from a niche to a mainstream climate tool, complementing more direct pathways toward global net-zero emissions.

A Research Report by Business Pen