Overview

ABI is a gold development and exploration company active in Quebec, Canada. Its primary

development asset is the Sleeping Giant (SG) mine and mill, while the key exploration project is

Flordin. ABI also owns several non-core assets and is open to earn-in deals, JVs, or sales of these

to optimize its portfolio and advance its other projects by non-dilutive means or monetize them.

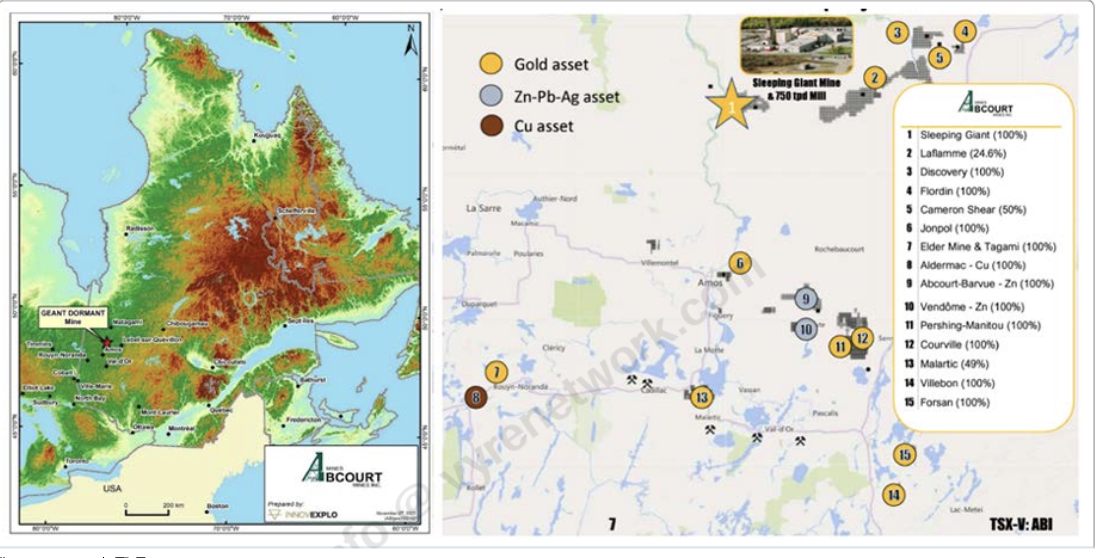

Figure 1: Maps showing the locations of ABI’s projects

Source: ABI

The Sleeping Giant mine poured its first doré gold bar via ABI in April 2024, using ore from a bulk sample from the Pershing-Manitou project. The site has complete surface infrastructure in place, several underground faces are ready for mining, and all necessary permits are secured. ABI’s team continues to drill for resource conversion and expansion at Sleeping Giant and conduct delineation drilling at Flordin, achieving success in securing vital funding to bring the flagship Sleeping Giant operation into production in the near future.

In our previous report, we focused on the exciting drill results from the Cartwright zone on the Flordin property, where strong gold mineralization was intercepted over 20- to 30-meter intervals, and the work the team at ABI was doing to prepare the mine for production. The focus of this report will be on how the firm will deploy the freshly secured capital to bring the Sleeping Giant mine into production soon and what investors can expect in the coming 12-month period.

Investment Highlights

- Abcourt Mines (“ABI” or the “Company”) is restarting the Sleeping Giant mine with gold production expected in Q4.25. All major infrastructure is now installed and ready, with resource conversion drilling ongoing and project optimization efforts supporting the transition to full- scale gold production.

- Solid backing for development: Management has set out a clear and structured plan to restart operations at Sleeping Giant and advance exploration at Flordin. Their disciplined and cost- efficient approach continues to secure long-term support from key cornerstone investors.

- Upside potential at the Flordin-Cartwright project: ABI has reported encouraging near- surface results from drilling at Cartwright, expanded the mineralization footprint at both Flordin and Cartwright and might demonstrate a 2 km mineralized corridor between Flordin and Cartwright.

- Strong gold price backdrop: ABI’s projects offer significant exposure to the gold price, which remains near record highs. This favourable pricing environment substantially enhances the economic outlook for the Sleeping Giant mine.

- We are maintaining a positive outlook for the company over the next 12-month period with an improved target price of $0.18.

DISCLAIMER

This report has been prepared by an analyst on contract with or employed by Couloir Capital Ltd. The analyst certifies that the views expressed in this report, which include the rating assigned to the issuer’s shares as well as the analytical substance and tone of the report, accurately reflect his or her personal views about the subject securities and the issuer. No part of his / her compensation was, is, or will be directly or indirectly related to the specific recommendations. Couloir Capital, its affiliates, and their respective officers, directors, representatives, researchers, and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Couloir Capital may have provided, in the past and may provide, in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services. Couloir Capital has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate but cannot be guaranteed. This document does not consider the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g., prohibitions to investments due to law, jurisdiction issues, etc.) that may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before making an investment. Couloir Capital will not treat recipients of this document as clients by virtue of having viewed this document.