Shares of Affirm Holdings (AFRM) experienced a significant boost during intraday trading on Monday following Goldman Sachs’ initiation of coverage on the buy now, pay later (BNPL) loan service with a “buy” rating. Goldman Sachs hailed Affirm as “the leading provider of modern credit solutions for consumers” and set a price target of $42, representing a 41% premium over Friday’s closing price.

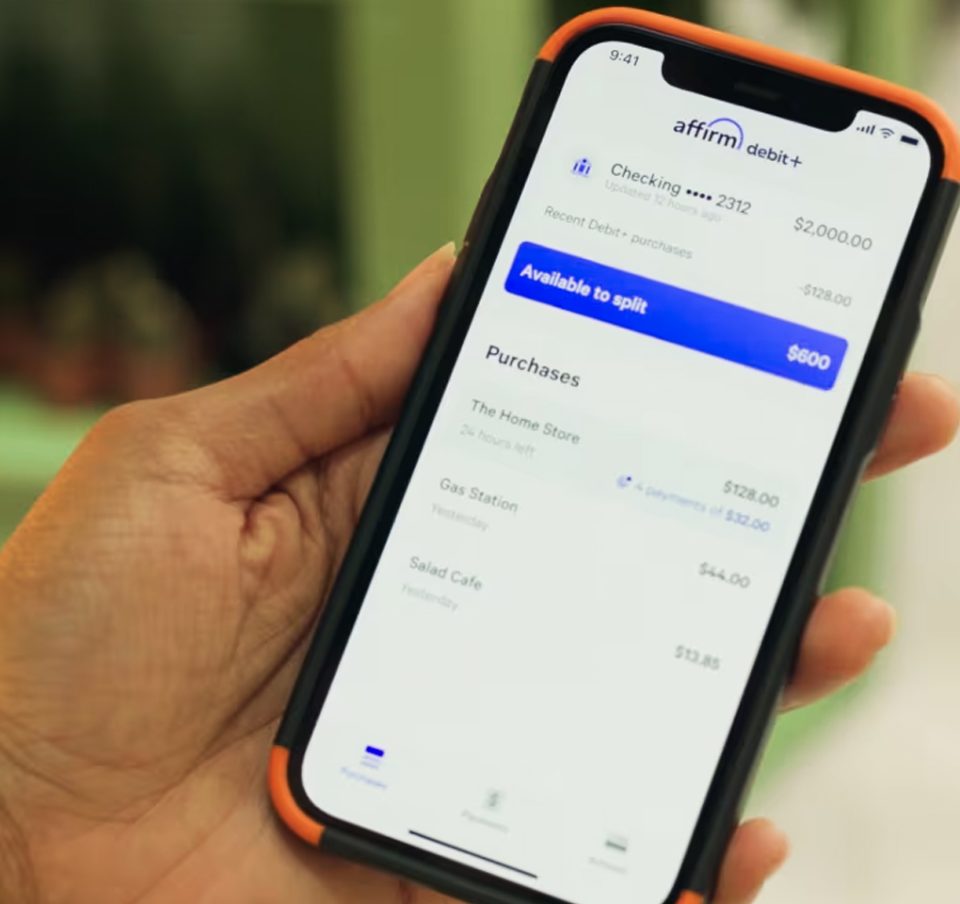

Goldman Sachs analysts commended Affirm for its “diverse portfolio of products for point of sale financing and everyday spending.” They were particularly impressed with the company’s sophisticated underwriting practices, which they noted surpass those of other financial technology (fintech) firms. The analysts emphasized Affirm’s “strong track record of achieving well-managed credit outcomes despite growing faster than its peers.”

They highlighted that Affirm’s robust underwriting capabilities position the company to expand its reach among subprime and near-prime borrowers, a challenging market segment that many lenders struggle to “sustainably participate in.” The analysts also cited the increasing demand for BNPL and Pay-in-4 options, along with Affirm’s strong presence on major e-commerce platforms, as key factors that could drive substantial market share growth. They believe these elements will help Affirm pave the way to becoming one of the first new closed-loop platforms in the payments ecosystem.

As of 1:15 p.m. ET on Monday, Affirm Holdings’ shares had surged by approximately 9% to $32.59, although the stock remains down about 34% year-to-date.

Source: investopedia

Source: investopedia