Analysts’ Ideas of the Week

Berkshire Hathaway Under New Leadership: Implications for Investors

Published: May 5, 2025

Author: FRC Analysts

View Complete Repor*Articles and research coverage are paid for and commissioned by issuers. See the bottom and below for other important disclosures, rating, and risk definitions, and specific information.

On May 3, 2025, Warren Buffett, the legendary investor and CEO of Berkshire Hathaway (BRK.A, BRK.B), announced at the company’s annual shareholder meeting in Omaha, Nebraska, that he will step down as CEO by the end of the year. Greg Abel, a 62-year-old Canadian executive and long-time Berkshire vice chairman, was named as his successor, a move unanimously approved by the board. This transition, coupled with a notable stock price decline of up to 6.8% in Monday trading, has sparked intense discussion among investors. Below, we analyze the implications of this leadership change, the stock’s reaction, and broader market trends, providing insights for investors navigating this pivotal moment for one of the world’s most iconic conglomerates.

The Leadership Transition: Greg Abel Takes the Helm

Warren Buffett, often called the “Oracle of Omaha,” has led Berkshire Hathaway (BRK.A, BRK.B) since 1965, transforming a struggling textile mill into a $1.16 trillion conglomerate with diverse holdings, including Geico, BNSF Railway, and significant stakes in Apple (AAPL), American Express (AXP), and Coca-Cola (KO). His announcement to step down, while anticipated since Abel was designated as successor in 2021, surprised many due to its timing. Abel, who has overseen non-insurance operations like utilities and retail since 2018, is praised for his hands-on management style and deep business acumen, particularly in the energy sector through Berkshire Hathaway Energy.

Implications

Abel steps into a role where he will be compared to Buffett’s unparalleled track record, which includes a 5,502,284% return for shareholders since 1965. Unlike Buffett, known for his value investing philosophy and minimal intervention in subsidiaries, Abel is described as more active, engaging directly with managers to address risks and opportunities. This shift could alter Berkshire’s decentralized culture, which has allowed subsidiaries like See’s Candies and Dairy Queen to operate with significant autonomy.

The leadership transition marks the end of an era and may impact investor confidence in Berkshire Hathaway. Abel’s hands-on style could boost efficiency but may disrupt the autonomy that defined Berkshire’s success. His lower public profile and limited investment track record could invite scrutiny, particularly around capital allocation choices. While Buffett’s continued role as chairman offers stability, his reduced involvement may alter perceptions of Berkshire’s direction. Investors should watch Abel’s early decisions on capital deployment and subsidiary oversight, as well as shareholder communications, for insight into his strategic approach and alignment with Buffett’s legacy.

Watching the War Chest: Abel’s First Big Test as Berkshire’s Heir

Berkshire Hathaway’s (BRK.A, BRK.B) $347.7 billion cash pile, equating to 30% of its market cap, underscores its financial strength but highlights the challenge of deploying capital in a high-valuation market. Abel’s approach to this reserve will be critical in maintaining investor confidence. Abel may continue Buffett’s cautious strategy, holding cash until significant opportunities arise, potentially in 2026 if tariff-driven market corrections occur. However, investor expectations for action could push him toward selective acquisitions or resuming buybacks, particularly if Berkshire’s stock price softens. Investors should monitor Abel’s capital allocation decisions in upcoming earnings calls and shareholder meetings, focusing on whether he signals large acquisitions or buybacks.

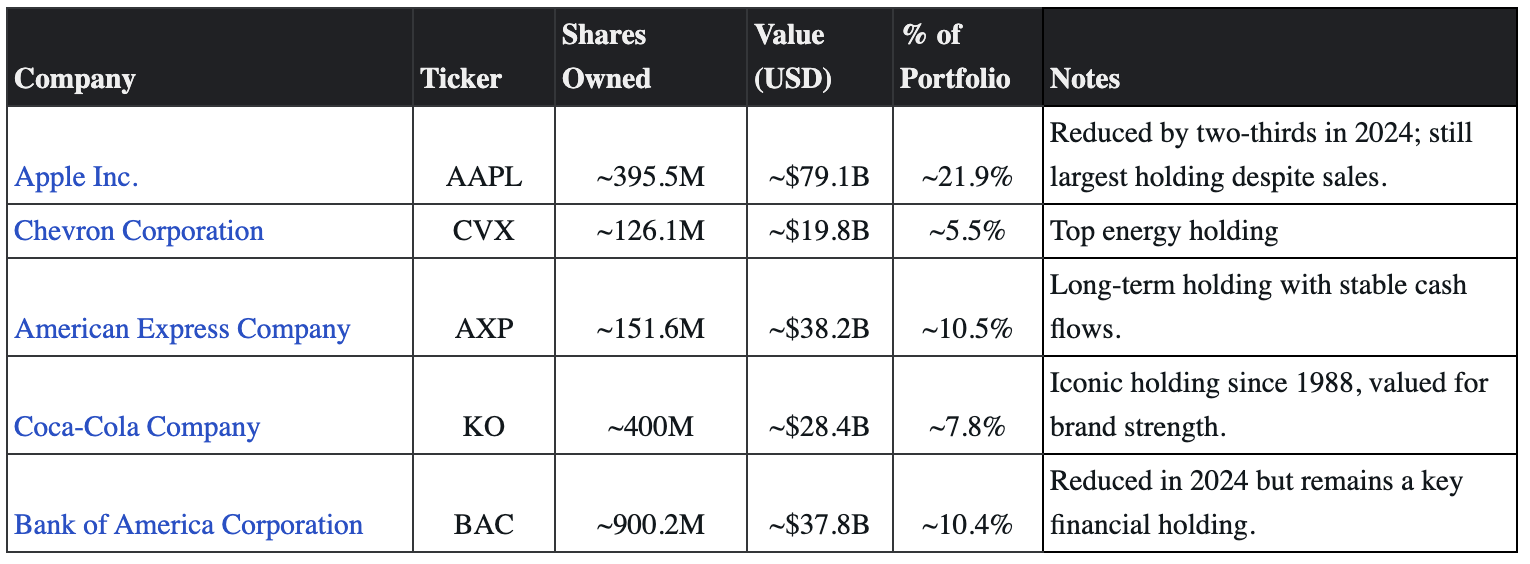

Top Five Holdings

Berkshire Hathaway’s equity portfolio is heavily concentrated, with two-thirds of its holdings in just five companies. Recent sales, notably of Apple (AAPL), have reduced exposure to certain holdings, but the top five remain significant. Below is a table of Berkshire’s top five equity holdings as of March 31, 2025:

The opinions expressed in this report are the true opinions of the analyst(s) about any companies and industries mentioned. Any “forward looking statements” are our best estimates and opinions based upon information that is publicly available and that we believe to be correct, but we have not independently verified with respect to truth or correctness. There is no guarantee that our forecasts will materialize. Actual results will likely vary. Certain companies may be covered by FRC under an issuer paid model. FRC or companies with related management, and Analysts, may hold shares/securities in some companies mentioned in this report. This creates a potential conflict of interest which readers should consider . Distribution procedure: our reports are distributed first to our web-based subscribers on the date shown on this report then made available to delayed access users through various other channels for a limited time. To subscribe for real-time access to research, visit https://www.researchfrc.com/