Introduction and Market Context

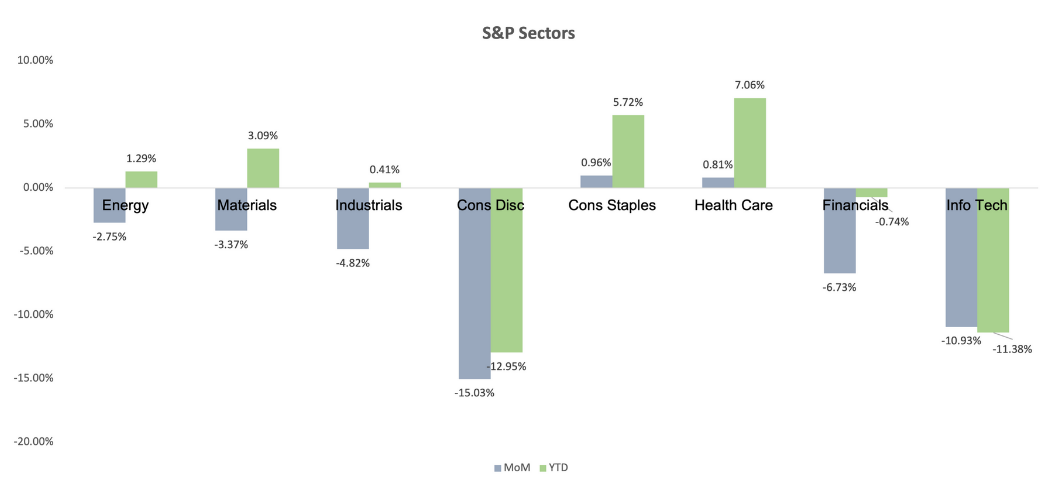

As of March 10, 2025, the equity markets are experiencing heightened volatility, primarily due to President Donald Trump’s recent actions include imposing tariffs on imports from Canada, Mexico, and China. This has led to fears of a global trade war, impacting the S&P 500, which is down 7% month-over-month (MoM) and 4% year-to-date (YTD).

Safe Haven Sectors: Consumer Staple and Health Care

In this volatile environment, certain sectors are emerging as safe havens, notably Consumer Staple and Health Care. These sectors are known for their defensive characteristics, meaning they are less sensitive to economic cycles due to the essential nature of their products and services. The S&P 500 Consumer Staples Index is up 1% MoM, and 6% YTD, while the S&P 500 Health Care Index is up 1% MoM, and 7% YTD, contrasting sharply with the S&P 500’s declines.

This table underscores the outperformance of Consumer Staple and Health Care compared to the broader market, highlighting their role as safe havens.

Source: S&P Capital IQ / FRC

Source: S&P Capital IQ / FRC

The Consumer Staple sector includes companies producing everyday necessities such as food, beverages, and household products. This sector’s stability stems from consistent consumer demand, as people continue to purchase essentials regardless of economic conditions. Additionally, strong brand recognition, such as that of Procter & Gamble and Coca-Cola, empowers these firms to absorb tariff-related cost increases by adjusting consumer prices, thereby bolstering their resilience during trade dispute.

The Health Care sector, encompassing medical services and pharmaceutical products, is another defensive stronghold. Its performance is driven by the necessity of health care, with demand remaining stable even during economic downturns. Companies like Johnson & Johnson and Eli Lilly benefit from regulatory protections and patents, which provide pricing power and revenue stability. The sector’s resilience is further supported by aging populations and increasing healthcare spending, making it a reliable performer amid market volatility.

*This article and research coverage is paid for and commissioned by issuers. See the bottom of this article for other important disclosures, rating, and risk definitions.