Analysts’ Ideas of the Week

Gold at Record Highs, Gold Stocks Still Lagging: A Hidden Opportunity

Published: May 20, 2025

Author: FRC Analysts

*Articles and research coverage are paid for and commissioned by issuers. See the bottom and below for other important disclosures, rating, and risk definitions, and specific information.

Gold is shining brightly in 2025, with prices soaring to US$3,290 per ounce, driven by geopolitical tensions, central bank buying, and economic uncertainty. Yet, gold mining stocks are not keeping pace, trading at valuations that suggest they are undervalued relative to gold’s rally. This disconnect presents a potential opportunity for investors seeking exposure to the gold market. This article examines the gold mining sector’s performance from 2021 to the present, highlighting why these stocks may be poised for a revaluation in 2025.

Gold: Key Performance Metrics

Trading Multiples: Undervaluation Amid Rising Gold Prices

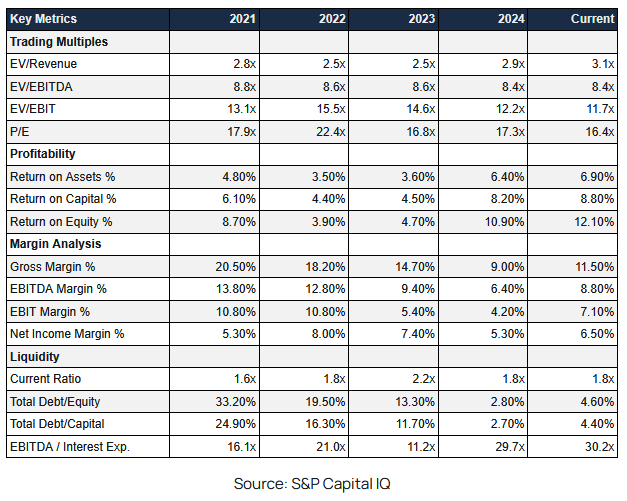

The trading multiples of gold mining companies indicate that the sector has yet to fully price in the recent surge in gold. As shown in the table above, despite a significant increase in gold prices over the past four years, the EV/EBITDA multiple has remained stable, while the Price-to-Earnings (P/E) ratio has compressed. This suggests that gold stocks are currently trading at attractive valuations relative to their EBITDA and earnings. We believe sustained high gold prices could prompt investors to reassess these multiples, potentially triggering a revaluation of mining stocks in 2025.

Profitability: Strengthening Returns Amid Challenges

Profitability metrics underscore the sector’s resilience. Return on Assets (ROA) has risen from 4.8% in 2021 to 6.9% currently, reflecting improved asset utilization as gold prices boost revenues. Return on Capital (ROC) has increased from 6.1% to 8.8%, and Return on Equity (ROE) has jumped from 8.7% to 12.1%, indicating that gold miners are generating stronger returns for shareholders. These gains suggest that miners are leveraging high gold prices to enhance efficiency, despite operational hurdles like rising costs.

Margin Analysis: Navigating Cost Pressures

Margin trends reveal a sector grappling with costs but showing signs of recovery. Gross Margin has declined from 20.5% in 2021 to 11.5% currently, reflecting pressures from rising production costs, labor, and energy expenses. EBITDA Margin has fallen from 13.8% to 8.8%, and EBIT Margin has dropped from 10.8% to 7.1%, indicating squeezed operating profitability. However, the recent uptick in margins suggests that miners have begun to optimize costs and improve efficiency.

The opinions expressed in this report are the true opinions of the analyst(s) about any companies and industries mentioned. Any “forward looking statements” are our best estimates and opinions based upon information that is publicly available and that we believe to be correct, but we have not independently verified with respect to truth or correctness. There is no guarantee that our forecasts will materialize. Actual results will likely vary. Certain companies may be covered by FRC under an issuer paid model. FRC or companies with related management, and Analysts, may hold shares/securities in some companies mentioned in this report. This creates a potential conflict of interest which readers should consider . Distribution procedure: our reports are distributed first to our web-based subscribers on the date shown on this report then made available to delayed access users through various other channels for a limited time. To subscribe for real-time access to research, visit https://www.researchfrc.com/