Analysts’ Ideas of the Week

Silver Miner Bought Deal & Strong PEA; Gold Miner Nears Production

Published: Sept 15, 2025

Author: FRC Analysts

*Articles and research coverage are paid for and commissioned by issuers. See the bottom and below for other important disclosures, rating, and risk definitions, and specific information.

*Disseminated on behalf of Giga Metals, Enterprise Group, Millennial Potash, Builders Capital, Zepp Health, Silver X Mining, Blue Lagoon Resources, Doubleview Gold, Grid Metals, and Trident Resources. See the bottom of this report for other important disclosures

We review the performance of our Top Picks, led by nickel junior Giga Metals (TSXV: GIGA), which gained 25% WoW. Over the past year, our Top Picks have delivered an average return of 94%, significantly outperforming the benchmark’s 51% gain. Visit our website to view the full list of Top Picks by sector. We also share key updates on our covered companies, including junior gold and silver miners, as well as copper, nickel, and other exploration plays. *Past performance is not indicative of future performance.

Updates on Resource Companies Under Coverage

Silver X Mining Corp. (AGX.V, AGXPF)

PR Title: Announces a $13M bought deal financing (QP: David Heyl, Edgard Vilela, and Donald Hickson, consultants of Silver X Mining)

Analyst Opinion: Positive – This financing follows a robust Preliminary Economic Assessment (PEA) on Silver X’s Nueva Recuperada mine in Peru, which outlined an AT-NPV10% of US$303M, and an AT-IRR of 69%, based on US$33/oz silver, cash costs of US$12/oz, and initial capex of US$82M. The project is expected to produce over 6 Moz AgEq/year, compared to the current production rate of approximately 1 Moz/year. The study confirms Silver X’s plan to operate two mines within the Nueva Recuperada Silver District: the Tangana Mining Unit, in operation since 2021, and the Plata Mining Unit, which is expected to come online next year. With silver trading near record highs, we anticipate increased M&A activity over the next 12 months as larger companies target juniors to expand their portfolios.

Blue Lagoon Resources Inc. (BLAGF, BLLG.CN)

PR Title: Nearing commissioning of its water treatment system; Adds key team members as Dome Mountain moves toward commercial production

Analyst Opinion: Positive – BLLG announced it is just days away from commissioning its water treatment system, the final step before blasting and mining operations can begin. The company had commenced pre-production in July 2025, when we conducted a site visit (see our site visit report for details). Underground preparation work is underway. In parallel, BLLG has strengthened its team with the addition of a veteran underground mine supervisor, and an experienced environmental manager, signaling readiness for ramp-up. Management plans to process 55,000 tpy for 15,000 oz of gold in the first year, with a target of 20,000 oz in year two.

Doubleview Gold Corp. (DBLVF, DBG.V)

PR Title: Drill results from the Hat project in B.C. (QP: Erik Ostensoe, P.Geo., Consulting Geologist of Doubleview Gold Corp.)

Analyst Opinion: Positive – Preliminary results from an ongoing drill program at the Lisle zone returned high-grade copper and gold intercepts over long intervals, including 1.2 m of 5.26% CuEq, 169 m of 1.00% CuEq, and 220 m of 0.87% CuEq, expanding the mineralized footprint of the Hat deposit. We expect this to positively impact an upcoming resource update and PEA. The Hat project hosts an open-pittable, polymetallic porphyry deposit with resources totaling 5 Blbs CuEq, uniquely enriched with scandium and cobalt.

Grid Metals Corp. (GRDM.V, MSMGF)

PR Title: Drill permit approval for its Falcon West project in Manitoba

Analyst Opinion: Positive – This permit will allow GRDM to begin drilling the Lucy South cesium zone at its 100%-owned Falcon West lithium-cesium project. Cesium, classified as a critical mineral by both the U.S. and Canada, is vital for high-temperature drilling fluids, with numerous high-tech and industrial applications.

Trident Resources Corp. (ROCK.V)

PR Title: Options the Reindeer property connecting its Knife Lake and Greywacke projects, Saskatchewan (QP: Cornell McDowell, P.Geo., VP Exploration for Trident Resources)

Analyst Opinion: Positive – Reindeer is at an early exploration stage, with several gold, copper, zinc, and silver showings already identified. Trident can earn a 100% interest by issuing 2M shares, and paying $35k in cash. This is a strategic transaction, as the property connects ROCK’s two gold projects, Contact Lake and Greywacke, in the region. The company’s portfolio hosts relatively high-grade historical resources totaling 1.6 Moz AuEq at 1.2 g/t.

FRC Top Picks

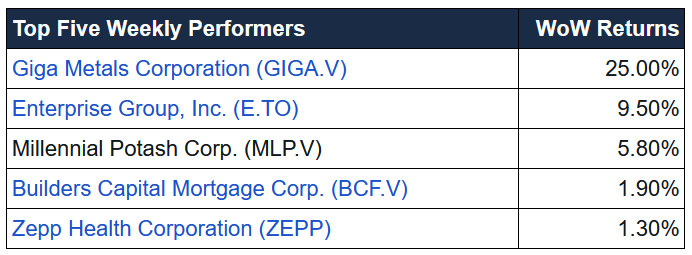

The table below highlights last week’s top five performers from our Top Picks. The best performer was nickel junior Giga Metals Corporation (TSXV: GIGA), which rose 25%. GIGA owns a large undeveloped nickel-cobalt project in B.C.

* Past performance is not indicative of future performance (as of Sep 15, 2025)

*Disclaimers – Annual fees ranging from $15,000 to $35,000 have been paid to FRC by Giga Metals, Enterprise Group, Millennial Potash, Builders Capital, Zepp Health, Silver X Mining, Blue Lagoon Resources, Doubleview Gold, Grid Metals, and Trident Resources for research coverage and distribution of reports. FRC or companies with related management, and Analysts, do not hold shares/securities in the companies mentioned in this report.

Disclaimer

The opinions expressed in this report are the true opinions of the analyst(s) about any companies and industries mentioned. Any “forward looking statements” are our best estimates and opinions based upon information that is publicly available and that we believe to be correct, but we have not independently verified with respect to truth or correctness. There is no guarantee that our forecasts will materialize. Actual results will likely vary. The companies listed above are covered by FRC under an issuer-paid model, where fees have been paid to FRC to commission this report and research coverage. This creates a potential conflict of interest which readers should consider. Distribution procedure: our reports are distributed first to our web-based subscribers on the date shown on this report then made available to delayed access users through various other channels for a limited time. To subscribe for real-time access to research, visit https://www.researchfrc.com/plans for subscription options. This report contains “forward looking” statements. Forward-looking statements regarding the Company, industry, and/or stock’s performance inherently involve risks and uncertainties that could cause actual results to differ from such forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, continued acceptance of the Company’s products/services in the marketplace; acceptance in the marketplace of the Company’s new product lines/services; competitive factors; new product/service introductions by others; technological changes; dependence on suppliers; systematic market risks and other risks discussed in the Company’s periodic report filings, including interim reports, annual reports, and annual information forms filed with the various securities regulators. By making these forward-looking statements, Fundamental Research Corp. and the analyst/author of this report undertakes no obligation to update these statements for revisions or changes after the date of this report. Fundamental Research Corp DOES NOT MAKE ANY WARRANTIES, EXPRESSED OR IMPLIED, AS TO RESULTS TO BE OBTAINED FROM USING THIS INFORMATION AND MAKES NO EXPRESS OR IMPLIED WARRANTIES OR FITNESS FOR A PARTICULAR USE. ANYONE USING THIS REPORT ASSUMES FULL RESPONSIBILITY FOR WHATEVER RESULTS THEY OBTAIN FROM WHATEVER USE THE INFORMATION WAS PUT TO. ALWAYS TALK TO YOUR FINANCIAL ADVISOR BEFORE YOU INVEST. WHETHER A STOCK SHOULD BE INCLUDED IN A PORTFOLIO DEPENDS ON ONE’S RISK TOLERANCE, OBJECTIVES, SITUATION, RETURN ON OTHER ASSETS, ETC. ONLY YOUR INVESTMENT ADVISOR WHO KNOWS YOUR UNIQUE CIRCUMSTANCES CAN MAKE A PROPER RECOMMENDATION AS TO THE MERIT OF ANY PARTICULAR SECURITY FOR INCLUSION IN YOUR PORTFOLIO. This REPORT is solely for informative purposes and is not a solicitation or an offer to buy or sell any security. It is not intended as being a complete description of the company, industry, securities or developments referred to in the material. Any forecasts contained in this report were independently prepared unless otherwise stated, and HAVE NOT BEEN endorsed by the Management of the company which is the subject of this report. Additional information is available upon request. THIS REPORT IS COPYRIGHT. YOU MAY NOT REDISTRIBUTE THIS REPORT WITHOUT OUR PERMISSION. Please give proper credit, including citing Fundamental Research Corp and/or the analyst, when quoting information from this report. The information contained in this report is intended to be viewed only in jurisdictions where it may be legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations or which would require any registration requirement within such jurisdiction.