Analysts’ Ideas of the Week

Top Picks Shine: Gold & Yield – Monument Mining and Builders Capital Beat Expectations

Published: June 2, 2025

Author: FRC Analysts

*Articles and research coverage are paid for and commissioned by issuers. See the bottom and below for other important disclosures, rating, and risk definitions, and specific information.

We review the performance of our Top Picks, including a junior gold miner, whose shares rose 31% last month. We also highlight promising earnings results from another gold producer, and an alternative lender under coverage, both on our list of Top Picks.

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts’ commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

Updates on Resource Companies Under Coverage

Monument Mining Limited (MMY.V, MMTMF)

PR Title: Reports Q3 results for the three months ended March 2025

Analyst Opinion: Positive – Q3 results exceeded our expectations. Production increased 74% YoY, and 11% QoQ, to 9.5 Koz, beating our estimate by 6%, driven by higher throughput and improved recoveries. This was the second-highest quarterly production since sulphide operations began in late 2022, trailing only Q4-FY2024. Cash costs declined 1% YoY, and 5% QoQ, to US$876/oz, closely aligning with our estimate of US$880/oz. Recoveries improved due to plant enhancements, and ongoing optimization efforts. EBITDA rose 7% QoQ, exceeding our forecast by 7%. We will publish a detailed update shortly.

North Peak Resources Ltd. (BTLLF, NPR.V)

PR Title: Sampling results from the Prospect Mountain Mine Complex (Prospect MMC) in Nevada

Analyst Opinion: Positive – Recent sampling within a past-producing area returned high gold and silver grades, including bonanza values of up to 46.5 g/t Au, and 569 g/t Ag. Prospect MMC is a historic gold-silver-lead producer in the Eureka mining district in Nevada. The project borders i-80 Gold’s (TSX: IAU) Ruby Hill project, which hosts a significant gold-silver resource. With several targets still untested, NPR plans to undertake additional drilling programs to explore these areas before advancing to a maiden resource estimate. The company is well funded, having recently completed a $5.4M equity financing.

Updates on Financials, Technology, Energy, and Special Situations Companies Under Coverage

Builders Capital Mortgage Corp./ TSXV: BCF

PR Title: Reports Q1 results for the three months ended March 2025

Analyst Opinion: Positive – BCF reported record revenue and EPS in Q1. Mortgage receivables (net) rose 20% QoQ to $52M, surpassing our year-end estimate of $49M. Revenue grew 50% YoY, beating our estimate by 15%, driven by higher mortgage receivables. EPS increased 13% YoY to $0.29, exceeding our estimate by 2%. The company maintained its annual regular dividend at $0.80/share, implying a yield of 9.0%. We will publish a detailed update shortly.

FRC Top Picks

The following table shows last month’s top five performers among our Top Picks. The top performer, Steppe Gold (TSX: STGO), was up 31%. STGO is a junior gold miner currently producing over 60 Koz gold annually.

* Past performance is not indicative of future performance (as of June 2, 2025)

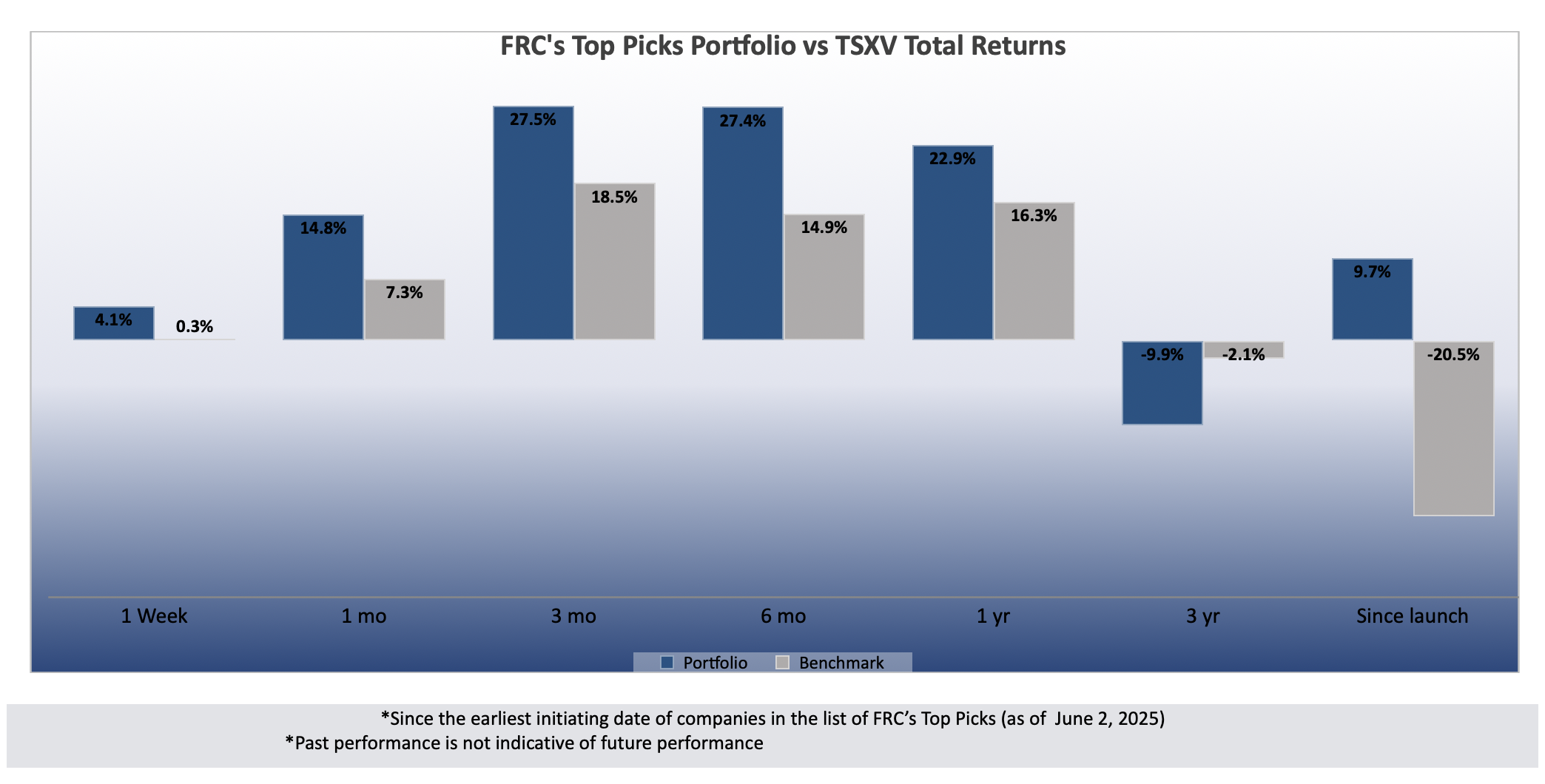

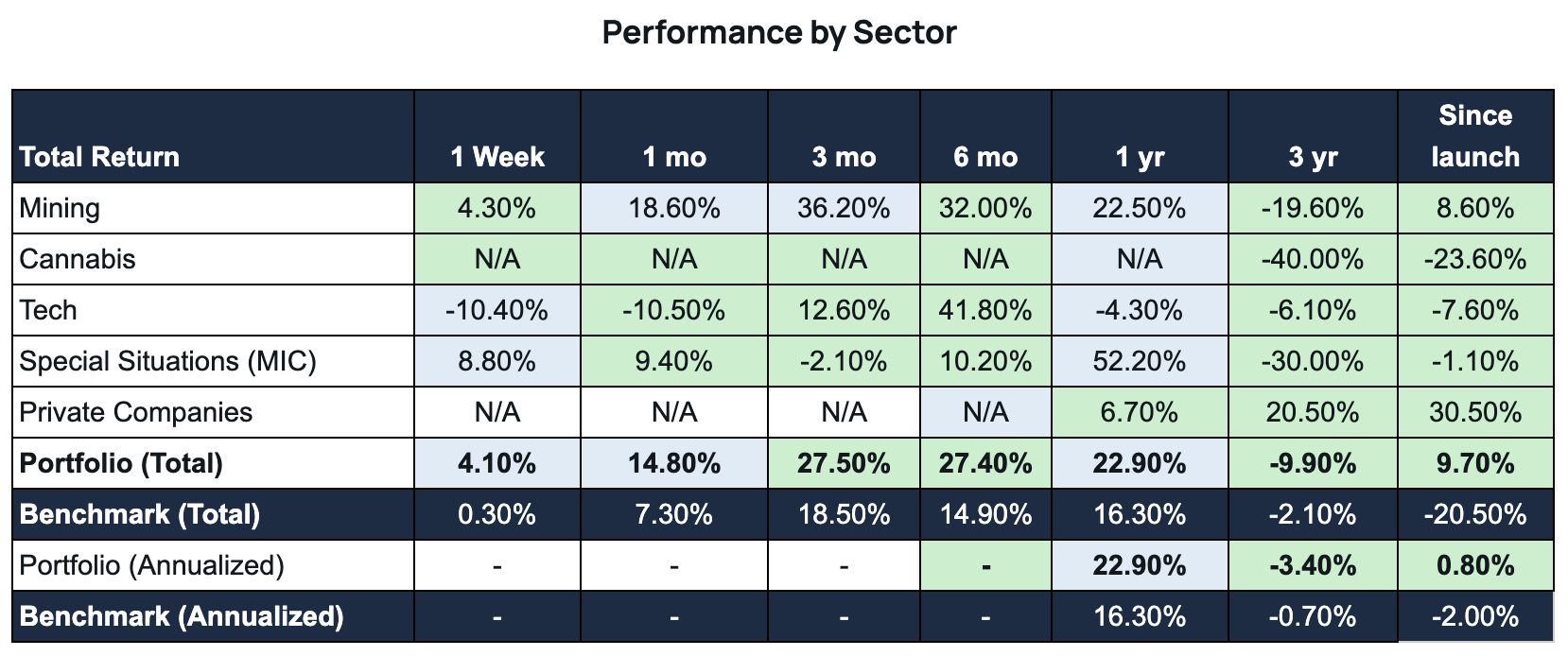

Our top picks have outperformed the benchmark (TSXV) in six out of seven time periods listed below.

1. Since the earliest initiating date of companies in the list of Top Picks (as of June 2, 2025)

2. Green (blue) indicates FRC’s picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.

The opinions expressed in this report are the true opinions of the analyst(s) about any companies and industries mentioned. Any “forward looking statements” are our best estimates and opinions based upon information that is publicly available and that we believe to be correct, but we have not independently verified with respect to truth or correctness. There is no guarantee that our forecasts will materialize. Actual results will likely vary. The companies listed above are covered by FRC under an issuer-paid model, where fees have been paid to FRC to commission this report and research coverage. This creates a potential conflict of interest which readers should consider. Distribution procedure: our reports are distributed first to our web-based subscribers on the date shown on this report then made available to delayed access users through various other channels for a limited time. To subscribe for real-time access to research, visit https://www.researchfrc.com/plans for subscription options. This report contains “forward looking” statements. Forward-looking statements regarding the Company, industry, and/or stock’s performance inherently involve risks and uncertainties that could cause actual results to differ from such forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, continued acceptance of the Company’s products/services in the marketplace; acceptance in the marketplace of the Company’s new product lines/services; competitive factors; new product/service introductions by others; technological changes; dependence on suppliers; systematic market risks and other risks discussed in the Company’s periodic report filings, including interim reports, annual reports, and annual information forms filed with the various securities regulators. By making these forward-looking statements, Fundamental Research Corp. and the analyst/author of this report undertakes no obligation to update these statements for revisions or changes after the date of this report. Fundamental Research Corp DOES NOT MAKE ANY WARRANTIES, EXPRESSED OR IMPLIED, AS TO RESULTS TO BE OBTAINED FROM USING THIS INFORMATION AND MAKES NO EXPRESS OR IMPLIED WARRANTIES OR FITNESS FOR A PARTICULAR USE. ANYONE USING THIS REPORT ASSUMES FULL RESPONSIBILITY FOR WHATEVER RESULTS THEY OBTAIN FROM WHATEVER USE THE INFORMATION WAS PUT TO. ALWAYS TALK TO YOUR FINANCIAL ADVISOR BEFORE YOU INVEST. WHETHER A STOCK SHOULD BE INCLUDED IN A PORTFOLIO DEPENDS ON ONE’S RISK TOLERANCE, OBJECTIVES, SITUATION, RETURN ON OTHER ASSETS, ETC. ONLY YOUR INVESTMENT ADVISOR WHO KNOWS YOUR UNIQUE CIRCUMSTANCES CAN MAKE A PROPER RECOMMENDATION AS TO THE MERIT OF ANY PARTICULAR SECURITY FOR INCLUSION IN YOUR PORTFOLIO. This REPORT is solely for informative purposes and is not a solicitation or an offer to buy or sell any security. It is not intended as being a complete description of the company, industry, securities or developments referred to in the material. Any forecasts contained in this report were independently prepared unless otherwise stated, and HAVE NOT BEEN endorsed by the Management of the company which is the subject of this report. Additional information is available upon request. THIS REPORT IS COPYRIGHT. YOU MAY NOT REDISTRIBUTE THIS REPORT WITHOUT OUR PERMISSION. Please give proper credit, including citing Fundamental Research Corp and/or the analyst, when quoting information from this report. The information contained in this report is intended to be viewed only in jurisdictions where it may be legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations or which would require any registration requirement within such jurisdiction.