The thoughts and opinions expressed in this article are those of the author and do not represent the views or endorsements of VYRE Business News Global. The organization assumes no responsibility for any claims made in this content.

POLITICS

USA

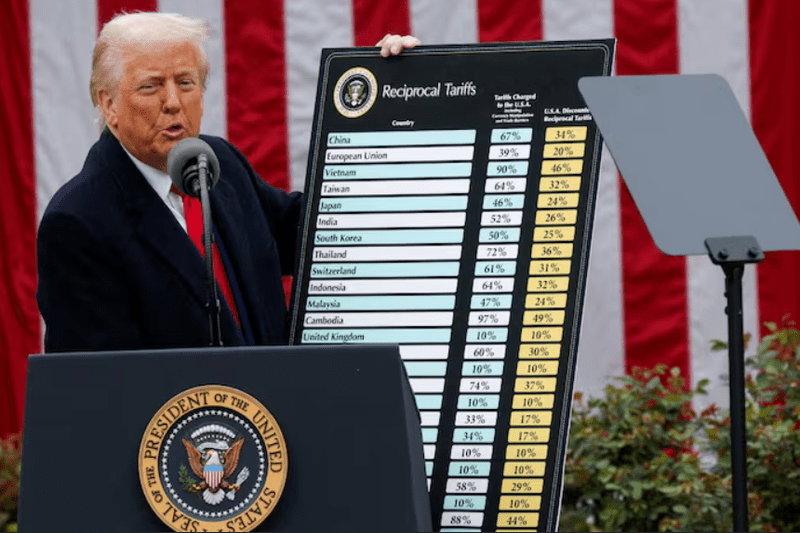

- The European Union, the US’s largest trading partner, vowed to retaliate after President Donald Trump announced sweeping tariffs against the bloc in his bid to dismantle the global trading dynamics that have put USA in a weak position.

- Germany considers withdrawing a massive stockpile of 1200 tons of gold from a US vault in New York following President Trump’s tariffs. The estimated value of the Germans’ Manhattan reserve is €113 billion (£96 billion) and accounts for 30 per cent of the country’s gold reserves worldwide.

- Japan’s government said it wasn’t considering compiling an extra budget to help mitigate the potential impacts from US tariffs, Minister of Finance Katsunobu Kato said.

- India looks open to lowering its up to 110% tariffs on automobiles for the first time in decades as the world rewires its supply chains and trade alliances amid Trump’s latest brinkmanship. India considers gold, silver imports from united states to bridge trade deficit

“The US is a leading producer of gold, silver, and platinum. India can easily source a sizable quantity of these valuable items from the US,” one of the people said on condition of anonymity. India’s total import of precious metals, including gold and gems crossed $74 billion in first 11 months of current financial year (April 2024-February 2025). In 2023-24 India imported $74.81 billion worth of these items. Of this about $5 billion of imports were from the US.”– India considers gold, silver imports from US to bridge trade deficit – Hindustan Times

- Singapore’s PM says “The US rejects the system it has created.” He says the U.S. has a trade surplus with Singapore and Singapore has no tariffs on the US, but still there is a 10% tariff now. “You don’t do that to a friend”

USA VS China – the most critical players in this Tariff escalation

China vowed to “fight until the end” if the US insists on imposing new tariffs, after Donald Trump threatened another 50% hike on goods from the Asian nation. Also, China restricts companies from investing in the United States in response to President Trump’s tariffs.

→ US Futures dropped after China made their threat.

On April 4th, China suspended exports of 7 rare earth minerals and magnets used in the defence, energy and automotive sectors. The new restrictions apply to 7 of 17 REEs—samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium—and requires companies to secure special export licenses to export the minerals and magnets.

- China’s rare earths controls prompt fears of auto shortages and shutdowns. Rare earths aren’t that rare if Trump can pull an Operation Warp Speed on processing and producing in the US, it will be a game-changer. Government barriers have been the biggest hindrance to the mining industry in the west.

→ USA retaliates with 104% tariffs

China started off by wanting to impose 34% tariffs on US goods, but then raised tariffs on all US goods to 84% and then a few days later to 125% that came into effect April 12

Vice-President of the Beijing-based Center for China and Globalization, Victor Zhikai Gao said:

- “China will lose the US market…”

- “We don’t care! China has been here for 5,000 years, most of the time there was no US, and we survived.”

- “If the US wants to go in that direction of completely shutting itself out of the China market. Be my guest!”

- “The world is big enough that the US is not the totality of the world’s market.”

Almost a third of U.S. services exports to China were related to education, coming from tuition and living expenses for the 270,000 Chinese students studying in the U.S., according to the most recent data from the Institute of International Education.

Computing services are another area where the U.S. runs a surplus with China. Companies like Microsoft Corp. and Amazon.com Inc. exported US$1.6 billion more in software, cloud computing and other digital services to China than the U.S. imported in 2023, the most recent year for which a data breakdown is available.

→ Trump tariffs put U.S. services trade surplus with China at risk

Meanwhile, European Union leaders reportedly plan to travel to Beijing for a summit with Chinese President Xi Jinping in late July. The news comes after Spain’s Prime Minister Pedro Sanchez called for Europe to forge closer ties with China in the face of Trump’s tariffs, calling Beijing a “partner of the EU.”

US President Trump exempted smartphones, computers, and chips from new tariffs, including those imported from China. Big tech firms such as Apple, Nvidia, Microsoft and the broader tech industry for sure took a huge breath of sigh of relief following this news. Although this could drastically impact the profit margins and thus evaluations of the very industry that allows the US stock market to perform so incredibly well. Tech is the driving force.

On April 15th, China announced they are halting all deliveries of Boeing jets.

US sets tariffs of up to 3,521% on South East Asia solar panels

The US Commerce Department has announced plans to impose tariffs of up to 3,521% on imports of solar panels from four South East Asian countries. It comes after an investigation that began a year ago when several major solar equipment producers asked the administration of then-President Joe Biden to protect their US operations.

“The proposed levies – targeting companies in Cambodia, Thailand, Malaysia and Vietnam – are in response to allegations of subsidies from China and the dumping of unfairly cheap products in the US market. A separate US government agency, the International Trade Commission, is due to reach a final decision on the new tariffs in June. The countervailing and anti-dumping duties, as these tariffs are known, vary between companies and the countries their products are made in.

Some solar equipment exporters in Cambodia face the highest duties of 3,521% because of what was seen as a lack of cooperation with the Commerce Department investigation. Products made in Malaysia by Chinese manufacturer Jinko Solar faced some of the lowest duties of just over 41%.Another China-based firm, Trina Solar, faces tariffs of 375% for the products it makes in Thailand.”

Weaponizing Treasuries

The United States says there is no risk of China weaponizing treasuries…… but how true of a statement is that? And over what time horizon is this in reference to?

Beijing warned nations against making trade agreements with Washington that hurt China, highlighting how economies around the world risk getting caught up in tensions

- “China firmly opposes any party reaching a deal at the expense of China’s interests. If this happens, China will not accept it and will resolutely take reciprocal countermeasures,” the Chinese Ministry of Commerce said.

- Chinese Foreign Ministry spokesperson Guo Jiakun said that the US should stop making threats and resorting to coercion if it wants an agreement on tariffs

- China asked South Korea not to export products using rare earths to US defense firms

- Japan is under US pressure to dial back trade with China in return for an easing of tariffs but that risks harming firms that do business there

Trump says he’ll cut tariffs on China to between 50% and 65%

China’s Huawei has developed a new AI chip called Ascend 910D seeking to match Nvidia – per WSJ, This came just weeks after the U.S. restricted Nvidia’s H20 chip sales to China.

China will hold a press conference about policies and measures on stabilizing employment, ensuring stable growth and promoting high-quality development for the economy. Trade war does create problems and uncertainty.

→ President Trump issues 90-day pause on tariffs for other countries other than China

NYC Mayor Eric Adams

He has left the democratic party and is running for re-election as an independent after they turned on him for not going with the democratic party on immigration. This came after a judge permanently dismissed a federal corruption case against the mayor.

Military

The US has massively bombed Yemen tonight, hitting a key oil port – Ras Isa oil port, a facility determined to be under Houthis control. Hours later a missile was launched by Houthis to Israel, but was intercepted by their defences.

US bombs rebel-held Ras Isa oil port in Yemen; Houthis fire missile at Israel in retaliation

Philippine lenders are prepared to bankroll the nation’s military modernization bid including the purchase of missile systems, fighter jets and submarines, executives said, as Manila bolsters its defense posture amid maritime clashes with China.

Massive explosion hits the Iranian port of Bandar Abbas

https://x.com/Megatron_ron/status/1916133927334432818

Iran’s Bandar Abbas Port Explosion: Watch Scary Visuals As Massive Blast Leaves 400+ Hurt

TRUMP & UKRAINE

Macron, Starmer, Trump and Zelensky met at the Vatican for a conversation after going to Rome for the Funeral of the Pope.

Ukraine and the US said they signed an agreement on a joint fund to invest in Ukraine’s reconstruction, and a draft of the deal said it would give Washington preferential access to new Ukrainian natural resources deals. → read more here What to Know About the Signed U.S.-Ukraine Minerals Deal

Russia

Another Russian General assassinated in Moscow via car bomb

https://x.com/Megatron_ron/status/1915722373816254553

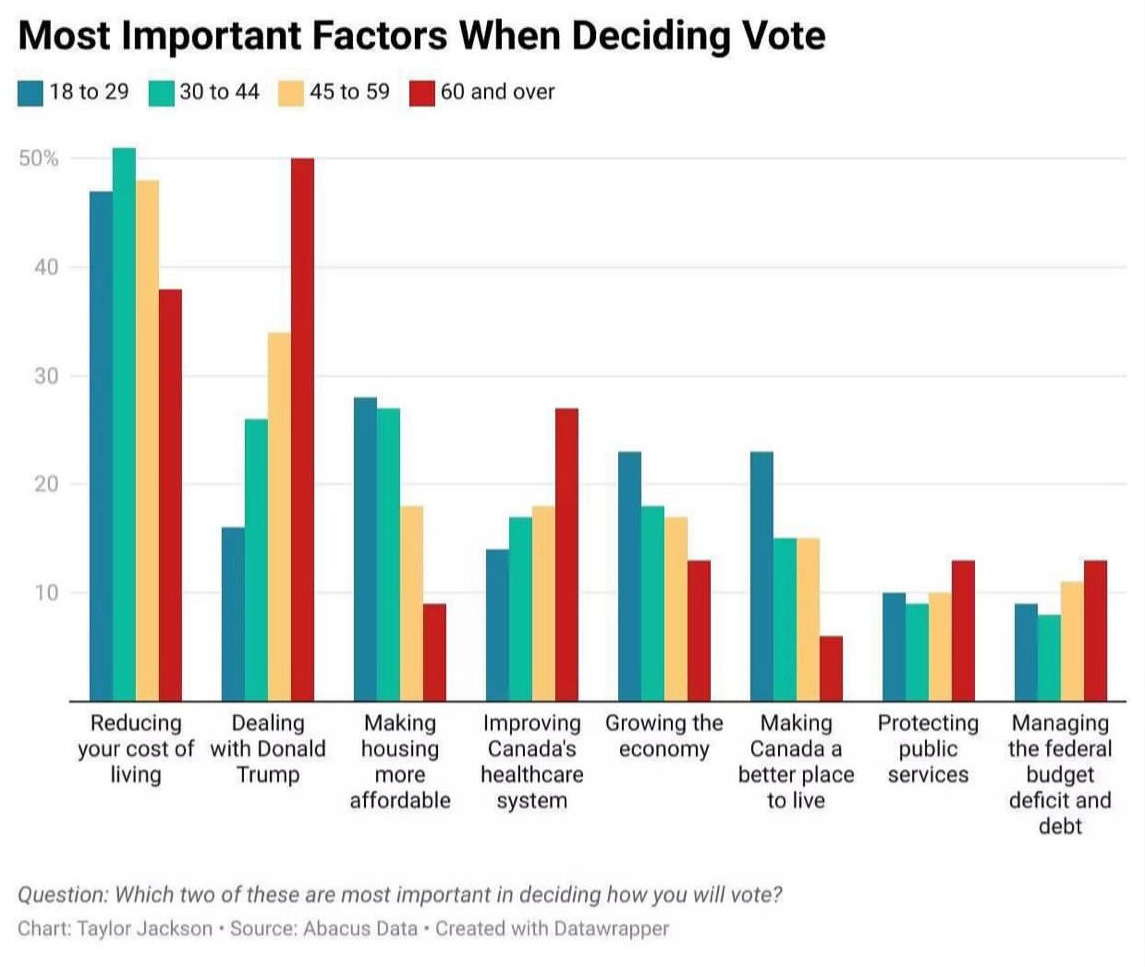

Canada

Mark Carnie Wins Canadian Parliament

- Wants to run greater deficits

- Promises another $130 billion in spending

- Increase CBC radio funding by $150 million and decide to make this statutory in order to protect its funding to ensure only parliament as whole would need to prove any changes, and not just the cabinet.

- Announced 25% tariffs on US cars imported to Canada

Klaus Schwab officially resigns as World Economic Forum’s Chairman.

“Founder quit after the board moved to investigate whistleblower allegations, which he denies, including use of luxury property and travel…”

GERMANY

AfD Is Now Germany’s Most Popular Party For The First Time Ever As ‘Ban’ Efforts Escalate

FRANCE

Marine La Pen has been convicted in court and is now banned from running for office for 5 years.

UK

The UK will be expected to pay a fee to guarantee British companies access to a €150bn EU weapons fund to buy weapons, under plans being discussed by diplomats in Brussels

An audience put Labour, the Tories, Lib Dems, Greens and Reform on the spot – on the issues they care about. Watch following video they had in the UK in april with the elections coming up.

Let me say this one thing about watching bureaucrats debate – it irks me, I am crackling in my skin as I listen to them play these political games. How insane that this is what we seek to protect this absurdity……. You call this logical? Functional? Its maddening of a society to think these games solve our problems.

Yet meanwhile, Uk supreme court ruled into law what defines a “woman” – an individual born biologically female.

Supreme Court rules that ‘woman’ in UK law refers to biological sex

Imagine having the need for the court system to validate basic biology and reality. The West is losing itself with ideological insanities that deviate far far away from truth.

SPAIN

Spanish police arrested the Press Secretary of Vox for reading a list of names of people arrested in Barcelona, for hate speech.

“José Antonio Fúster, official spokesman of the Spanish right-wing Vox Party and deputy in the Madrid Assembly, is being investigated by the Catalan police force for linking migration with criminality.

During a press conference in Bambú, in July 2023, he read out aloud a list of first names of people arrested after heavy riots in Barcelona.

“The list of the first 50 people arrested on Saturday night in Barcelona: Sabar, Omar, Nassim, Abdelkader, Salah, Salah, Younes, Karim, Jamil, Amir, Alí, Oussama, Hassan… I could go on. Can you see any pattern? The only hatred is against Spaniards and their security.””

NETHERLANDS

In Amsterdam, there was a failed car bomb after a car set on fire from a small explosion police believed was a deliberate attack.

INDIA & PAKISTAN at war……?

India summoned the top Pakistani diplomat in New Delhi, local media reported, a day after it announced measures to downgrade ties with Islamabad as relations between the nuclear-armed rivals plummeted following a deadly militant attack in Kashmir.

After the worst civilian massacre in Kashmir since 2008, India SLAMS Pakistan. India closed the border, expelled diplomats, & suspended the Indus Water Treaty. India effectively cut off the flow of water to Pakistan, depriving Pakistan of 80% of its water needs. Islamabad warned early on that this would be an act of war

SYRIA

End of month saw more clashes between Druze militias and Jolani’s forces on the outskirts of Damascus.

SOUTH KOREA

South Korea’s main opposition Democratic Party of Korea named Lee Jae-myung, the party’s ex-leader, as its candidate for the snap presidential election slated for June 3

NIGERIA

More death and violence in northwest Nigeria as villagers battle militants

Algeria & French

Algeria prepares to expel 12 French diplomats from the French embassy in Algiers

CONGO

The Democratic Republic of Congo government will initiate legal proceedings against former President Joseph Kabila for allegedly supporting Rwanda-backed M23 rebels in the country’s mineral-rich east

ECONOMICS

Apple was fined 500 million euros ($570 million) on Wednesday and Meta 200 million euros, as European Union antitrust regulators handed out the first sanctions under landmark legislation aimed at curbing the power of Big Tech.

Global money supply is soaring to new record highs and markets see it.

Several European countries lost electricity

Major blackouts hit France, Spain and Portugal. Trains are stopped, airports are blocked, banking systems are down, internet problems, mobile networks are down.

Central Banks

FED – No FED meeting

- Bank of America is budgeting for 4 rate cuts in 2025: May, July, Sept and Dec

ECB – cuts interest rates for seventh time in a year

- ECB president Christine Lagarde: ECB is ready to use instruments it has if needed

PBOC – China keeps lending rates steady; trade war raises bets for stimulus

BOJ – The Bank of Japan left its benchmark rate unchanged while pushing back the timing for when it expects to reach its inflation target

BOC – held rates unchanged at 2.75%

US ECONOMY

Bessent says long way from needing contingency plans. He also said “sure” when asked if all options on the table, saying the treasury has a big toolkit, could boost buybacks if need be……. QE again?

Bond King Jeffrey Gundlach

“No, US bond market credit spreads are not “well contained” since year end, the extra interest junk bond companies need to pay to borrow vs the US treasury have increased by 140 basis points.”

Deutsche Bank is warning of a structural dollar downtrend in the coming years which will knock the US currency down to its weakest level in more than a decade against the euro.

Trump VS Jerome Powell

France is warning that the president of the United states would put the credibility of the dollar on the line if he fired federal reserve chair Jerome Powell.

One Of The Largest Malls In The U.S. Just Defaulted On Its $300 Million Mortgage | ZeroHedge

“Pyramid took out the loan from JPMorgan Chase in 2014 to finance Destiny USA’s expansion. It has only made interest payments and failed to refinance or repay the principal as required, due in part to the mall’s declining value amid retail closures and e-commerce growth.

Recall about a month and a half ago we highlighted that at the end of Q4 2024, commercial real estate continued to exhibit severe weakness, with commercial real estate bonds hitting record distress levels, surpassing the previous records reached in Q3 2024.

Commercial real estate bonds are just commercial real estate loans packaged into securities and sold to investors. One category of bonds, commercial mortgage-backed securities (“CMBS”), saw their distress rate increase to 10.6 percent, a fourth consecutive monthly record.

Most notably, in the CMBS category—which comprises approximately $625 billion in outstanding commercial real estate debt—loans on office properties now exhibit a distress rate above 17 percent while apartment loan distress accelerated to 12.5 percent.”

US manufacturing recession

The NY Empire State Manufacturing Survey 6-mth Ordering Intentions fell to the LOWEST READING IN THE HISTORY OF THE INDEX!

Copper production in USA

“The Trump administration should consider implementing export restrictions on domestically produced copper concentrate and copper scrap,” wrote Rio Tinto.

COPPER

Trading house Mercuria is warning that China’s copper stockpiles could plunge to zero within months, triggering one of the most severe tightening shocks in market history.

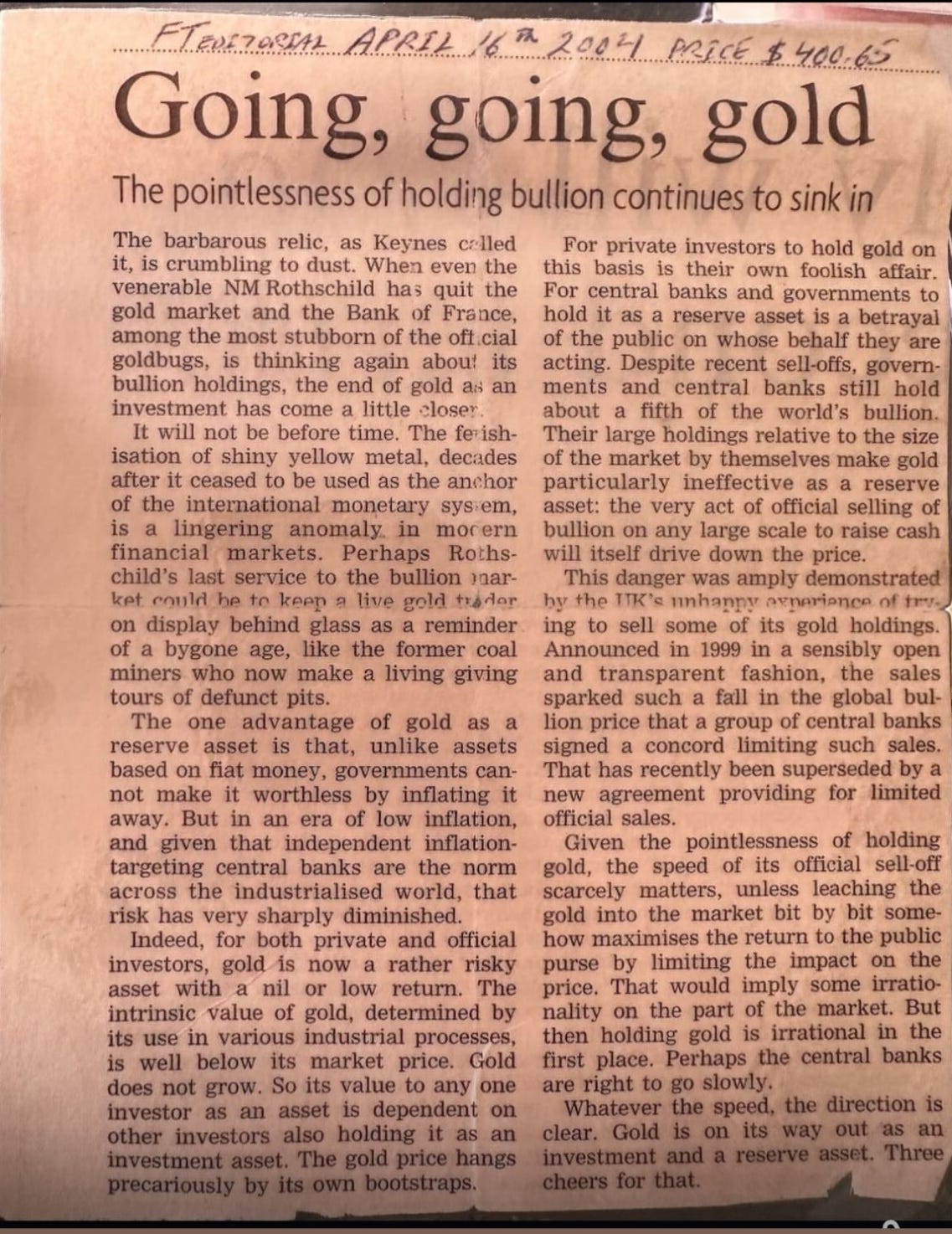

GOLD

“Gold is forever. It is beautiful, useful, and never wears out. Small wonder that gold has been prized over all else, in all ages, as a store of value that will survive the travails of life and the ravages of time.” — James Blakeley

SILVER

BRICS

Russian Foreign Minister Sergey Lavrov says BRICS is exploring the creation of a new payments platform, opening alternative platforms to non-members of BRICs.

“There are a number of other initiatives currently under consideration within the BRICS format, one of them being a proposal by Brazil to create an alternative payment platform, with work underway on this track. I am confident that countries, even those outside BRICS, will have access to such mechanisms when they are created. There is an opportunity to form payment platforms independent of external influence, one example being the financial messaging system of the Bank of Russia. It is convenient, and it does not depend on any SWIFT network,” the minister noted.

CHINA

China’s stock market rebounded after a steep historic selloff. A group of state-linked funds known as the national team scooped up assets and the central bank promised loans to help stabilize the market. The onshore CSI 300 Index, which had dropped more than 7% the day, registering one of the worst days since the financial crises.

China announces it has discovered 2 new deposits of high-purity quartz, a mineral with a small but crucial role in the production of semiconductors and solar panels. This has the intentions of helping reduce dependence on US imports.

- one near Qinling, Henan province, and the other in Altay, Xinjiang region.

China is planning to spend $1.6 trillion to help its hugely indebted local governments.They also released an action plan to promote the use of the yuan and its own payment system in international trade as it seeks to reduce its dependence on the dollar amid an escalating trade war with the United States. Aims to leverage Shanghai’s role as a global financial hub to promote the use of the Chinese currency, especially in trade involving countries in the Global South. Shanghai will “enhance the functionality” of the Cross-Border Interbank Payment System (CIPS) – China’s alternative to the Society for Worldwide Interbank Financial Telecommunication (Swift) payment system – and continue expanding the global coverage of the CIPS network, according to the policy. It will also strengthen financial support for Chinese enterprises “going global” and advance the Belt and Road Initiative, while “enabling all types of market players to engage in international competition and cooperation in a safer, more convenient and efficient manner”, according to an official statement.

CANADA

Canadian economy lost 33,000 jobs and unemployment jumped to 6.7% for the month of March

Canadian pension fund Caisse de Dépôt et Placement du Québec (CDPQ) is moving to sell a major Chicago office tower at a steep discount, reflecting ongoing struggles in the US office market and signaling broader Canadian pullback from American real estate.

- Market expectations suggest bids will come in around $60 million, sharply below the roughly $145 million Ivanhoé and its partner, Callahan Capital Properties, paid for the tower in 2017, down nearly 59%. Public records show the building carries no debt.

JAPAN

COLOMBIA

Colombian President Gustavo Petro took aim at the head of the IMF, referencing “vampires,” after the lender paused his nation’s access to its $8.1 billion flexible credit line, in place since 2009,

- This is due to the lack of measures to reduce public deficit and debt, which have risen more than expected in the fund’s eyes

- Has only used it once, during the Covid-19 pandemic in September 2020, when it withdrew approximately $5.4bn to address the emergency.

UK businesses file for insolvency

More than 3,700 firms filed for insolvency in the past month, according to notices filed to The Gazette, where the country’s business closures are advertised. That’s a 32% increase on the same period last year.

AFRICA’s AFREXIMBANK

The African Export–Import Bank (Afreximbank), a key investor in oil and gas projects, has earmarked $3 billion to finance the purchase of refined products within Africa as part of broader plans to boost refining capacity.

- “The US$3 billion Revolving Intra-African Oil Import Financing Programme is intended to mainly provide critical trade finance to oil traders (both African and international), banks, and Governments – represented by their Ministry of Finance or Ministry of Petroleum Resources/Energy – and state-owned enterprises mandated to import refined petroleum products, who seek to source refined products from African Refineries for onward consumption within the continent and export opportunities as may be applicable. Afreximbank, affiliated trading entity ATDC Minerals (ATMIN) will also participate actively in the trading and financing activities of the leading African oil trading companies with long term relationship with Afreximbank who are also expected to support this effort.”

GERMANY

Germany has been in recession for 6 quarters: the longest contraction in its post-reunification history. They are seeking to re-industrialize. Is more government spending and inflation the solution out?

INDIA

The Reserve Bank of India on April 9 unveiled a new set of stricter regulations for financial institutions that give gold loans, which are basically loans secured by gold. The move RBI has proposed is aimed at refining the underwriting processes, enhancing the management of collateral, and ensuring that the funds are utilised appropriately.

Apple plans to produce all US-sold iPhones in India by 2026.

Argentina

Argentina’s FX reforms and IMF deal

IRAN

Iran is expanding uranium production after indicating that it has significantly higher reserves of the metal than previously estimated, according to the latest nuclear-watchdog data

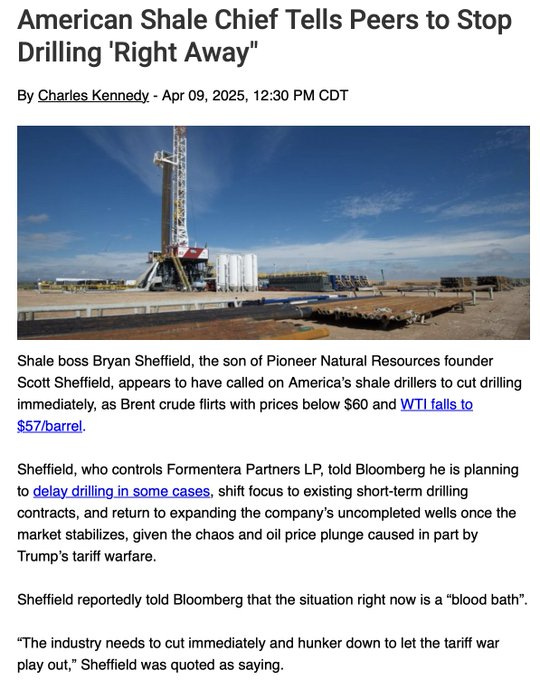

OIL

PANAMA

Crypto Payment

Panama City Approves Bitcoin And Crypto Payments for Taxes, Fees, & Permits. The legislation mandates that public institutions must receive funds in U.S. dollars. To facilitate this, the city has partnered with a bank responsible for handling cryptocurrency transactions.

Restart the Copper mine

“Panama’s President Jose Raul Mulino said his government is studying options to restart the nation’s flagship copper mine without the need for congressional approval. At that time, the Supreme Court ruled against a contract approved in Congress that extended the mine’s operations. The possibility of reopening shouldn’t be in the hands of the legislature, he said.

“I have the enormous responsibility of solving this problem in a way that represents a great asset to Panama,” the president said. “We will do what is necessary to establish a real association, and make it understood with clarity that the mine is Panama’s and belongs to Panamanians, and to no one else. Within those parameters we can work on a variety of options.” he said.” – Panama mulls mine restart options that don’t need Congress – BNN Bloomberg

CRYPTO

Bitcoin came down to below $75,000 USD, from a selloff that started late January 2025.

Mastercard announced that it will give merchants the option to receive payments in stablecoins amid increasing global regulatory clarity on the digital assets that are usually pegged to fiat currencies.

- In a press release, Mastercard said it was partnering with firms including payments processor Nuvei and stablecoin issuers Circle and Paxos to enable the payments in the cryptocurrencies.

- Lawmakers introduced the bipartisan Guiding and Establishing National Innovation for US Stablecoins Act, or GENIUS Act, earlier this year to create a regulatory framework for stablecoins in the US. The bill passed a Senate committee vote in March and is moving toward potentially becoming law.

CULTURE

Active shooter incident at FSU – Florida State University

Massive strike from L.A. county workers. Thousands were in the streets downtown LA marching

Nic Tartaglia’s MacroΩInsights

I am obsessed with the macro world, where I seek to dissect and understand the ever-changing dynamics of the world on a monthly basis through a Political, Cultural & Economic lens.