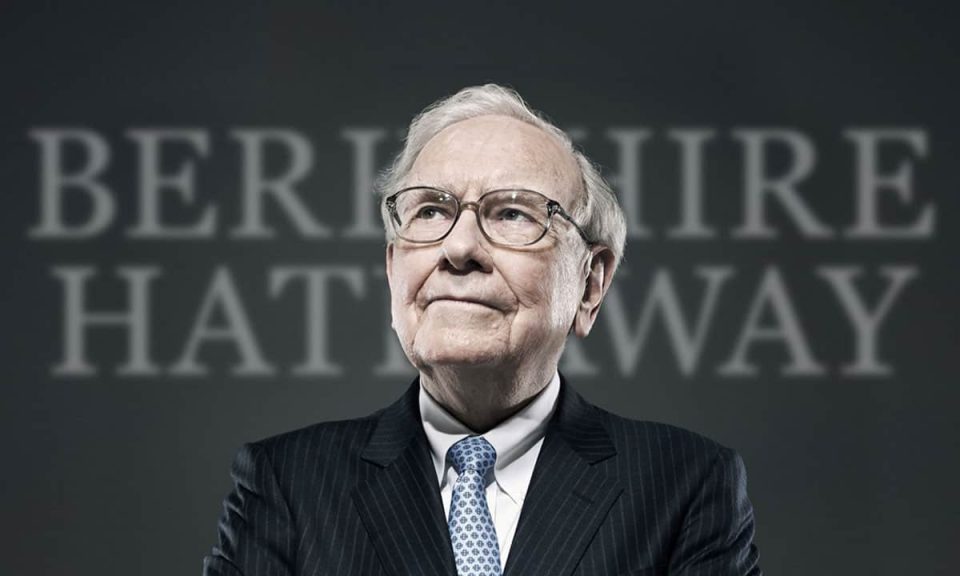

Berkshire Hathaway Inc. (NYSE: BRK.A, BRK.B) shares faced notable declines Monday following Warren Buffett’s unexpected announcement that he will step down as CEO, ushering in a new leadership era for the conglomerate after six decades under his stewardship.

At 94 years old, Buffett revealed the leadership change during Berkshire’s annual meeting in Omaha, Nebraska, naming Greg Abel, the company’s vice chairman of non-insurance operations, as his successor. The board unanimously approved Abel’s promotion to president and CEO effective January 1, 2026, while Buffett will continue as chairman, maintaining a guiding role in the company’s strategic direction.

The market reacted swiftly to the news. Berkshire Hathaway’s Class A shares dropped 6.2% to approximately $760,000 per share from a record closing high of $809,350 on Friday. Similarly, Class B shares fell 6.2% to $506.12 after hitting an all-time peak of $539.80 the previous day. This pullback reflects investor uncertainty as they digest the implications of the leadership change for the company’s future.

Buffett’s tenure at Berkshire Hathaway is legendary, spanning over 60 years of transformative growth and value creation. Under his leadership, the company evolved from a struggling textile manufacturer into a sprawling conglomerate with diverse holdings, including insurance, utilities, railroads, manufacturing, and retail. Berkshire’s market capitalization now exceeds $1.16 trillion, with annual revenues surpassing $371 billion, underscoring its status as a titan in the finance and industrial sectors.

Greg Abel’s appointment signals a strategic continuity with a focus on Berkshire’s broad portfolio beyond insurance. Abel has been instrumental in managing the company’s non-insurance businesses, which include utilities, energy, and manufacturing operations. His elevation to CEO suggests that Berkshire will maintain its diversified investment approach, leveraging Abel’s operational expertise to drive growth in these segments.

The timing of the announcement, made at the company’s annual meeting, was unexpected but deliberate. Buffett has long emphasized the importance of succession planning, and this move provides clarity to shareholders and markets about the company’s leadership transition well in advance. By remaining as chairman, Buffett ensures a smooth handover while retaining influence over Berkshire’s long-term strategy.

Despite the immediate stock price reaction, analysts note that Berkshire Hathaway’s fundamentals remain strong. The company’s stock has experienced significant appreciation over the past year, with Class A shares reaching a 52-week high of $812,855 and an average price of $691,072 during this period. The shares have demonstrated resilience and growth potential, even as the market adjusts to the news.

Looking ahead, market forecasts for Berkshire Hathaway’s Class B shares suggest moderate growth with expected price ranges between $470 and $592 over the coming months. This outlook reflects cautious optimism as investors evaluate Abel’s leadership capabilities and the company’s strategic direction post-Buffett.

The leadership transition at Berkshire Hathaway marks a significant milestone in corporate America. Warren Buffett’s legacy as an investor and business leader is unparalleled, and the company’s future will now be shaped by Greg Abel’s vision and management style. Investors will be closely watching how this transition influences Berkshire’s performance and its ability to sustain long-term value creation.

Berkshire Hathaway’s shares have adjusted to the news of Warren Buffett stepping down as CEO, with Greg Abel set to take the helm in 2026. The company remains a dominant force in the financial and industrial sectors, poised to continue its diversified growth strategy under new leadership while benefiting from Buffett’s ongoing role as chairman. This transition represents both an end of an era and the beginning of a new chapter for one of the world’s most influential conglomerates.