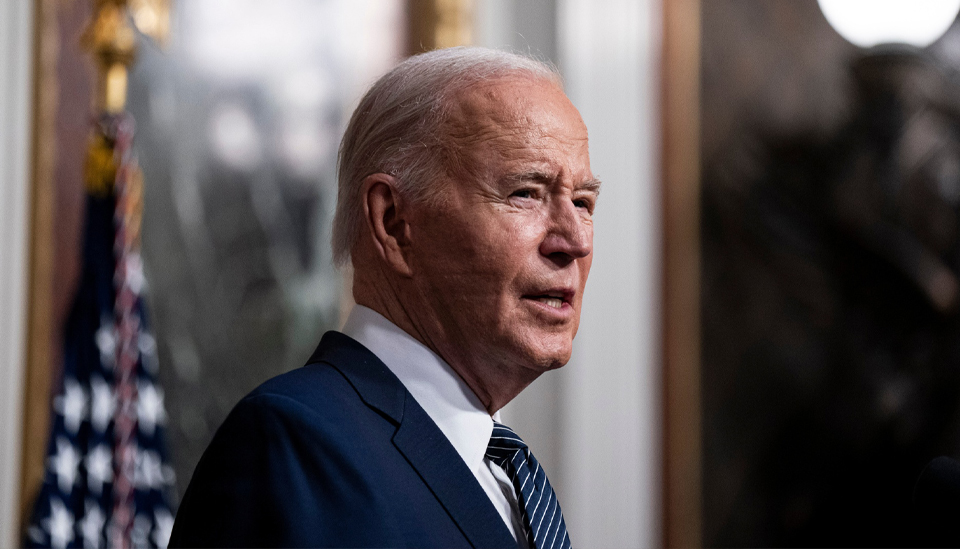

With President Joe Biden withdrawing from the race and endorsing Kamala Harris as his replacement, investors are naturally questioning how this shift in the Democratic ticket might influence the stock market.

To understand potential market reactions, it’s helpful to examine how the market has responded to fluctuations in the race between Biden and his Republican challenger, former President Donald Trump. “The market has been consistently trending in the same direction as President Trump’s odds of victory in November,” said Adam Turnquist, chief technical strategist at LPL Financial. Turnquist noticed this correlation starting in March, when both the market and Trump’s prospects began to align.

However, this doesn’t imply that market participants are necessarily endorsing Trump’s policies. “I don’t think you can make the case that the market is moving higher because Trump’s odds are moving higher,” Turnquist explained. “But we know the market doesn’t like uncertainty.” As Trump’s chances of winning have increased, the market has found comfort in that perceived certainty. Turnquist also noted that earlier in 2024, when Biden was favored to win, the market showed a positive correlation with his re-election chances.

In essence, the market appears to react positively to the likelihood of a decisive victory by either candidate. However, disarray within the Democratic ticket could potentially enhance certainty around a Trump victory or even a Republican congressional sweep.

Speculation about Biden’s candidacy intensified following the June 27 debate, where he delivered a halting and sometimes incoherent performance. This led to concerns among Democratic politicians about his condition and viability. Vice President Kamala Harris began to surpass Biden in some betting markets for the Democratic presidential nomination following the debate.

Betting markets have also indicated a higher probability of a Trump victory, especially after an attempted assassination attempt on the former president at a rally near Pittsburgh, which correlated with a rise in Dow futures.

Jeff deGraaf, founder of Renaissance Macro Research, observed that the negative correlation between Biden’s poll standings and the S&P 500’s performance, though not statistically significant, explained stock-market performance better than other factors such as oil prices, Treasury yields, Federal Reserve policy, corporate bond spreads, purchasing managers’ index readings, inflation data, and GDP.

Some investors and strategists argue that the prospects of a Trump victory — potentially extending his 2017 tax-cut package and further deregulation — have been positive for the market. Equity strategists at Morgan Stanley, led by Mike Wilson, noted increased client interest in small-capitalization and cyclical stocks post-debate, reminiscent of the market response after Trump’s 2016 election victory.

However, investors should be mindful of key differences between now and 2016. “First, we think the data indicates that the cycle is more mature today, which supports a quality and large-cap bias,” they wrote. Additionally, the market welcomed a reflationary/pro-fiscal approach in 2016 as the economy was recovering from the manufacturing/commodity downturn of 2015, and inflation wasn’t a significant issue for consumers.

Both Biden and Trump are not expected to significantly rein in fiscal deficits, but the potential extension of tax cuts and other measures were cited as reasons for a sharp rise in Treasury yields post-debate.

Investors should remember that election years typically see increased volatility as November approaches, Turnquist noted. Another critical factor is the stock market’s performance in the three months leading up to Election Day on November 5. Historically, the market’s performance during this period has predicted 20 of 24 election outcomes, with incumbents tending to win when the market rises and lose when it falls.

Source MarketWatch