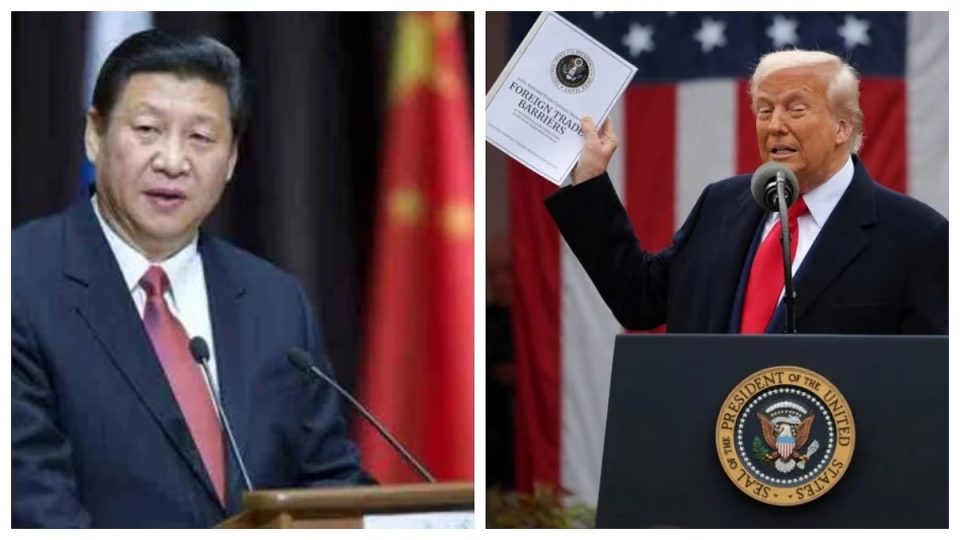

In a significant escalation of the ongoing trade conflict between the United States and China, Beijing has announced that it will impose a 34% tariff on all U.S. imports starting April 10. This move is a direct response to U.S. President Donald Trump’s recent decision to introduce a 34% tariff on Chinese products entering the U.S. The new tariffs mark a substantial increase in tensions between the two economic giants, potentially affecting hundreds of billions of dollars in trade.

The trade dispute between the U.S. and China has been intensifying since Trump resumed his presidency in January. The White House has justified its tariffs as necessary measures to address issues such as the illicit flow of fentanyl from China to the U.S. However, China views these actions as unilateral bullying that contradicts international trade regulations and undermines its legitimate rights and interests.

China’s decision to impose a 34% tariff on all U.S. imports is a broad and significant escalation compared to its previous targeted measures. Earlier responses included tariffs on specific U.S. products like agricultural goods and fuel, as well as actions against certain American companies. The current tariffs apply to all U.S. products, signaling a more comprehensive approach to retaliation.

In addition to the tariffs, China has also expanded its export controls on rare earth elements, which are crucial for high-tech products such as computer chips and electric vehicle batteries. This move could severely impact U.S. access to these essential materials, further complicating the trade landscape.

The Chinese government has added 27 U.S. companies to lists of firms subject to trade sanctions or export controls. This includes companies involved in dual-use goods, which are products that have both civilian and military applications. The inclusion of these companies on the sanctions list reflects China’s strategic approach to leveraging its economic influence in the dispute.

Beijing has also filed a formal complaint with the World Trade Organization (WTO) over the U.S. tariffs, arguing that they violate WTO rules. This legal action marks the beginning of a formal dispute resolution process, which could lead to further international scrutiny of the trade practices of both nations. The WTO has acknowledged China’s request for discussions, setting a 60-day timeline for resolution.

The escalating trade tensions have significant implications for both economies and global markets. As the trade conflict deepens, investors are watching closely for any signs of resolution or further escalation. The ongoing tensions have already triggered a worldwide stock market decline, raising concerns about a potential recession. The situation underscores the need for diplomatic efforts to stabilize the global economic order and prevent further damage to international trade relations.