Curaleaf Holdings, Inc. (TSX: CURA, OTCQX: CURLF) has just tightened its grip on the European cannabis market by buying out its minority partner in Curaleaf International Holdings Limited. The move brings Curaleaf’s ownership of its European holding company to 100 percent, marking a significant milestone for the company as it continues to expand its international reach.

The transaction closed on July 2, 2025, and follows a Put/Call Option agreement that was set in motion back in 2021 when a strategic institutional investor first joined Curaleaf’s European venture. The investor chose to receive Curaleaf Subordinate Voting Shares as payment, rather than cash, a decision that signals confidence in the company’s future prospects. Regulators have conditionally approved the issuance of these shares on June 25, pending standard listing conditions.

With this buyout, Curaleaf now has complete control over its European operations. This is more than just a technical shift. By consolidating ownership, Curaleaf can make decisions more quickly and align its European strategy with its global ambitions. The company believes this will help it accelerate initiatives across multiple markets and create more value for shareholders.

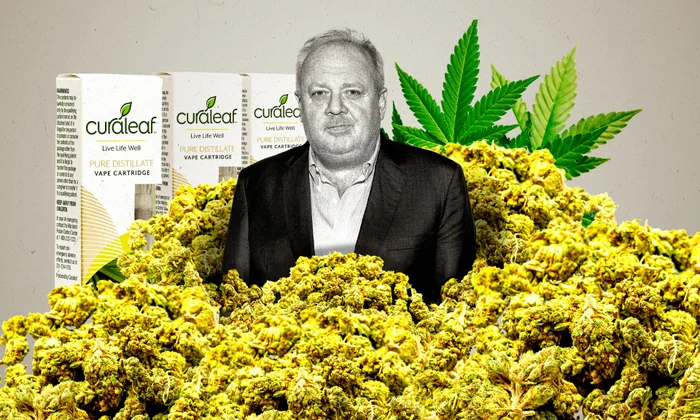

Boris Jordan, Executive Chairman of Curaleaf Holdings, described the buyout as a key step in the company’s ongoing commitment to international growth and shareholder value. He also thanked the outgoing investor for their support and belief in Curaleaf’s future, highlighting the collaborative spirit that has characterized the partnership to date.

Curaleaf is not new to international expansion. The company has built a broad portfolio of brands, including Select, Grassroots, Find, Anthem, and The Hemp Company. Its reach extends across medical and adult-use markets, with a focus on quality and reliability. Curaleaf International, the company’s European arm, is involved in every stage of the cannabis supply chain, from cultivation to distribution.

The company’s European network is extensive, featuring a clinic, pharmacy, and laboratory in the UK; cultivation and EU-GMP processing facilities in Portugal; and an EU-GMP processing, quality assurance, and research site in Spain. In Germany, the network includes Four20 Pharma, a wholesaler and distributor, while in Poland, it operates both a wholesaler and a clinic. Additionally, Northern Green Canada, an EU-GMP producer, is part of this comprehensive network.

This infrastructure gives Curaleaf a unique position to serve a rapidly evolving market. The company’s emphasis on research and quality is designed to ensure that its products meet both regulatory standards and consumer expectations across Europe, Canada, and Australasia.

One notable aspect of the transaction is that the minority investor opted to receive Curaleaf shares instead of cash. This choice is telling. It suggests that the investor sees long-term value in holding equity in Curaleaf, rather than cashing out. For Curaleaf, it means the company can conserve cash and further align its interests with those of its shareholders.

With the buyout complete, Curaleaf is in a strong position to pursue its ambitions in Europe. The company has made no secret of its plans to expand internationally, and this consolidation gives it the flexibility and control needed to move quickly in a competitive landscape.

Curaleaf’s leadership believes that having full control over its European operations will allow for faster decision-making and better alignment with the company’s overall strategy. As the cannabis industry continues to mature, especially in Europe, Curaleaf’s integrated approach could set it apart from competitors.

Curaleaf’s acquisition of the remaining stake in its European holding company is more than just a corporate maneuver. It’s a signal of intent from a company that wants to be a global leader in cannabis. With a robust infrastructure, a diverse brand portfolio, and now complete control over its European business, Curaleaf is set to make its mark in the international cannabis market.