First Majestic Silver made waves in the market as it announced the successful commissioning and commencement of bullion sales at its state-of-the-art minting facility, First Mint, LLC. This milestone marks a significant leap forward for the company, triggering a notable surge in its stock price.

First Majestic Silver Surges on First Mint

Following the announcement, First Majestic Silver’s stock witnessed a substantial surge, opening trading at $5.29 on Wednesday morning, a modest increase from the previous day’s close of $5.25. At the time of this publishing, the stock is trading at $5.52, reflecting a 5.14% increase.

First Mint of First Majestic: Revolutionizing Silver Production

First Mint, the brainchild of First Majestic, is set to revolutionize the company’s silver production landscape. With plans to produce over 10% of its current silver production from its Mexican operations, the mint represents a strategic investment in expanding the company’s operational footprint.

Benefits of In-House Minting

By launching First Mint, First Majestic gains the ability to sell its silver production directly to shareholders and bullion customers, cutting down unit production costs and expediting delivery times. This move ensures that the company’s bullion store remains well-stocked to meet customer demand efficiently.

First Mint of First Majestic Silver – Environmentally Conscious Practices

First Mint prides itself on its use of advanced equipment that consumes less electricity and emits no gases compared to traditional minting techniques. The facility is now pursuing ISO 9001 accreditation, a testament to its commitment to quality and environmental sustainability.

Limited Edition Collectibles

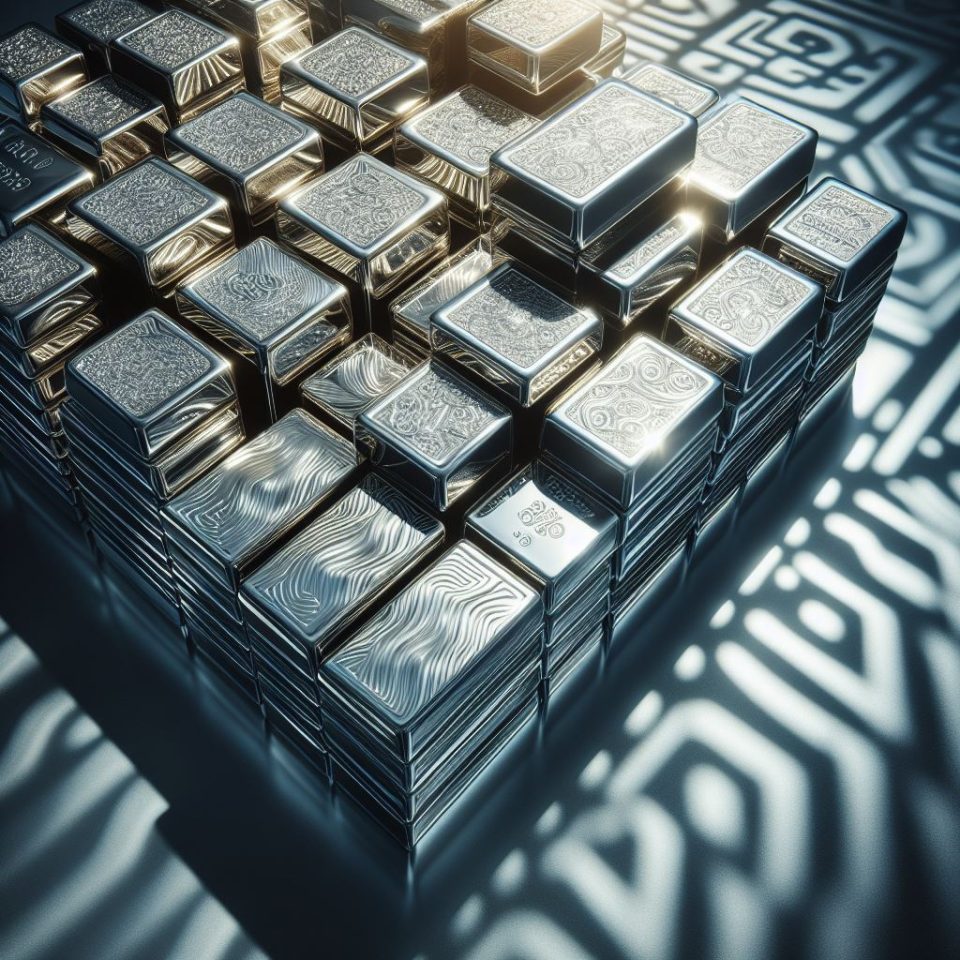

To commemorate its inaugural production run, First Mint will offer limited edition “First Strike” bullion bars as collectibles. These exclusive products, including one-kilogram, ten-ounce, and five-ounce bars, will be accompanied by certificates of authenticity and exclusive packaging, appealing to both investors and collectors alike.

Future Outlook and Production Plans

As production ramps up, investors can expect First Mint to maintain a steady supply of cast bars and one-ounce silver rounds, with additional capacity to accommodate third-party projects. This expansion bodes well for the company’s future growth trajectory and operational efficiency.

Financial Performance and Outlook

Despite reporting an adjusted loss per share in the fourth quarter of 2023, First Majestic exceeded analyst expectations, indicating resilience amidst challenging market conditions. The company’s revenues saw a slight decline year over year, reflecting the broader economic landscape.

Price Performance and Zacks Rank

While shares of First Majestic have faced challenges over the past year, the company remains focused on its long-term strategic objectives. Currently carrying a Zacks Rank #5 (Strong Sell), First Majestic is poised to navigate market headwinds and capitalize on opportunities for growth and innovation.

With the successful commencement of bullion sales at First Mint, First Majestic Silver demonstrates its commitment to innovation and operational excellence. The launch of this state-of-the-art minting facility marks a significant milestone in the company’s journey, signaling potential for enhanced efficiency, sustainability, and customer satisfaction. As investors monitor developments at First Mint, they anticipate continued growth and value creation in the dynamic silver market landscape.