Global Education Communities Corp.

Strategic Student Housing Cushions Market Headwinds

Published: Jan 17, 2026

Author: FRC Analysts

Disclosure: Global Education Communities Corp. has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions.

Company Details

Sector – Research Report

Trading Information

Ticker & Exchange – GEC.TO :TSX

Report Highlights

- Q1 FY2026 (ended November 2025): EPS exceeded expectations, driven by stronger-than-anticipated revenue from the flagship student housing business, higher gross margins, and lower G&A expenses.

- Revenue: Increased 2% YoY, missing our estimate by 3%. Growth was led by the rental business (+14% YoY, 67% of total revenue vs. 60% last year), partially offset by weaker education revenue due to lower international enrollments.

- Profitability: Gross margin rose 2.7 pp to 63% (1.5 pp above estimate). G&A declined following last year’s sale of Sprott Shaw College (SSC), lifting EPS from ($0.07) to $0.01, +7% vs. our estimate.

- Federal Immigration Cuts & Market Insulation: We believe federal cuts to international student permits, immigration caps, and tighter work permit rules will put pressure on housing markets across Canada. However, Vancouver is relatively insulated, especially GEC’s student housing, due to a severe shortage of affordable units, with vacancy rates under 1%. We believe GEC’s strategic mix, with 40–50% domestic students, further cushions the impact by reducing reliance on international students.

- Rental Recovery and Persistent Demand: Following a brief cooling in 2025, we expect Vancouver rents to rise through 2026 and 2027, driven by low vacancy rates, and higher construction costs. We believe that rising rental income, combined with lower interest rates, will boost GEC’s property valuations this year.

- Relative to REITs, GEC is trading at 8x forward revenue (sector: 12x), and 14x forward EBITDA (sector: 20x), a 31% discount on average.

Price and Volume (1-year)

| YTD | 12M | |

| KIDZ | 50% | 25% |

| TSXV | 13% | 15% |

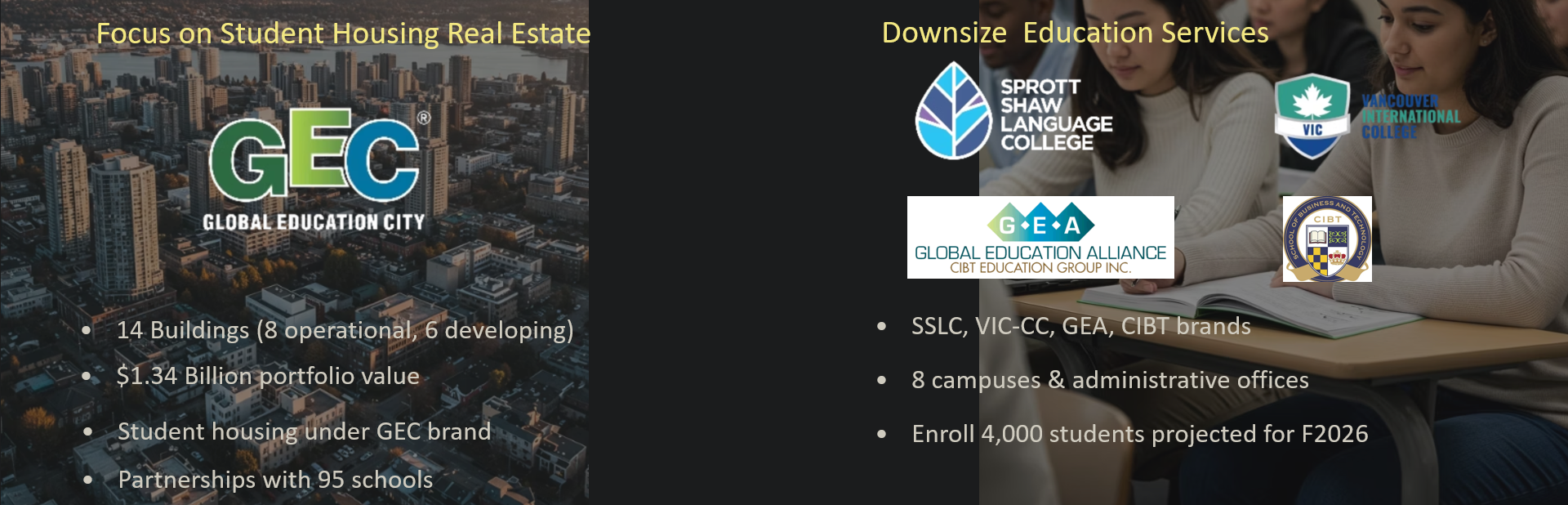

GEC operates B.C.’s largest off campus student housing platform, comprising 14 buildings, eight currently operating and six under development Rental assets offer inflation-protected income, with low volatility, making them attractive to pension funds and institutions Per

Q1 financial statements, these projects were appraised at $307 M, up 0.3% QoQ Eight operating buildings across six projects (1,232 beds)GEC holds minority interests, and acts as project operator across all properties Potential to generate $14M in NOI, or $11k/bed in NOI per year Developing six buildings across four projects (2,988 beds)

Core Business Strategy

In addition to GEC, the company also owns two language schools : Sprott Shaw Language College (SSLC) and Vancouver International College (VIC) .

Source: Company Several major Canadian REITs have recorded property write-downs over the past 12 months, largely due to softer market rents and valuation pressures. With rents and property values expected to recover modestly in 2026, we believe GEC is well positioned to report valuation gains . These gains should be further supported as ongoing development projects reach completion, providing additional upside to asset values and NAV.

The opinions expressed in this report are the true opinions of the analyst(s) about any companies and industries mentioned. Any “forward looking statements” are our best estimates and opinions based upon information that is publicly available and that we believe to be correct, but we have not independently verified with respect to truth or correctness. There is no guarantee that our forecasts will materialize. Actual results will likely vary. The companies listed above are covered by FRC under an issuer-paid model, where fees have been paid to FRC to commission this report and research coverage. This creates a potential conflict of interest which readers should consider. Distribution procedure: our reports are distributed first to our web-based subscribers on the date shown on this report then made available to delayed access users through various other channels for a limited time. To subscribe for real-time access to research, visit https://www.researchfrc.com/plans for subscription options. This report contains “forward looking” statements. Forward-looking statements regarding the Company, industry, and/or stock’s performance inherently involve risks and uncertainties that could cause actual results to differ from such forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, continued acceptance of the Company’s products/services in the marketplace; acceptance in the marketplace of the Company’s new product lines/services; competitive factors; new product/service introductions by others; technological changes; dependence on suppliers; systematic market risks and other risks discussed in the Company’s periodic report filings, including interim reports, annual reports, and annual information forms filed with the various securities regulators. By making these forward-looking statements, Fundamental Research Corp. and the analyst/author of this report undertakes no obligation to update these statements for revisions or changes after the date of this report. Fundamental Research Corp DOES NOT MAKE ANY WARRANTIES, EXPRESSED OR IMPLIED, AS TO RESULTS TO BE OBTAINED FROM USING THIS INFORMATION AND MAKES NO EXPRESS OR IMPLIED WARRANTIES OR FITNESS FOR A PARTICULAR USE. ANYONE USING THIS REPORT ASSUMES FULL RESPONSIBILITY FOR WHATEVER RESULTS THEY OBTAIN FROM WHATEVER USE THE INFORMATION WAS PUT TO. ALWAYS TALK TO YOUR FINANCIAL ADVISOR BEFORE YOU INVEST. WHETHER A STOCK SHOULD BE INCLUDED IN A PORTFOLIO DEPENDS ON ONE’S RISK TOLERANCE, OBJECTIVES, SITUATION, RETURN ON OTHER ASSETS, ETC. ONLY YOUR INVESTMENT ADVISOR WHO KNOWS YOUR UNIQUE CIRCUMSTANCES CAN MAKE A PROPER RECOMMENDATION AS TO THE MERIT OF ANY PARTICULAR SECURITY FOR INCLUSION IN YOUR PORTFOLIO. This REPORT is solely for informative purposes and is not a solicitation or an offer to buy or sell any security. It is not intended as being a complete description of the company, industry, securities or developments referred to in the material. Any forecasts contained in this report were independently prepared unless otherwise stated, and HAVE NOT BEEN endorsed by the Management of the company which is the subject of this report. Additional information is available upon request. THIS REPORT IS COPYRIGHT. YOU MAY NOT REDISTRIBUTE THIS REPORT WITHOUT OUR PERMISSION. Please give proper credit, including citing Fundamental Research Corp and/or the analyst, when quoting information from this report. The information contained in this report is intended to be viewed only in jurisdictions where it may be legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations or which would require any registration requirement within such jurisdiction.