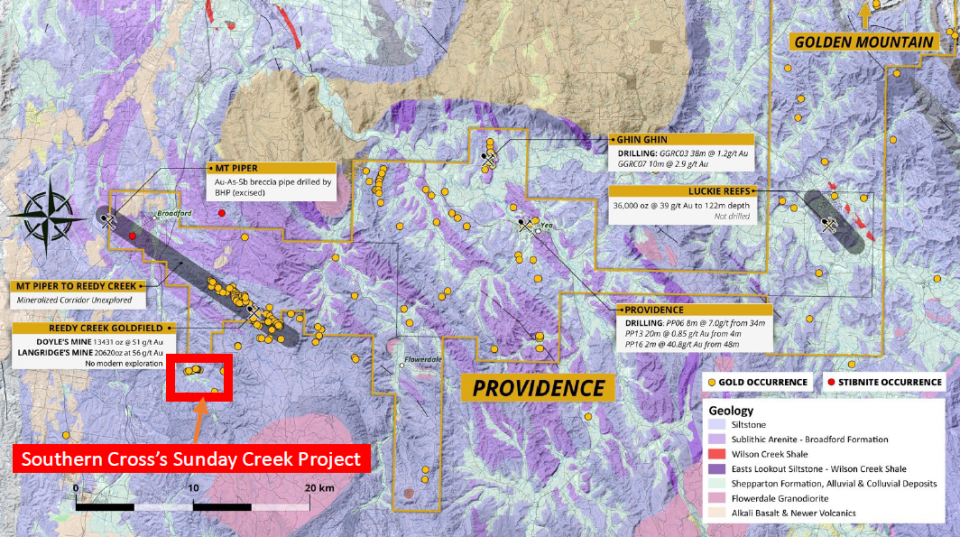

Great Pacific Gold Corp. (TSXV: GPAC, OTCQX: FSXLF, FSE: V3H), a mineral exploration company with a portfolio spanning Papua New Guinea and Australia, has completed the sale of its Reedy Creek and Providence projects in Victoria, Australia, to Golden Cross Resources Inc. (formerly Zincore Metals Inc.). This move marks a significant step in Great Pacific Gold’s ongoing strategy to concentrate resources on its core projects, particularly in Papua New Guinea.

The transaction, structured as a share purchase agreement, saw Golden Cross acquire all outstanding shares of a Great Pacific Gold subsidiary that holds the Australian exploration licenses for Reedy Creek and Providence. In exchange, Great Pacific Gold received a total cash consideration of $720,000 (C$1,000,000), split evenly between an initial deposit and a closing payment. The company also received 6,000,000 common shares of Golden Cross, with various voluntary resale restrictions placed on most of these shares.

The share distribution consists of 800,000 shares that are immediately tradable, 1,600,000 shares that will be released in monthly installments over four months, and 3,600,000 shares that will be released in semi-annual installments over a period of three years.

Additionally, Great Pacific Gold retains contingent rights to receive up to $2,160,000 (C$3,000,000) in milestone payments. These include $720,000 (C$1,000,000) if a technical report establishes a resource of at least one million ounces of gold or gold equivalent, and $1,440,000 (C$2,000,000) upon commencement of commercial gold production from the properties.

The divestment aligns with Great Pacific Gold’s strategy to focus capital and technical efforts on its highest-potential assets, particularly in Papua New Guinea. CEO Greg McCunn previously highlighted that the cash infusion provides non-dilutive funding for ongoing exploration programs, while the equity stake in Golden Cross ensures continued exposure to the prospective Australian land package. The company is also evaluating further opportunities to monetize additional non-core assets in Australia.

Great Pacific Gold’s core portfolio includes several promising projects:

- Kesar Project (PNG): A greenfield exploration project adjacent to K92 Mining’s tenements, featuring high-grade gold in both outcrop and soil samples. The company is actively drilling in key target areas.

- Wild Dog Project (PNG): A brownfield site with a history of small-scale mining and multiple epithermal and porphyry targets. Infrastructure upgrades have enabled new exploration and environmental work.

- Arau Project (PNG): Hosts the Mt. Victor target, with potential for high-sulphidation epithermal gold-base metal deposits. Drilling results are pending.

- Lauriston Gold Project (Australia): Located near the Fosterville Goldfield Belt, this project has yielded high-grade gold intercepts and is under strategic review for further value creation.

- Walhalla Gold Belt Project (Australia): Comprising over 1,400 km² of concessions, this project includes the Pinnacles target, which is fully permitted and ready for drilling.

The company also holds other core and non-core mineral assets, with several Australian projects in the process of being divested to further streamline operations.

With the sale of Reedy Creek and Providence, Great Pacific Gold strengthens its financial position and sharpens its operational focus. The transaction delivers immediate liquidity and preserves upside potential through equity and contingent milestone payments. As exploration and development activities accelerate across its core projects, the company is focused on unlocking further value for shareholders and maintaining exposure to future discoveries in both Papua New Guinea and Australia.