JetBlue Offers Early Retirement to Pilots

JetBlue Airways (NASDAQ: JBLU) is reportedly preparing to offer early retirement packages to its pilots as the struggling airline undergoes significant network changes. According to aviation insider xJonNYC, JetBlue is taking this step as part of its ‘JetForward’ strategy, which aims to cut costs and return the airline to profitability.

A Strategic Shift: JetForward Initiative

The New York-based carrier recently embarked on a transformation project known as its ‘JetForward’ strategy. This initiative involves substantial changes to JetBlue’s operations, including a considerable reduction in its flight network. As part of these adjustments, the airline is scaling back its presence in several markets and reevaluating its workforce needs.

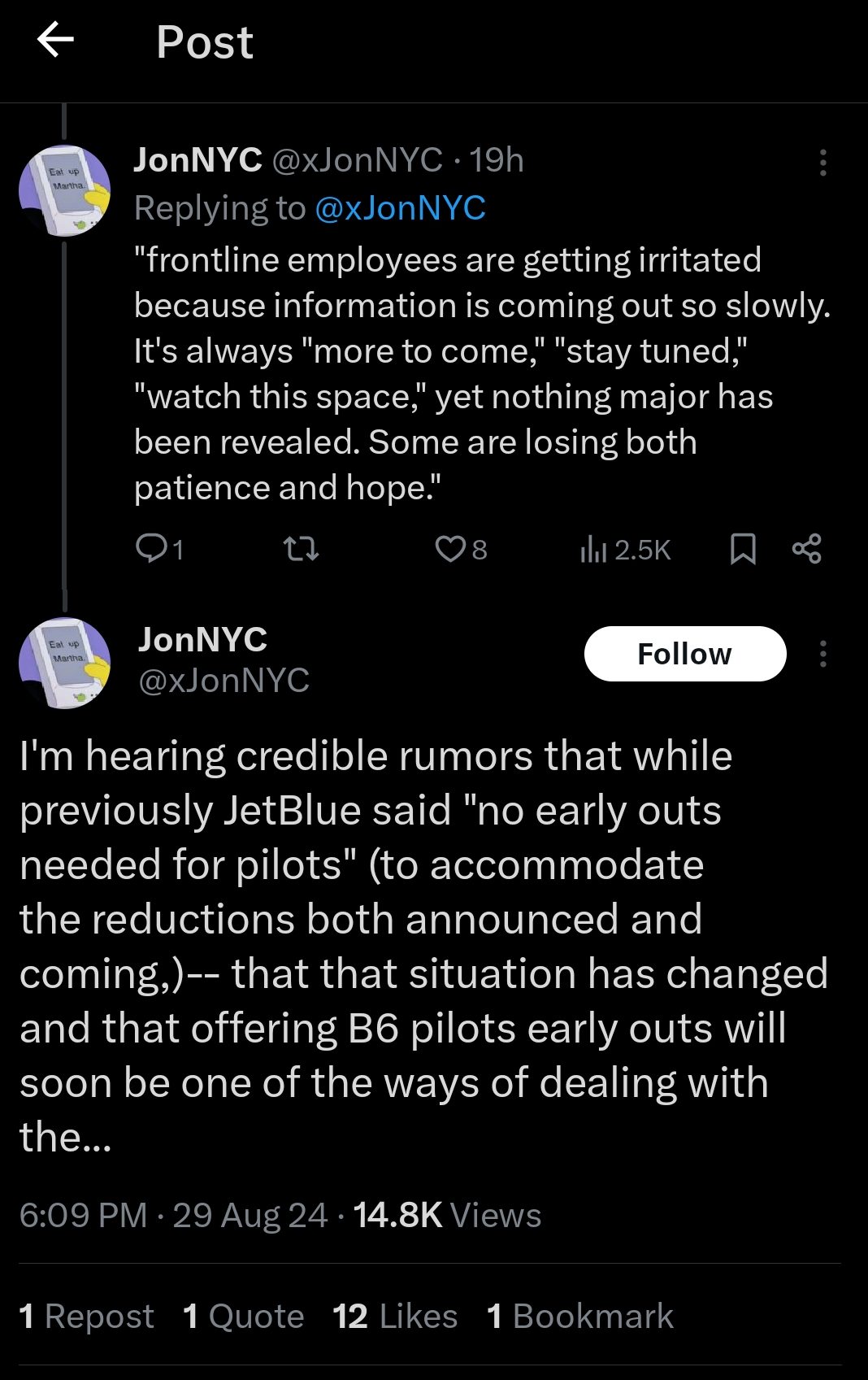

On Thursday, xJonNYC shared on social media platform X that credible sources had informed him of plans by JetBlue to incentivize early retirement for pilots. This move is intended to rightsize the workforce in line with the airline’s new, smaller operational footprint.

Growing Speculation About Workforce Reductions

There had been initial speculation that early retirements would not be necessary, but the situation appears to have shifted dramatically in recent weeks. While JetBlue has not yet confirmed these reports, either internally or publicly, an official announcement is expected soon. The rumors have sparked concerns among employees about the potential for further cuts as the airline seeks to align its resources with its revised strategy.

Network Reductions and Cost-Cutting Measures

As part of the JetForward strategy, JetBlue has already withdrawn entirely from 15 cities. Additionally, the airline is cutting back some of its transatlantic flights and has deferred the delivery of 44 new airplanes that were intended to support its previously ambitious expansion plans.

Last month, JetBlue offered flight attendants up to six months of unpaid leave. This measure was aimed at cutting costs during the slower winter season and preventing an oversupply of crew members relative to the reduced flight schedule. The news was communicated by JetBlue’s flight attendant union, which warned that flight schedules would be ‘significantly reduced’ and that crew members might spend more time on reserve if there were not enough volunteers for unpaid leave.

Operational Adjustments: Mint Business Class Changes

In another cost-saving measure, it was revealed in June that JetBlue had disabled the personal privacy doors in its Mint Business Class on some aircraft. This change allowed the airline to operate these planes with fewer flight attendants on duty, further highlighting JetBlue’s focus on operational efficiency.

Financial Struggles and Leadership’s Response

JetBlue’s financial performance has been under pressure for some time. In the first six months of 2024, the airline reported an operating loss of $663 million. However, the new president of JetBlue, Marty St. George, remains optimistic about the future. He has expressed confidence in the airline’s ability to return to profitability.

To achieve this goal, St. George recently announced that expansion plans are on hold. Instead, the focus will be on “driving value from our existing asset base.” This shift in strategy reflects a more cautious approach to growth, emphasizing cost control and maximizing returns from current operations.

JetBlue’s Financial Snapshot: Current Status and Market Position

JetBlue’s financial metrics paint a challenging picture. The airline’s market capitalization currently stands at $1.77 billion, while its enterprise value is significantly higher at $6.24 billion. The company has 346.83 million shares outstanding, with a notable increase of 3.54% over the past year.

JetBlue’s financial ratios indicate a company grappling with high debt levels and low liquidity. The current ratio is 0.54, suggesting limited short-term liquidity, while the debt-to-equity ratio is 2.23, reflecting significant leverage. Moreover, the return on equity (ROE) is -30.30%, and the return on invested capital (ROIC) is -1.96%, underscoring ongoing profitability challenges.

Stock Performance and Market Sentiment

JetBlue’s stock price has faced volatility over the past year, decreasing by 12.64%. The airline’s beta of 1.93 indicates higher price volatility compared to the market average, reflecting investor uncertainty. The stock is currently trading below both its 50-day and 200-day moving averages, signaling bearish sentiment.

Investors have heavily shorted the company’s stock, with 19.80% of outstanding shares sold short. This high level of short interest suggests that investors are skeptical about JetBlue’s near-term prospects, potentially anticipating further declines in the stock price.

Financial Performance: Income Statement and Cash Flow

JetBlue’s income statement reveals a challenging environment. Over the last 12 months, the airline generated $9.32 billion in revenue but recorded a net loss of $947 million, resulting in a loss per share of $2.80. Operating income stood at -$262 million, and EBITDA was $313 million. The company’s free cash flow is deeply negative, at -$1.74 billion, reflecting ongoing cash burn and investment challenges.

Balance Sheet and Debt Levels

The company’s balance sheet shows a cash position of $1.50 billion against a total debt of $6.01 billion, resulting in a net cash position of -$4.51 billion. The substantial debt load and negative net cash position underscore the financial pressures facing JetBlue as it navigates a challenging operating environment.

Investor Outlook: Analyst Ratings and Price Targets

The average analyst price target for JetBlue is $6.05, representing an 18.51% upside from the current trading price. However, the consensus rating is “Hold,” reflecting cautious optimism. Analysts are closely watching the company’s efforts to return to profitability and the impact of its strategic initiatives.

Navigating a Turbulent Path Ahead

JetBlue is at a crossroads, facing significant operational and financial challenges. JetBlue Airway’s decision to offer early retirement to pilots and make substantial network reductions underscores the urgency of its efforts to return to profitability.

Investors will be closely monitoring JetBlue’s next moves, particularly any official announcements regarding workforce reductions and further adjustments to its network strategy. With the next earnings report scheduled for October 29, 2024, the market will soon gain more clarity on JetBlue’s financial health and future direction. In the meantime, the airline must navigate a turbulent path as it strives to stabilize its operations and rebuild investor confidence.

Chart by Trading View