US Job Market Revision: A Closer Look

The US economy’s employment figures for March 2024 have been revised downward by 818,000, revealing a potentially earlier cooling in the labor market than initially believed. This substantial revision highlights a shift in the economic landscape and has sparked renewed discussions on the health of the US job market. Analysts and economists are now reassessing their projections, considering the implications of this downward adjustment on future economic growth.

Significant Downward Revision of US Job Market

On Wednesday morning, the Bureau of Labor Statistics released its annual employment revisions. These adjustments are standard practice, with final revised numbers expected early next year. The latest report showed the most notable downward revisions in the professional and business services sector, where employment was reduced by 358,000. Additionally, the leisure and hospitality industry saw a downward adjustment of 150,000 jobs. This decline in job numbers not only raises concerns about the sectors affected but also reflects broader economic uncertainties. As companies navigate changing consumer demands and economic pressures, these revisions may prompt businesses and policymakers to reconsider their strategies to stimulate job growth and ensure economic stability..

The revision has decreased the monthly job additions rate from 242,000 to 174,000. Despite this significant reduction, Omair Sharif, president of Inflation Insights, commented, “Despite this big downward revision, that’s still a very healthy growth rate in terms of the monthly jobs added to the economy.”

Economists’ Perspectives

Economists have advised caution regarding the implications of these revisions. Michael Reid, RBC Capital Markets US economist, noted in a client memo on August 16 that “the realization that the economy created fewer jobs than initially estimated [does not] change the broader trends in GDP growth, stock market and wealth gains, and consumption.”

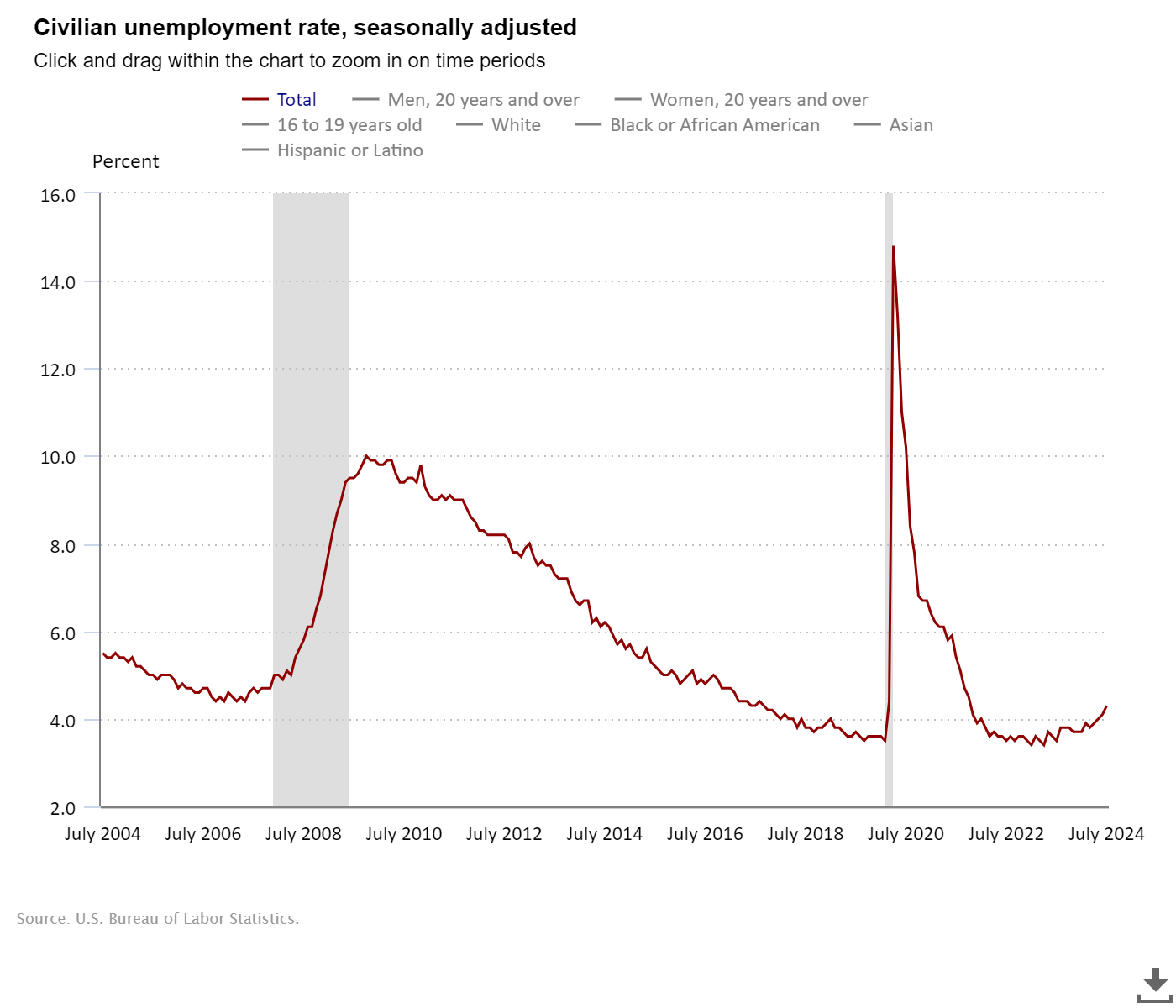

This revision comes at a crucial time as recent data have indicated signs of a slowing labor market. A weaker July jobs report contributed to this narrative. It revealed the second-lowest job additions since 2020 and the highest unemployment rate, 4.3%, in nearly three years.

Labor Market Trends and Indicators

July’s increase in the unemployment rate triggered the Sahm Rule, a recession indicator that often precedes economic downturns. However, more recent data on weekly unemployment filings suggest that layoffs remain relatively low. This has led some economists to argue that while the labor market is slowing, it may not be on the verge of an outright downturn.

“It’s important to zoom out a little bit in this kind of situation,” stated Evercore ISI senior economist Marco Casiraghi. He added, “And I think this is also what the Fed will do. And if you zoom out, you see that the economy is slowing down, but still growing. The labor market is softening, but it’s not rapidly deteriorating.”

“It’s important to zoom out a little bit in this kind of situation,” stated Evercore ISI senior economist Marco Casiraghi. He added, “And I think this is also what the Fed will do. And if you zoom out, you see that the economy is slowing down, but still growing. The labor market is softening, but it’s not rapidly deteriorating.”

Federal Reserve’s Upcoming Speech

The revised employment figures come ahead of a key speech by Fed Chair Jerome Powell at the Jackson Hole Symposium on Friday morning. Powell’s address is expected to address the current state of the labor market and its implications for monetary policy.

David Mericle, chief US economist at Goldman Sachs, anticipates that Powell will express more confidence in the inflation outlook while highlighting downside risks in the labor market. This perspective would align with Goldman Sachs’ forecast of three consecutive 25 basis point rate cuts in September, November, and December.

As of Wednesday morning, markets were fully pricing in an interest rate cut by the end of the Fed’s September meeting. There is also a 32% chance that the Fed may implement a 50 basis point cut.

Market Data

The downward revision of US job figures reflects deeper complexities within the labor market. As the Federal Reserve prepares to address these developments, investors and economists will be watching closely. The current data suggests a labor market that is softening but not yet in severe decline,. This may influence future monetary policy decisions.

Revision of US Job Market – What Does it Mean?

The recent downward revision of the US job market figures for March 2024 marks a significant moment in economic analysis, prompting a historical reflection on the labor market’s trends. Over the past decade, the US economy has experienced a rollercoaster of employment fluctuations, particularly in the wake of the COVID-19 pandemic. The initial post-pandemic recovery saw a surge in job creation, with many sectors rapidly expanding to meet pent-up demand. However, these latest revisions indicate that the labor market may have begun cooling sooner than anticipated, suggesting underlying weaknesses that could reshape economic expectations.

How Would The Markets React?

How Would The Markets React?

This substantial downward adjustment of 818,000 jobs, particularly in the professional and business services sector and leisure and hospitality industries, raises concerns about the resilience of the labor market. For investors and market analysts, this development could signal a shift in economic sentiment, potentially leading to increased volatility in the stock market. A weaker job market often translates to reduced consumer spending power, which can impact corporate earnings and overall economic growth. As discussions around monetary policy and interest rates gain momentum, market participants will be closely monitoring these employment trends, as they will be crucial in determining the Federal Reserve’s next moves and shaping investor confidence in the coming months.

Charts by Trading View

Source: Yahoo Finance