Minaurum Gold Inc. (TSXV: MGG, OTCQX: MMRGF) has taken a significant step forward at its Alamos silver project in southern Sonora, Mexico, after recent drilling revealed a series of stacked, high-grade silver veins at the Promontorio zone. This discovery not only adds new depth to the company’s geological understanding of the area but also hints at broader potential for similar mineralization across the property, which could have a meaningful impact on the company’s upcoming maiden resource estimate.

The latest drill results from Promontorio show four substantial, roughly parallel vein structures, each returning notable silver-equivalent (AgEq) grades over meaningful widths. Among the most eye-catching intercepts:

- 10.20 meters of 453 grams per tonne (g/t) AgEq (Hole AL24-120)

- 8.60 meters of 321 g/t AgEq (Hole AL24-120)

- 11.60 meters of 218 g/t AgEq (Hole AL24-122)

- 4.50 meters of 300 g/t AgEq (Hole AL24-123)

- 0.65 meters of 958 g/t AgEq (Hole AL24-125)

These results, according to Minaurum’s President and CEO Darrell Rader, are particularly encouraging because they not only confirm the presence of multiple stacked veins at Promontorio, but also suggest the possibility of similar systems at other targets on the property. Rader points to recent developments at other Mexican silver mines, such as Las Chispas and Cerro Los Gatos, as examples of how stacked vein systems can drive major resource growth and project value.

Promontorio, together with the Europa vein zone, will form the backbone of Minaurum’s forthcoming maiden resource estimate at Alamos. The Promontorio zone itself extends for about one kilometer and includes four main veins, notably Veta Grande and Veta Las Guijas.

Recent drilling has targeted both the Las Guijas and Veta Grande veins, with holes such as AL24-120 and AL24-122 demonstrating not just high grades but also continuity and width. For example, AL24-120 intersected multiple wide, mineralized intervals, including a 28.05-meter zone with 10.20 meters grading 453 g/t AgEq. AL24-122, drilled below AL24-120, returned 11.60 meters at 218 g/t AgEq, further supporting the down-plunge potential of the system.

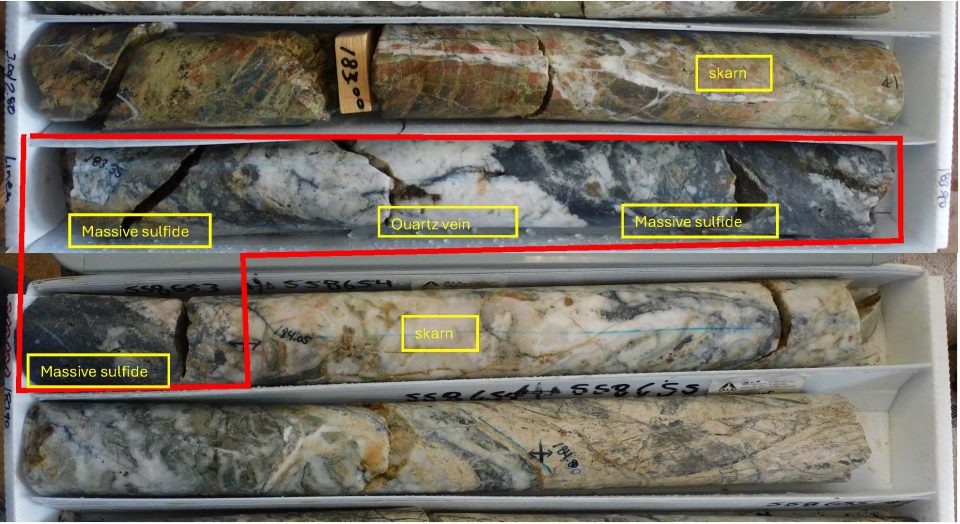

Elsewhere, holes AL24-123 and AL24-125 confirmed mineralization at shallower and deeper levels, respectively. AL24-123 cut a high-grade interval of 4.50 meters at 300 g/t AgEq within an 18-meter mineralized zone, while AL24-125 intersected 0.65 meters of 958 g/t AgEq and notable copper grades, highlighting the polymetallic nature of the veins.

Minaurum’s drilling campaign over the past year has consistently delivered strong results. Previous headline intercepts include 36.65 meters of 328 g/t AgEq (including 3.85 meters at 1,022 g/t AgEq in AL24-117), as well as ultra-high-grade intervals such as 3.00 meters at 4,173 g/t AgEq (AL24-111) and 0.70 meters at 2,976 g/t AgEq (AL24-105).1

These results will feed into the company’s maiden resource estimate for Alamos, which is expected to provide a clearer picture of the project’s scale and economic potential. The company’s focus on both high-grade and wide mineralized zones could make Alamos a standout among emerging silver projects in Mexico.

With the identification of stacked vein systems and the continued delivery of high-grade drill results, Minaurum appears positioned to advance Alamos toward resource definition and, potentially, development. The company also holds the Lone Mountain CRD Project in Nevada, USA, but Alamos remains its flagship asset for now.