NewLake Capital Partners, Inc. (OTCQX: NLCP), a prominent provider of real estate capital to state-licensed cannabis operators, has disclosed the tax treatment of its common stock dividends for the year 2024. This announcement aims to assist shareholders in meeting their tax reporting obligations regarding the dividend distributions of taxable income.

Dividend Tax Treatment Overview

The tax classification for the 2024 dividend distributions is crucial for shareholders as it directly affects their tax reporting. Stockholders can expect to receive IRS Form 1099-DIV from their brokers or transfer agents, which will detail the necessary information for tax purposes. It is advisable for shareholders to review these statements to ensure they align with the data provided by NewLake.

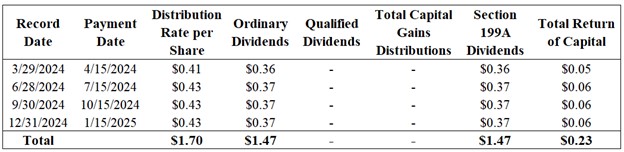

The following table outlines the expected federal income tax treatment of the 2024 dividends:

The cash distributions made on January 15, 2025, with a record date of December 31, 2024, will be considered taxable income for the calendar year 2024.

It’s important to note that Section 199A dividends are included in the ordinary dividends amount and may have specific implications for shareholders when filing taxes. Given the complexities involved in tax reporting, shareholders have been encouraged to consult their tax advisors regarding U.S. federal, state, local, and foreign income tax consequences related to acquiring, holding, and disposing of NewLake’s common stock. The company emphasized that it does not provide tax, accounting, or legal advice and that any statements regarding tax implications should not be used to avoid penalties.

NewLake Capital Partners operates as an internally managed real estate investment trust (REIT) focused on providing capital solutions to state-licensed cannabis operators through long-term lease agreements and build-to-suit transactions. The company’s portfolio includes a diverse array of properties, comprising 32 locations that feature both cultivation facilities and dispensaries.

As NewLake continues to navigate the evolving landscape of cannabis-related real estate investment, understanding the tax implications of its dividend distributions becomes essential for investors looking to optimize their financial strategies in this burgeoning sector.