P2 Gold is advancing its flagship Gabbs Project located in Nevada, USA, one of the world’s top mining jurisdictions. The project boasts a measured and indicated resource of 1.16 million ounces of AuEq and an inferred resource of 2.29 million ounces of AuEq, containing gold, silver and copper. The recently updated (October 7, 2025) PEA outlines a 14.2-year life-of-mine operation, producing over 1.5 million ounces of gold, 2.5 million ounces of silver, and 213,000 tons of copper. At current price levels, the project is expected to generate 73% of its revenue from gold, 1.5% from silver, and 25.5% from copper.

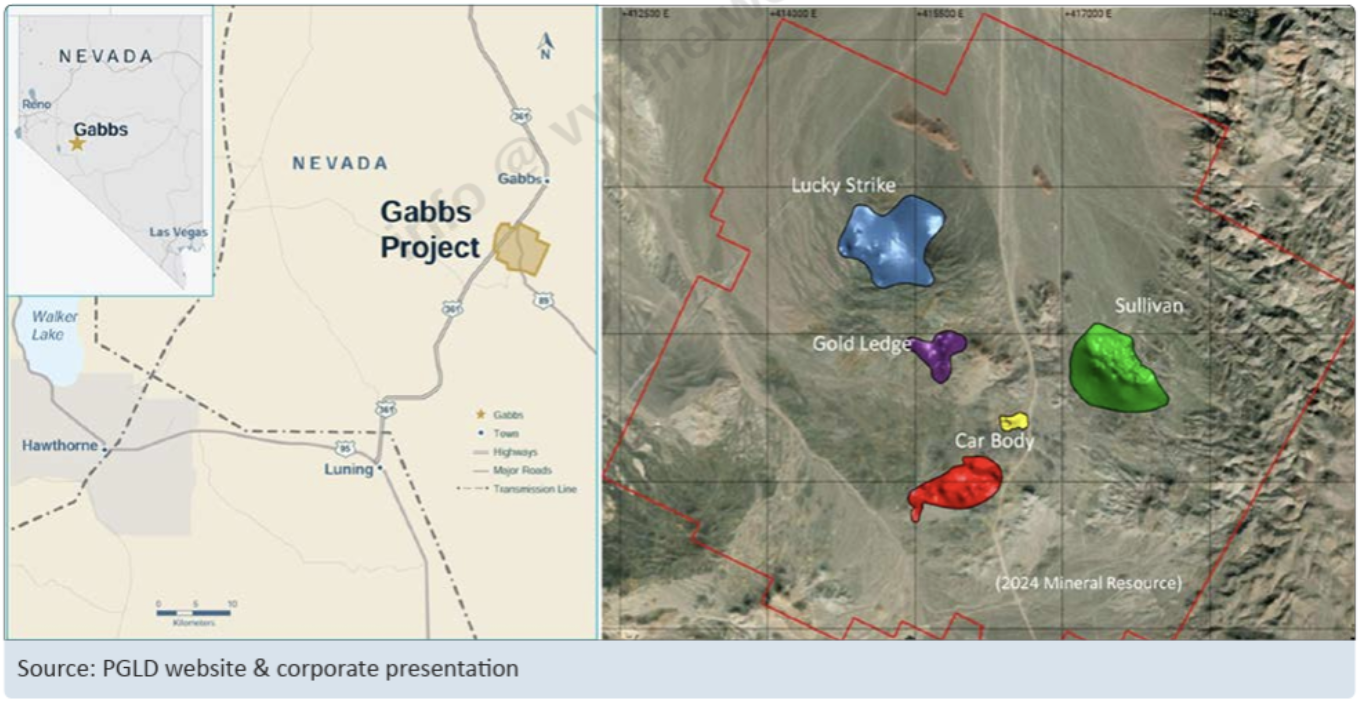

Figure 1: Map showing the location of PGLD’s Gabbs Project and key mineralized zones

Investment Highlights

Investment Highlights

-

- P2 Gold (“PGLD”, or “Company”) is advancing its flagship gold and copper Gabb’s Project in mining-friendly Nevada, USA, which boasts a project NPV of US$1.429 billion at a 10% discount rate using spot commodity prices. The Company delivered a 470% shareholder return since our initial research report, dated November 28th, 2024.

- Strongly improved PEA: The updated 2025 PEA has dramatically improved economics due to increased metallurgical recoveries, adding +74koz Au, +423koz Ag, + 23kt Cu production over the life of mine (LOM) and a higher commodity price environment, which is set to persist.

- Robust underlying resource: The Gabbs Project boasts 1.2 million AuEq in the indicated and over 2.1 million AuEq in the inferred category (2024 PEA). This resource underpins the PEA with a 14.2-year LOM and remains highly leveraged to the gold price.

- Experienced Management Team: The PGLD team brings extensive expertise and a proven track record of successfully advancing projects from exploration and development through to production. With 16.9% of the company held by insiders, the interests of management are strongly aligned with those of shareholders.

- Healthy financial position: With $6 million in the treasury from a recent private placement and likely more funds being added in the near future, the firm is poised to execute its development plans for the Gabbs Project.

- We are maintaining coverage with a BUY rating and a positive outlook for the company over the next 12 period with a target price of $0.70 per share.

This report has been prepared by an analyst on contract with or employed by Couloir Capital Ltd. The analyst certifies that the views expressed in this report, which include the rating assigned to the issuer’s shares as well as the analytical substance and tone of the report, accurately reflect his or her personal views about the subject securities and the issuer. No part of his / her compensation was, is, or will be directly or indirectly related to the specific recommendations.

Couloir Capital, its affiliates, and their respective officers, directors, representatives, researchers, and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Couloir Capital may have provided, in the past and may provide, in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services.

Couloir Capital has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate, but cannot be guaranteed. This document does not consider the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g., prohibitions to investments due to law, jurisdiction issues, etc.) that may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before making an investment. Couloir Capital will not treat recipients of this document as clients by virtue of having viewed this document.

Company-specific disclosures, if any, are below:

1. In the last 24 months, Couloir Capital Ltd. has been retained by the subject issuer under a service agreement that includes analyst research coverage.

2. The views of the Analyst are personal.

3. No part of the Analyst’s compensation was directly or indirectly related to the specific ratings as used by the research Analyst in the Reports.

4. The Analyst does not maintain a financial interest in the securities or options of the Company.

5. The principal of Couloir Capital maintains a financial interest in the securities or options of the Company through an affiliated hedge fund entity.

6. The information contained in the Reports is based upon publicly available information that the Analyst believes to be correct but has not independently verified with respect to truth or correctness.

Investment Ratings -Recommendations

Each company within an analyst’s universe, or group of companies covered, is assigned:

1. A recommendation or rating, usually BUY, HOLD, or SELL;

2. A 12-month target price, which represents an analyst’s current assessment of a company’s

potential stock price over the next year; and

3. An overall risk rating which represents an analyst’s assessment of the company’s overall investment risk.

These ratings are more fully explained below. Before acting on a recommendation, we caution you to confer with your investment advisor to determine the suitability of our recommendation for your specific investment objectives, risk tolerance, and investment time horizon.

Couloir Capital’s recommendation categories include the following:

Buy

The analyst believes that the security will outperform other companies in their sector on a risk-adjusted basis or for the reasons stated in the research report the analyst believes that the security is deserving of a (continued) BUY rating.

Hold

The analyst believes that the security is expected to perform in line with other companies in their sector on a risk-adjusted basis or for the reasons stated in the research report the analyst believes that the security is deserving of a (continued) HOLD rating.

Sell

Investors are advised to sell the security or hold alternative securities within the sector. Stocks in this category are expected to under-perform other companies on a risk-adjusted basis or for the reasons stated in the research report the analyst believes that the security is deserving of a (continued) SELL rating.

Tender

The analyst is recommending that investors tender to a specific offering for the company’s stock.

Research Comment

An analyst comment about an issuer event that does not include a rating.

Coverage Dropped

Couloir Capital will no longer cover the issuer. Couloir Capital will provide notice to clients whenever coverage of an issuer is discontinued. Following termination of coverage, we recommend clients seek advice from their respective Investment Advisor.

Under Review

Placing a stock Under Review does not revise the current rating or recommendation of the analyst. A stock will be placed Under Review when the relevant company has a significant material event with further information pending or to be announced. An analyst will place a stock Under Review while he/she awaits enough information to re-evaluate the company’s financial situation.

The above ratings are determined by the analyst at the time of publication. On occasion, total returns

may fall outside of the ranges due to market price movements and/or short-term volatility.

Overall Risk Rating

Very High Risk: Venture-type companies or more established micro, small, mid or large-cap companies whose risk profile parameters and/or lack of liquidity warrant such a designation. These companies are only appropriate for investors who have a very high tolerance for risk and volatility and who can incur a temporary or permanent loss of a very significant portion of their investment capital.

High Risk: Typically, micro or small-cap companies which have an above-average investment risk relative to more established or mid to large-cap companies. These companies will generally not form part of the broad senior stock market indices and often will have less liquidity than more established mid and large-cap companies. These companies are only appropriate for investors who have a high tolerance for risk and volatility and who can incur a temporary or permanent loss of a significant portion of their investment capital.

Medium-High Risk: Typically, mid to large-cap companies have a medium to high investment risk. These companies will often form part of the broader senior stock market indices or sector-specific indices. These companies are only appropriate for investors who have a medium to high tolerance for risk and volatility and who are prepared to accept general stock market risk including the risk of a temporary or permanent loss of some of their investment capital

Moderate Risk: Large to very large cap companies with established earnings who have a track record of lower volatility when compared against the broad senior stock market indices. These companies are only appropriate for investors who have a medium tolerance for risk and volatility and who are prepared to accept general stock market risk including the risk of a temporary or permanent loss of some of their investment capital.