Enterprise Group, Inc.

Q4 Disappointing, 2025 Recovery Anticipated

Published: March 28, 2025

Author: FRC Analysts

VIEW COMPLETE REPORT*This report and research coverage is paid for and commissioned by Enterprise Group, Inc – See the bottom of this report for other important disclosures rating, and risk definitions. All figures in C$ unless otherwise specified.

Sector: Energy | Industry: Oil & Gas E&P

Ticker Symbols: E.TO – TSX ETOLF – NASDAQ

Report Highlights

️ Enterprise Group Inc. is an FRC Top Pick ️

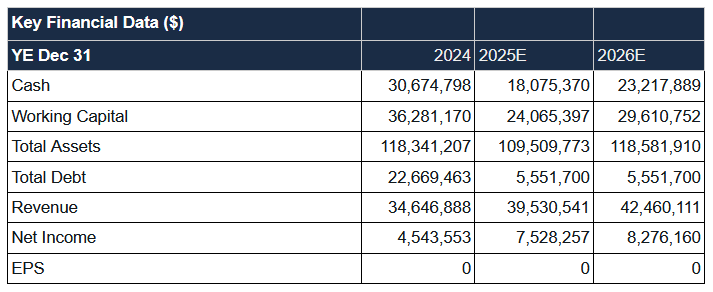

- Q4-2024 revenue was down 19% YoY, and as a result, 2024 revenue was up just 3% YoY, missing our estimate by 8%, despite posting 12% YoY growth for 2024-9M.

- With expenses outpacing revenue growth, EPS fell from $0.12 to $0.07 vs our forecast of $0.10.

- Management attributed the revenue decline to an unexpected slowdown in client activity, primarily driven by lower oil prices. Additionally, the delay of the Kitimat, B.C., LNG plant, a critical coastal project for shipping Canadian natural gas globally, from mid-2024 to mid-2025, has led several gas producers to postpone their drilling plans.

- On a positive note, management noted a significant increase in activity in Q1-2025, fueled by higher gas prices, and the resumption of drilling by several clients. In Q4, E closed a $29M bought deal financing, with proceeds used to repay most of its outstanding debt. This is a major development, as most companies in the sector are highly leveraged. Lower interest expenses will positively impact 2025 EPS.

- E is down 28% following the release of weaker-than-expected Q4 earnings results yesterday. The S&P Oil & Gas Equipment & Services index is down 13% YTD, driven by lower oil prices, a broader market pullback, and concerns over a potential recession sparked by escalating trade tensions.

- While Enterprise lacks direct exposure to the U.S., and is unlikely to benefit directly from Trump’s mandate to boost energy production, we expect positive investor sentiment to spill over to the broader North American energy services sector.