President Lee Jae Myung of South Korea has voiced mounting concerns among business leaders about investing heavily in American manufacturing following recent tensions between the two countries. These tensions come amid South Korea’s pledge of a substantial $350 billion investment fund to the U.S., part of a broader trade agreement intended to lower tariffs and boost economic ties. However, last week’s controversial actions by U.S. authorities, including an immigration raid detaining hundreds of South Korean workers at a Hyundai-LG joint project plant in Georgia, have intensified doubts about the commitment to these investments.

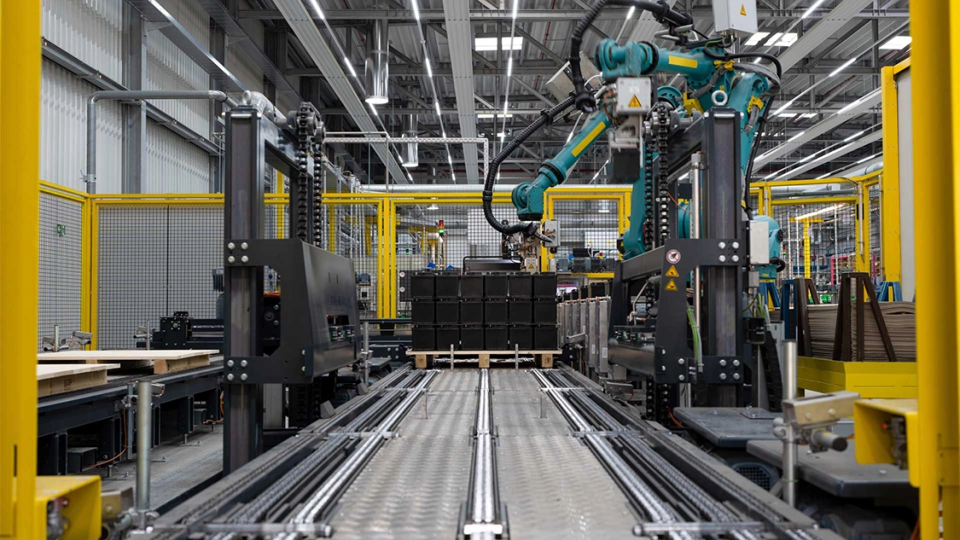

South Korea’s investment fund commitment came as part of a deal to maintain U.S. tariffs on imports from Seoul at 15%. This funding is targeted at sectors like shipbuilding, semiconductors, batteries, and pharmaceuticals, key industries critical to both national security and economic stability. However, South Korea’s approach differs significantly from a companion agreement with Japan, where Tokyo pledged an even larger $550 billion to American projects. South Korean officials argue that the scale of their economy and foreign exchange risks require a more cautious deployment of funds, with $350 billion essentially serving as a ceiling rather than an immediate outflow of capital.

Kim Yong-beom, South Korea’s director of national policy, warned that demanding terms identical to Japan’s investment deal could destabilize South Korea’s economic standing. He highlighted that the governance over investment decisions and profit-sharing mechanisms remain disputed issues. Unlike Japan’s prominent deal, where President Donald Trump holds decision power over the allocation of the $550 billion pledged, South Korean leaders seek a more equitable arrangement to protect their economic interests and maintain control over their contributions.

The political backdrop, however, complicates these financial plans. President Trump’s executive order recently formalized parts of the U.S.-Japan trade deal, particularly tariff cuts on Japanese auto imports, while asserting U.S. authority in how funds are spent. Simultaneously, the immigration raid at the Hyundai battery plant sent shockwaves through Seoul. Over 300 South Korean workers were detained for allegedly working without legal authorization, stirring unease among both government and corporate circles. President Lee admitted the incident has “generated considerable uncertainty,” making Korean companies hesitant to invest further in the U.S. due to fears over visa policies and operational risks.

This fallout threatens to stall critical initiatives such as the Make American Shipbuilding Great Again (MASGA) project, an effort supported by South Korea’s investment aimed at revitalizing U.S. shipbuilding. Kim Yong-beom emphasized that without mutual agreement, cooperation in such industries could falter, undermining the broader objectives of the trade deals.

President Lee has called for improved visa issuance processes to facilitate smoother business operations and maintain investment momentum. South Korea is negotiating with Washington to ensure either an increased visa quota or a new visa category for Korean workers tied to U.S. investments. This is seen as an essential step to reassure companies that their workforce needs will be met without jeopardizing legal compliance or risking political backlash.

The mood among South Korea’s business leaders reflects frustration and caution. Many feel pressured to honor commitments made by their government to invest billions in the U.S., yet they also see the recent immigration enforcement actions and the unilateral powers granted to the U.S. administration as signals that their investments may face unforeseen challenges or lack reciprocal goodwill. Such concerns challenge the foundations of a partnership long viewed as a strategic economic alliance.

In Japan, the situation is somewhat different but no less tense. The larger $550 billion pledge to the U.S. comes with similarly stiff conditions and oversight by the Trump administration, which wields the right to raise tariffs if Japan does not align with U.S. preferences. Japanese business leaders share apprehensions about the rigidity of these terms and the uncertainty surrounding future trade relations, adding to the skepticism about the long-term benefits of their investment promises.

Taken together, the events of the past weeks illustrate a growing backlash in South Korea and Japan against what is increasingly perceived as heavy-handed U.S. trade diplomacy. For governments and companies in both countries, the question is becoming less about the willingness to support American industry and more about how sustainable and fair these arrangements will be moving forward. With hundreds of billions of dollars pledged, the stakes remain high, but so do the risks of eroding goodwill and investment enthusiasm.

For now, South Korean and Japanese leaders face a delicate balancing act: honoring international commitments while addressing the concerns and welfare of their citizens and business communities. The fallout from the Georgia raid and the terms of investment decision-making highlight just how complex and fragile this economic relationship has become in 2025.