What does Manilla have to do with Nevada? Well nothing actually, it just popped in our head. Kind of like click-bait, one can say.

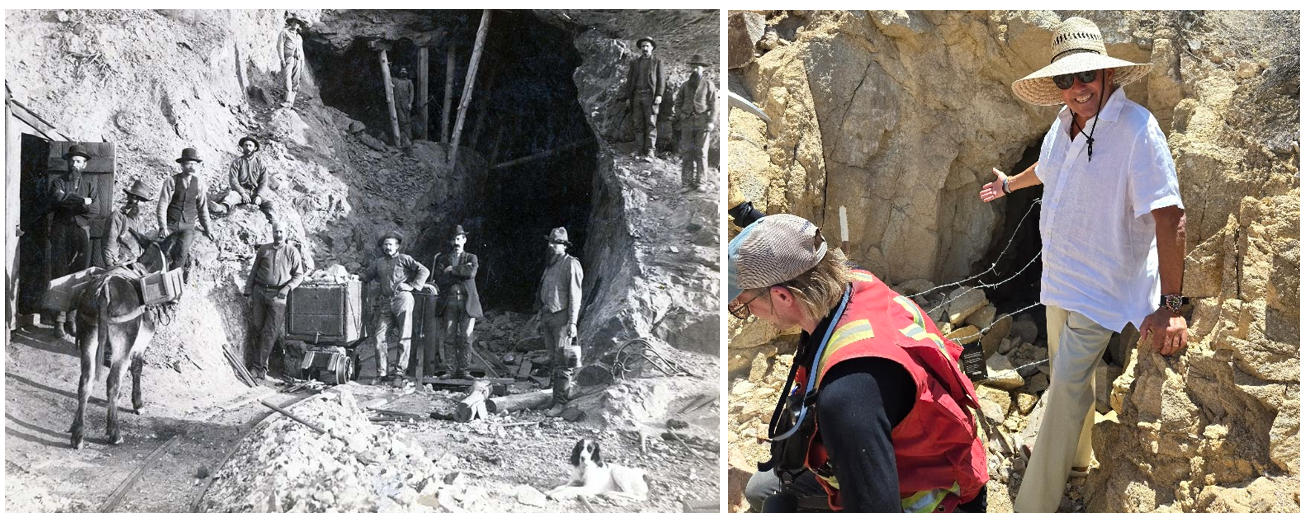

Anyway, we just got back from a road-trip to Goodsprings, Nevada. We went to meet with Dr. Sergei Diakov, who many believe is one of the Top ten precious metal geologists, in the entire world (with a multi-billion dollar track record to prove it). He was going to the Fairchild Gold (FAIR) property to do further ‘due diligence’ and to further sniff around, like geologist tend to repeatedly do over and over again, when they spot a potentially good property.

We thought it would be a good idea to meet him and at the same time, see firsthand what an abandoned mine (there are more than a dozen on the Fairchild property) looked like. We’re not new to the mining sector, but we are newbies at digging deep, into the practice of digging deep and why.

The truly world renowned, Dr. Diakov (in addition to numerous past and current projects), is now the Senior Advisor and Chairman of a newly established Technical Committee for publicly traded start-up Fairchild Gold Corp (FAIR) on the Toronto Venture Exchange. Depending on your quote vendor, it could be TSVX:FAIR, or FAIR:V.

The truly world renowned, Dr. Diakov (in addition to numerous past and current projects), is now the Senior Advisor and Chairman of a newly established Technical Committee for publicly traded start-up Fairchild Gold Corp (FAIR) on the Toronto Venture Exchange. Depending on your quote vendor, it could be TSVX:FAIR, or FAIR:V.

To be perfectly honest, our primary interest in the Nevada road tip, was in finding out “..why the hell is a guy who helped BHP Limited (BHP) then Rio Tinto (RIO) find the world class discovery called Oyu Tolgoi mine, or the ‘OT’ in Mongolia – of all places, be involved with a start-up valued under $10 million, with a property 43 miles outside of Las Vegas – of all places.”

To be perfectly honest, our primary interest in the Nevada road tip, was in finding out “..why the hell is a guy who helped BHP Limited (BHP) then Rio Tinto (RIO) find the world class discovery called Oyu Tolgoi mine, or the ‘OT’ in Mongolia – of all places, be involved with a start-up valued under $10 million, with a property 43 miles outside of Las Vegas – of all places.”

Sergei even wrote a book about it called the ‘Discovery of Oyu Tolgoi: A Case Study of Mineral and Geological Exploration.* He has worked for or with three of the Top ten producers in the world including; BHP, Anglo American and AngloGold Ashanti. With $87.5 billion in combined revenues, we think you’ll agree, they know a good geologist when they see one.

That, and so we could later brag, “We met and are now ‘friends’ with one of the top geologists in the world!” Oh and glad you asked, because we know you’d like details on just how big the OT discovery was, that Sergei helped find.

That, and so we could later brag, “We met and are now ‘friends’ with one of the top geologists in the world!” Oh and glad you asked, because we know you’d like details on just how big the OT discovery was, that Sergei helped find.

The OT discovery is estimated to have 1,850 tonnes (or 4.1 million pounds, or 62 million ounces) of Gold, valued at $217 billion at today’s prices, making it one of the world’s largest Gold and Copper mines (500,000 tonnes of cooper from 2008 to 2036) – with decades of mining ahead. To put it into perspective, Rio had revenues of $101 billion last year, up from $33 billion in 2016. So safe to say, they struck Gold in OT.

Around 560 people work in 12-hour shifts with a production rate of 100,000 tonnes a day. The open pit mine will eventually cover an area of 1×1.5 miles and will be about 2,100 feet deep.

Bigger picture, here are last years revenues of the Top 12 producers:

- Rio Tinto (RIO) $54B (as in billion)

- BHP (BHP) $53B

- Anglo American (AAL) $28B

- Newmont (NEM) $19.6B

- Barrick Mining (B) $13.3B

- Agnico Eagle (AEM) $8.9B

- AngloGold Ashanti (AU) $6.5B

- Kinross Gold (KGC) $5.5B

- Gold Fields Limited (GFI) $5.2B

- Wheaton Precious Metals (WPM) $1.4B

- Alamos Gold (AGI) $1.4B

- Franco Nevada (FNV) $1.2B

So again, we wonder what did or does he see, that has him interested in this Nevada property (along with some other very wealthy and sophisticated mining investors based in Montreal), at such an early stage? For investors, getting involved this early in the game is akin to getting involved in a Biotech company, when they are at the ‘pre-clinical’ stage. Big risk, big reward.

So while this is where the risks are the greatest, it’s also where the potential rewards are greatest. Investors at this stage aren’t looking for a 50 or even a 100% gain. They are patient and hoping they found the next ten-bagger. Covering all of our investment sectors, we’ve had 14 ten-baggers in the past 25 years. And we can assure you they take time.

Anyway, inquiring minds want to know. What’s so interesting Sergei? What did he see this early, that made him think “hmmm,” interesting. And then later make him think, “Hmm, I’d better get officially involved here, so I can be in charge of overturning every rock and stone (literally) – so if there is something big out there, it WILL be found!”

And not to be Captain Obvious, but as you can imagine dozens (if not hundreds) of Junior mining companies (many with excellent early prospects) would love to say that Dr. Diakov, is their Senior Advisor and Chairman of their Technical Committee. But he can’t kiss all the pretty girls, no matter how much stock or options they offer to award him with. Like investors, Geologists to pick their targets and projects carefully because exploration is time consuming, and everyone only has so much time.

Any Junior miner would love to brag that Sergei is on their property sniffing around. Like we are doing, right now! Keep in mind no matter how famous or talented a geologist is – they can’t magically make precious metals appear, when there is none or simply not enough.

What they are good at it, is finding it — IF it is there...and that’s good enough of a speculative clue, we can ever hope to have.

On the flip side, if he does find another motherlode to add to his resume AND we knew he was poking around the property, we would be sick if we were sitting on the sidelines – and the stock went up ten-fold, or even more without us. So investing at this level and risk stage, and holding for a few years, can be considered a ‘defensive’ stock purchase of sorts, just in case he and their Senior geologist Aaron S. McBreairty* (a rising star and AI data analysis expert) get lucky – so to speak. No “shoulda, woulda, coulda” in our lifespan.

Sergei and Aaron have to be believers – even if the overall odds are small (like with any Biotech) that their dreams come to fruition.

BTW the OT was discovered by tiny (once tiny) Turquoise Hill Resources*, a Canadian mineral exploration and development company headquartered in Montreal, Quebec (coincidently where Fairchild’s top investors are). Rio Tinto Group (RIO) stepped up to the plate in 2012, to develop what Turquoise Hill discovered as it takes billions to grind Gold from stone. Gold in 2012 was $1,600 an ounce or a discovery value of $62 billion in hindsight, using older reserve numbers. Meaning it’s been great decade for Rio, which has been at this game since 1873.

Just to connect the dots, as it can get confusing, Magma Copper was ‘first’ professional miner to the OT site in 1996. Then BHP acquired Magma later in the year. BHP surveyed (studied/explored) the property in detail from 1996 and 1999, and unfortunately (for them) decided not to proceed and flipped the property into a joint venture, resulting in an agreement with Ivanhoe Mines that allowed for acquisition of up to 100% of the project. Ivanhoe Mines Mongolia Inc. commenced exploration in May 2000, and achieved 100% of the project in 2002. In 2006, Rio Tinto entered into a joint venture agreement with Ivanhoe Mines, and in July 2012 obtained majority control of the latter which was renamed Turquoise Hill Resources. Source: Science Direct

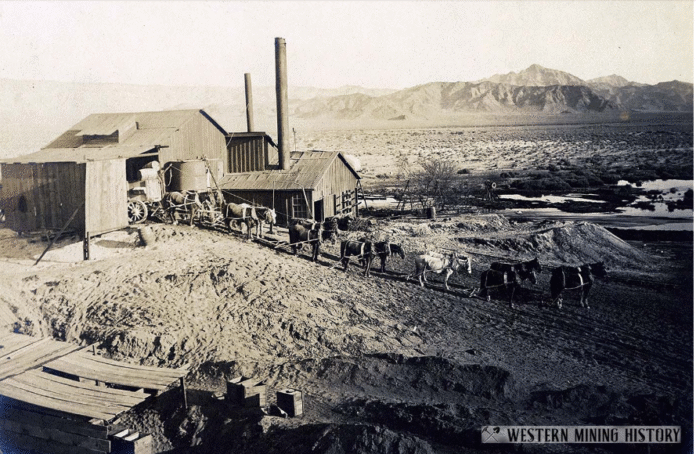

Our secondary interest is that when Gold was first discovered in Goodsprings in the late 1800’s, it was selling for a mere $18 an ounce. Gold had been mined from numerous spots all over the area, smelters were built and Gold was shipped out on horse and wagon, over extremely rocky terrain. Today there are dozens of these ‘hole in the mountain’ open mines, on the Fairchild property. We wanted to see them firsthand. Our theory is that using today’s technology, can they cost-effectively find more Gold and Copper. And at today’s prices, even less is more. A lot more. 183 times more to be exact.

Finding 100,000 ounces of gold in 1863, when Gold was first found at GoodSprings at $18.63 an ounce, would be worth $1,863,000. Respectable but not resume worthy. That same size discovery at today’s prices, would be worth $330 million. As in look what we found, a junior motherlode!

Using picks, shovels and dynamite, between 1902 and 1959 at the GoodSprings district and SearchLight District, both in Clark County Nevada, produced 305,812 ounces of gold — valued at $1,018,353,960 at today’s prices. Hmm.

So the goal isn’t discovering IF there is gold and copper on the property. The goal is discovering if there is ENOUGH additional gold or copper, yet to be discovered using MODERN techniques.

So the goal isn’t discovering IF there is gold and copper on the property. The goal is discovering if there is ENOUGH additional gold or copper, yet to be discovered using MODERN techniques.

Techniques such as ‘Induced Polarization’ or using ‘Arial Magnetometers’ (we’ll explain later in an upcoming detailed report) and AI for data analysis. This report is just a heads up, “look what we just found!” with more details to follow.

In sum, is Fairchild Gold Corp speculative? Yes. Volatile? Yes (see chart below). But the potential in our eyes is ENOURMOUS. So large in fact, if we dare put a number on it, for sure the SEC would come hunt us down! So we’ll just have to settle with “Yuge.”

Fairchild Gold is going to be our pet project for the next year, where we will reveal every nook and cranny and steps that a precious metals company (miners) like Fairchild needs to take, when they’ve chosen a property to explore. Also like a Biotech start-up, there will be dozens of ‘stop or continue’ milestones to expect in the coming months and years. Yes, we said years, because our base model (as with most Biotechs) is not to ‘trade’ the stock to make 30 or 40 or even 100%. Our model is do or die. Back in they 80’s when we worked for Drexel Burnham, we used to say “take the certificate (have yours delivered), throw it in a bottom drawer and don’t open the drawer for a couple years.” Capito?

In Biotech there are ongoing interim trials (milestones) which can say “stop” three people just died, trying to get cured. Or they (Independent Review Boards – IRB) can say “continue” searching, because early evidence (which they call ‘statistically significant’) has been encouraging. Still no guarantees, but continue digging.

In mining exploration there are similar milestones. Instead of independent review boards, mining exploration companies have Qualified Persons (QP) whose job is crucial for ensuring the accuracy and reliability of technical reports, verifying data, and maintaining transparency in mining operations. They can say, “look, give up, there ain’t enough – move to another location or shut down exploration.” Or they can say “Holy shit! Keep going, you may be onto something big here.”

Key Responsibilities of a QP in Mining:

Ensuring Compliance:

QPs ensure that industry standards and best practices are followed in technical reports and mining operations.

Data Verification:

They verify the accuracy and suitability of geological, metallurgical, and environmental data for public disclosure.

Technical Report Accuracy:

QPs are responsible for the scientific and technical information presented in reports related to mining projects.

Risk Mitigation:

By ensuring accuracy and compliance, QPs help mitigate risks associated with mining projects.

Maintaining Investor Confidence:

Their work helps build and maintain confidence in the viability of mining projects among investors and regulators.

Like any Biotech ‘exploration’ company searching for a new treatment for an ailment (which we’ve successfully done a number of times), there is no guarantee they will ever find, what they are hoping to find. But we what can guarantee, is our upcoming reporting will give you an education on the steps a mining company typically takes, to find the motherload. We will share details on every step Fairchild Gold takes.

A final similarity to the Biotech industry, is in funding, though to a much lesser extent. You could find (we have) a Biotech company with $100 million in cash – as Biotech investors on Wall Street have been funding these revenue-less exploration companies for decades. But.. they are spending $25 million a quarter on research (exploration). In essence investors are investing in six lab coats injecting patients with who knows what, and then collecting and monitoring data of what happens to these patients, with fingers crossed. No offsetting revenues are coming in, so it doesn’t take a genius to know the lab coats will be out of money in exactly one-year.

So investors closely monitor interim data. If the data six months into it comes in good (statistically significant) Wall Street may fund the company with an additional $250 million more. Or a big pharma Company like Pfizer will say, “seen enough we’ll take over from here.” Then they do a joint venture or they acquire the Biotech company for a couple billion.

The same thing happens in the mining industry. The mining company moves the ball so far, releases early data (which all the majors read) and they joint venture or raise additional capital, to move to the next step. In fact that is the game plan of the majority of Junior exploration companies. Put out good data, raise more funding, joint venture or potentially get acquired. Wash, rinse and repeat.

Immunomedics Goes from $3 to $87 and acquired for $26 Billion by Big Pharma

The reason we say to a “much lesser extent” is the funding required to “continue” is in the millions. Versus the hundreds of it costs to continue with Biotech’s. We’ll break down these cost in detail in our upcoming report. We’ll share how much will be needed for the next step and when it will be needed.

As example Brixton Metals which we recently added to the Watch List announced they were ‘fully’ funded with a $6 million raise. Adding Brixton Metals (BBBXF) $0.05 to the Watch List.

Perpetua Resources (PPTA) which we added to the Watch List raised $300 million, though aren’t just exploring, they are building a smelter. Adding Perpetua Resources (PPTA) $13.60 to Watchlist.

As an example let’s say the exploration team does a ‘visual‘ that has promising results. They say okay, let’s hire a helicopter with an arial magnetometer and further narrow down (or widen) where to start. This could be near where they visually saw the presence of surface minerals. Cost might be $100,000.

As an example let’s say the exploration team does a ‘visual‘ that has promising results. They say okay, let’s hire a helicopter with an arial magnetometer and further narrow down (or widen) where to start. This could be near where they visually saw the presence of surface minerals. Cost might be $100,000.

Then they may say, now let’s hire a Induced Polarization company to the examine the area highlighted by the magnetometer, this time further narrowing down the exploration area.

This involves injecting a direct current into the ground and then measuring the voltage decay after the current is switched off. That helps in identifying sulfide minerals like pyrite and chalcopyrite, which are often associated with valuable ore deposits. Maybe another $100,000. We can go on and on (and will later) but suffice to say, it is a lot less expensive than biomedical research, where lives are at stake.

So back to funding. GOOD ongoing data mean more money from Wall Street (or Montreal) to continue searching. In the case of mining companies, they might raise $5 million instead of the $100 million that Biotechs need to continue searching. So in that aspect, speculating in mining companies – can be a lot less expensive and thus less risky than investing in bio-medical companies.

As most subscribers are aware, we have been only been dabbling in precious metals since 2019, when Gold first broke a five-year ceiling at $1,400. But now we’re going balls deep. So subscribe and join us on what may be an extremely enjoyable journey.

Gold ($1,330) About to Cross the Magic Five Year High of $1,400?

Next week we’ll have details of our trip to Nevada including how Fairchild Acquired the Property.

*Founded in 1994, Turquoise was originally known as Indochina Goldfields Ltd, later renamed Ivanhoe Mines Ltd, and finally became Turquoise Hill Resources Ltd in 2012.

*Founded in 1994, Turquoise was originally known as Indochina Goldfields Ltd, later renamed Ivanhoe Mines Ltd, and finally became Turquoise Hill Resources Ltd in 2012.

*Diakov’s Oyu Tolgoi Book: Discovery of Oyu Tolgoi: A Case Study of Mineral and Geological Exploration

Modern Techniques: Magnetometers

Modern Techniques: Induced Polarization

Clark County Gold Mined (1902-1959)

Senior Geologist: *Aaron S. McBreairty (G.I.T).

An accomplished geologist and project director with over a decade of specialized experience in mineral exploration, project management, and the application of advanced technologies in geology.

His diverse skill set encompasses geological modeling, strategic planning for drilling operations, and data analysis, applied across numerous high-profile projects throughout North America. Recent work includes leadership roles on the Red Lake Cole Gold Project in Ontario and the Mustang Project in Newfoundland and Labrador’s Queensway region.

Mr. McBreairty’s expertise in 3D modeling (Seequent Target), remote sensing (ASTER, Landsat-7), and AI applications supports a technology-forward approach to modern exploration challenges. He has effectively led multidisciplinary teams, overseen complex drilling operations, and developed GIS-based georeferencing and data management solutions tailored to project needs.

Currently, he consults for multiple entities, focusing on porphyry projects in Nevada, where he provides strategic geological insights. In addition to his technical competencies, Mr. McBreairty demonstrates excellence in logistical planning, field operations, and regulatory compliance, consistently delivering results in demanding environments. His professional portfolio underscores a commitment to innovation, strategic leadership, and meaningful contributions to the advancement of the resource sector.

Goodsprings Nevada, 1910

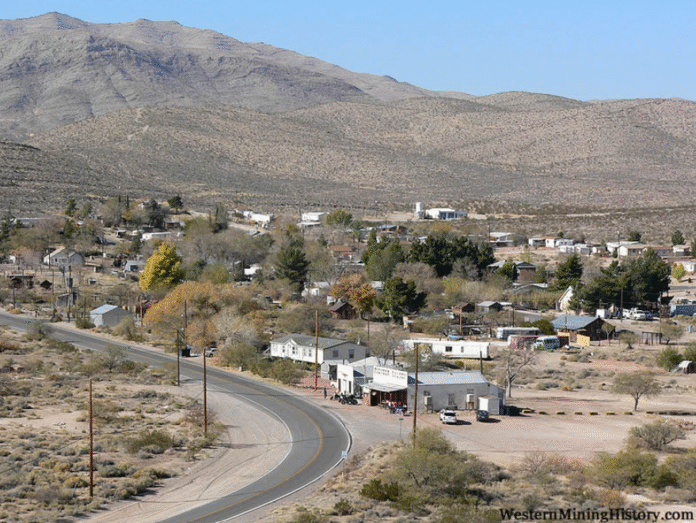

Goodsprings Nevada Today

Just saying, Goodsprings has roads, water and power, that could be appealing to a potential acquiror who wouldn’t have to invest in roads, water and power, to a remote location in the mountains of a place like Ecuador. And it’s always sunny!

Disclaimer:

Certain statements contained herein, as well as oral statements that may be made by Richard Redfern QP may constitute “forward-looking statements.” Any reference to a “Historical Resource” contained herein is considered historical in nature and as such is based on prior data and reports prepared by previous property owners. Some of the rock chip and drillhole sample assays presented herein are from historical data that may pre-date NI 43-101. Most of the assays were performed by professional, ISO- certified assaying companies. The historical works mostly were conducted under the supervision of a person who is/was a Qualified Person.

All post 2012 rock chip geochemical analyses were performed by certified assay labs. As such, the historical sampling, assaying and QA/QC protocols are not known, and therefore these results must also be seen and interpreted in an historical context. These data are presented here for historical information purposes only. These data have been studied and verified and felt to be appropriate at this early stage of this exploration project by Richard R. Redfern, MSc. and QP, who has written 43-101 technical reports on mineral properties.

The contents of this presentation, including the historical information contained herein, are for informational purposes only and do not constitute an offer to sell or a solicitation to purchase any securities referred to herein.

Forward looking statements

This presentation includes certain forward-looking statements about future events and/or financial results which are forward looking in nature and subject to risks and uncertainties. Forward-looking statements include without limitation, statements regarding the company’s plans, goals or objectives and future completion of mine feasibility studies, mine development programs, capital and operating costs, production, potential mineralization and reserves, exploration results and future planning and objectives of Fairchild. Forward-looking statements can generally be identified by forward-looking terminology such as “may,” “will,”, “expect,” “intend,” “estimate,” “anticipate,” “believe,” or “continues” or the negative thereof or variations thereon or similar terminology. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from expectations include risks associated with mining generally and pre-development stage projects in particular including but not limited to changes in general economic conditions, litigation, legislative, environmental and other judicial, regulatory, technological and operational difficulties, labor relations matters, foreign exchange costs & rates. Revelers Media an associated firm of Institutional Analyst and Institutional Gold Analyst to has been hired by the Company to build a news related website to disseminate news and SEDAR filings for a monthly retainer of two thousand and five hundred dollars a month. It will further negotiate for an equity stake in the company.

Credit: Internet Stock Review