Tesla (NASDAQ: TSLA) is preparing to introduce a lower-cost version of its popular Model Y crossover as it faces a noticeable drop in sales and a surge in competition from other electric vehicle makers. The American automaker has been dealing with a complex market landscape where slowing demand and new rivals are reshaping the electric vehicle sector.

Sales of Tesla’s Model Y, which has been a strong performer for the company, have declined compared to prior periods. This slowdown can be attributed to multiple factors, including increased competition from players such as Ford, with its Mustang Mach-E, General Motors’ Chevrolet Bolt EUV, and newer entrants like Rivian and Lucid Motors, which have all expanded their electric SUV lineup. The growing choices available to consumers, combined with broader economic pressures such as inflation and rising interest rates, have contributed to a more cautious approach among buyers.

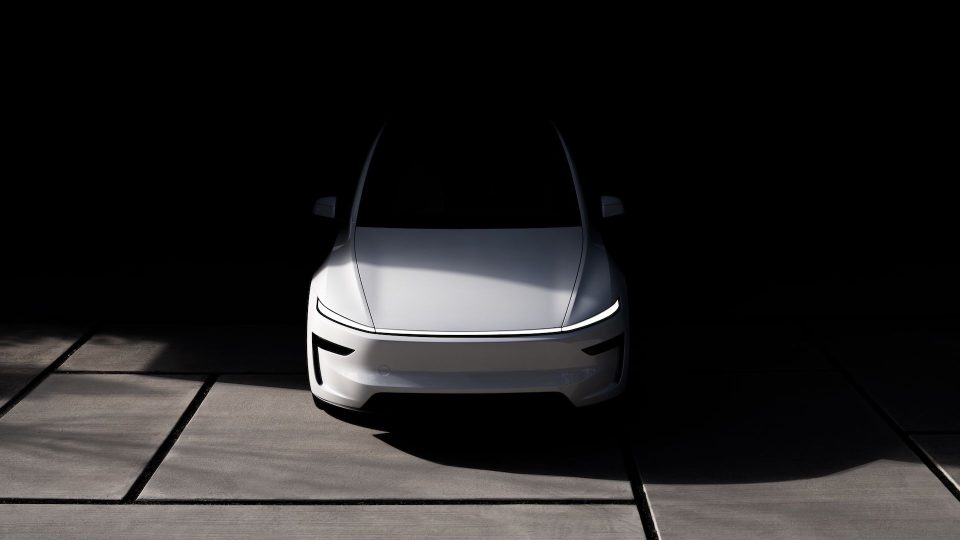

Tesla’s strategy to introduce a more affordable Model Y aims to recapture interest among price-sensitive consumers and address the challenge presented by competitors offering compelling alternatives at competitive price points. This move could help Tesla maintain momentum in the U.S. and global markets, where the cost of electric vehicles remains a significant factor influencing purchasing decisions.

While Tesla has long been a leader in the electric vehicle market, the landscape is evolving swiftly. Companies like Ford have invested heavily in their electric vehicle technology, broadening their offerings to include popular segments like crossovers and compact SUVs. General Motors has similarly doubled down on electric vehicle production with multiple models targeted at different market tiers. Meanwhile, newer companies such as Rivian have carved out a niche with rugged electric trucks and SUVs, while Lucid Motors focuses on luxury electric vehicles, making the competitive pressure especially intense across various price segments.

The introduction of a lower-cost Model Y highlights Tesla’s recognition that the market dynamics have shifted. Demand is no longer solely driven by brand loyalty or early adoption enthusiasm. Instead, affordability and value propositions weigh heavily as consumers weigh options from a wider array of manufacturers. Tesla had initially benefited from being one of the few electric vehicle manufacturers with scaled production capabilities, but competitors have since closed that gap considerably.

Tesla’s decision is likely a response to recent quarterly sales reports indicating that while the company still commands a large share of the electric vehicle market, the growth rate has slowed. The more affordable Model Y is expected to appeal to a segment of buyers who previously might have delayed purchase due to cost or have chosen electric vehicles from competitors leveling up their features and pricing.

This market-driven pricing adjustment comes amid ongoing efforts by automakers to meet increasingly strict emissions standards set by regulators, pushing many to accelerate their electric vehicle rollouts. The result is an expanded range of vehicles with varying price points that suit different lifestyles and budgets, further intensifying competition.

Tesla’s next challenge will be balancing the cost reduction with maintaining the performance and technology features that buyers expect. The Model Y has been noted for its long-range capability, acceleration, and advanced driver assistance features. How the company manages these attributes while cutting price will be critical in retaining its position among consumers who have many electric vehicle options available today.

The move to deliver a lower-cost Model Y reflects Tesla’s adaptability as the electric vehicle market transitions from early growth fueled by innovation and enthusiasm to a mature phase driven by consumer choice and competitive pricing. As the landscape changes, Tesla’s success will depend on delivering value that resonates with buyers increasingly spoiled for choice and price-conscious in a dynamic market environment.