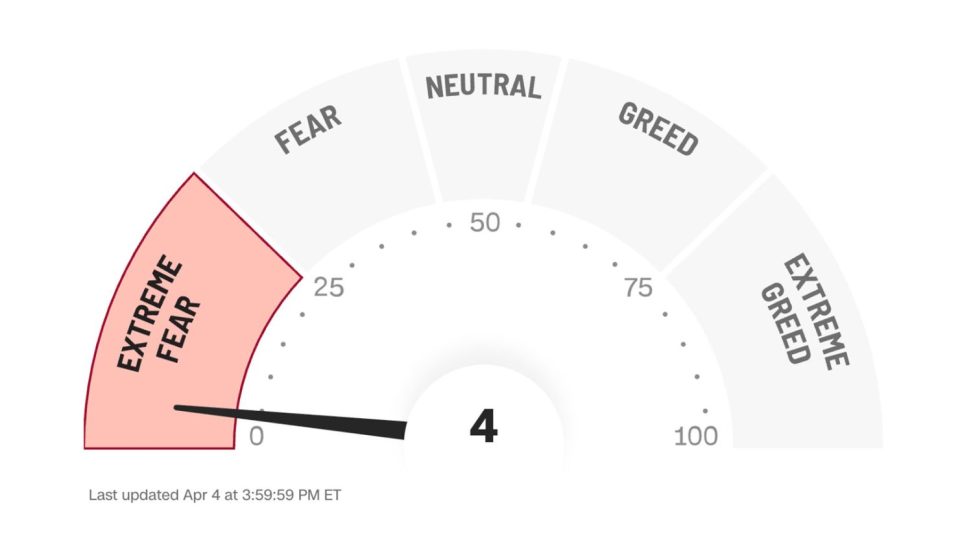

The CNN Fear and Greed Index, a widely followed gauge of investor sentiment, has shifted dramatically in recent weeks. After hitting an extreme low of 2 in April, signaling near panic levels, the index has climbed to 61 as of today, reflecting a market mood that has moved firmly into the territory of greed.

This index, which ranges from 0 to 100, combines seven market indicators to provide a snapshot of how investors are feeling. Scores near zero indicate extreme fear, often associated with market sell-offs and undervaluation, while scores near 100 suggest excessive greed, which can precede market bubbles or corrections. A reading between 40 and 60 is generally considered neutral. The recent rise from 2 to 61 marks a significant swing in sentiment within just a few weeks.

The index is built on seven components that capture different facets of market behavior:

- Stock Price Momentum: Measures the S&P 500’s current price relative to its 125-day average, indicating bullish or bearish trends.

- Stock Price Strength: Looks at the number of stocks hitting 52-week highs versus lows.

- Stock Price Breadth: Assesses the volume of stocks participating in market moves.

- Put and Call Ratio: Compares options trading volume for puts (bets on price declines) versus calls (bets on price increases).

- Market Volatility: Captured by the VIX index, reflecting uncertainty or calm.

- Safe Haven Demand: Compares performance of stocks to bonds, with higher bond demand signaling fear.

- Junk Bond Demand: Measures the spread between junk bonds and safer government bonds, with narrower spreads indicating greed.

Each factor is scored and combined equally to produce the overall index value.

In April, the index plunged to its lowest level since the early days of the COVID-19 pandemic in March 2020, when markets experienced sharp declines. At that time, the index hovered in single digits for weeks, coinciding with the S&P 500 losing over 30% of its value. The recent plunge to 2 was driven by heightened investor anxiety amid geopolitical tensions and trade uncertainties, particularly related to tariffs between the U.S. and China. Although a 90-day tariff reprieve was announced, uncertainty around future trade policies kept fear elevated.

Since then, the index has rebounded to 61, suggesting that investors have regained confidence and are more willing to take risks. This shift could be attributed to easing fears over trade disputes, better-than-expected economic data, or a reassessment of market valuations. However, such a rapid move toward greed also raises caution, as excessive optimism can lead to overvalued markets and increased vulnerability to corrections.

The Fear and Greed Index serves as a useful tool for understanding market psychology, which often drives price movements beyond what fundamentals alone would suggest. Extreme fear can signal buying opportunities as prices fall below intrinsic value, while extreme greed may warn of overheating markets.

Investors should consider the index alongside other analysis tools. For example, a reading above 60, like the current 61, suggests growing risk appetite but also the potential for complacency. Historically, sustainable market rallies tend to follow when the index moves above 25 after a period of fear, but caution is warranted as markets can be volatile during transitions between fear and greed.

While CNN’s Fear and Greed Index is a popular sentiment gauge, it is not the only one available. Other sentiment indicators may use different methodologies or focus on specific asset classes, such as cryptocurrencies, which have their own Fear and Greed Index based on similar principles.

Understanding these sentiment measures helps investors navigate market cycles by providing insight into collective behavior. Markets driven by emotion can deviate significantly from intrinsic values, creating both risks and opportunities.

The recent swing in CNN’s Fear and Greed Index from extreme fear to greed highlights the volatile nature of investor sentiment and its impact on market behavior. With the index now at 61, the market mood has shifted from cautious to optimistic, reflecting renewed confidence but also signaling the need for vigilance.