As global temperatures soar due to escalating greenhouse gas emissions, a new financial opportunity is emerging in the realm of carbon dioxide removal (CDR). This innovative field, which has gained traction only in recent years, is attracting significant investment as companies and investors alike seek solutions to mitigate climate change while capitalizing on what many view as a lucrative market.

CDR technologies, designed to extract carbon dioxide from the atmosphere, have garnered over $5 billion in funding since 2018, according to investment bank Jefferies. This surge marks a dramatic shift from previous years when such investments were virtually nonexistent. Damien Steel, CEO of Deep Sky, a Canadian company focused on CDR projects, describes this moment as “the single greatest opportunity I’ve seen in 20 years of doing venture capital,” highlighting the sector’s potential for growth.

The urgency for effective carbon removal solutions is underscored by the commitments of over 1,000 major corporations to achieve net-zero emissions in the coming decades. Companies like Microsoft, Google, and British Airways have already pledged approximately $1.6 billion towards purchasing carbon removal credits this year alone, a stark increase from less than $1 million in 2019. Industry experts predict that this figure could escalate to $10 billion in 2025, with McKinsey estimating the market could reach a staggering $1.2 trillion by 2050.

Despite these promising financial projections, the reality of CDR technology remains complex. Currently, only a handful of facilities are operational worldwide, and even the largest among them capture only a fraction of the daily greenhouse gas emissions produced globally. Experts caution that while investment is crucial, it will take time for these technologies to scale effectively and make a significant impact on atmospheric carbon levels.

Critics argue that while CDR can play a role in addressing climate change, it should not replace immediate efforts to reduce fossil fuel consumption. Many scientists advocate for a rapid transition away from oil, gas, and coal as the most effective strategy for combating global warming. The consensus is clear, while CDR offers a potential avenue for mitigating climate impacts, it must be part of a broader strategy that prioritizes emissions reductions.

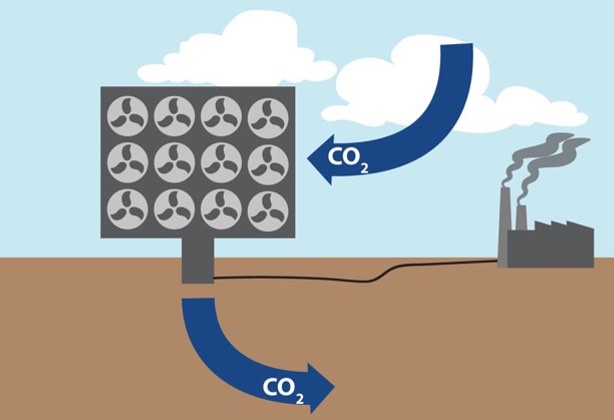

The landscape of carbon removal is diverse, encompassing various methods such as direct air capture (DAC), soil carbon sequestration, and enhanced mineralization. Each method presents unique challenges and opportunities for scalability and effectiveness. For instance, DAC technologies can extract CO2 directly from ambient air but require substantial energy inputs and infrastructure development.

As the market evolves, companies involved in CDR are not just focused on environmental benefits but are also keenly aware of the economic implications. The potential for job creation and technological innovation within this sector could drive significant economic growth while addressing one of humanity’s most pressing challenges.

The race to develop and deploy carbon removal technologies represents both an environmental imperative and a financial opportunity. Investors are increasingly drawn to this burgeoning industry as they recognize its potential to deliver both ecological benefits and substantial returns. However, achieving meaningful progress will require continued investment as well as a commitment to comprehensive strategies that address the root causes of climate change. As we move forward, balancing innovation with responsibility will be crucial in shaping a sustainable future.