Fortune Minerals Limited

Trump’s Tariff Threats Boost Urgency for Domestic Critical Minerals

Published: March 28, 2025

Author: FRC Analysts

View Complete Report*This report and research coverage is paid for and commissioned by Fortune Minerals Limited – See the bottom of this report for other important disclosures rating, and risk definitions. All figures in C$ unless otherwise specified.

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

Ticker Symbols: FT.TO – TSX FTMDF – NASDAQ

️ Fortune Minerals Limited is an FRC Top Pick ️

- FT’s NICO project in the NWT hosts the largest primary cobalt deposit in North America, the world’s largest bismuth deposit, and 1.1 Moz of gold. The U.S., EU, and Canada have identified cobalt, bismuth, and copper as critical minerals. In 2024, the company secured funding commitments totaling ~$17M from the U.S Department of Defense, and the Government of Canada.

- Gold prices are near-record highs, driven by investor demand for safe-haven assets amidst economic and political uncertainty, with geopolitical and trade war risks supporting a positive near-term outlook.

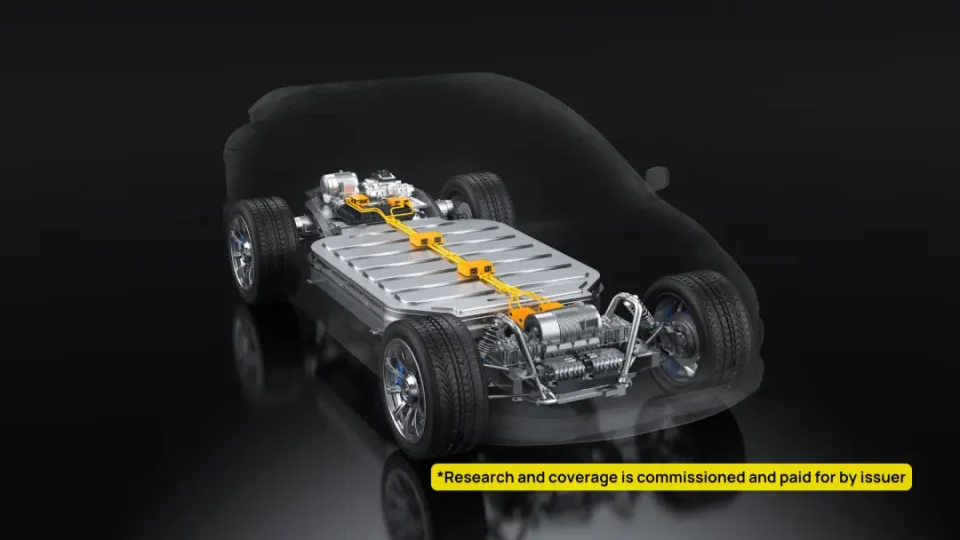

- Cobalt prices are up 56% in the past month after the Democratic Republic of the Congo temporarily halted exports to address oversupply, and support prices. While the market will likely remain in surplus over the next two to three years, we remain optimistic about the long-term outlook due to robust global demand for Electric Vehicles (EVs).

- Bismuth prices are up 567% in the past two months, driven by China’s export restrictions on critical metals, including bismuth, in response to new tariffs introduced by Trump.

- FT’s plan involves building a mine and concentrator in the NWT, and converting a former steel fabrication plant in Alberta into a hydrometallurgical refinery, capable of producing cobalt sulphates, gold doré, bismuth ingots, and copper.

- The company’s collaboration with Rio Tinto (NYSE: RIO) has confirmed the feasibility of processing materials from RIO’s Kennecott operations in Utah at FT’s proposed refinery site in Alberta. Management is also in discussions with other companies interested in recovering cobalt and bismuth from residues.

- FT’s immediate goals include finalizing the refinery plant site purchase, completing an updated Feasibility Study (FS), and permitting.

- While Trump’s tariff threats have raised uncertainties, we anticipate growing demand for critical metal sources in North America to reduce reliance on China. Battery/EV manufacturers/miners are actively seeking stable/long-term supply sources.