*See the Disclaimer on the bottom of this page for important disclosures.

The Nevada desert has always been a place of hidden wealth, a silent expanse where volcanic ridges hold secrets beneath their dust. This month, those secrets drew Fairchild Gold Corp. (TSXV: FAIR, FRA: Y4Y) deeper into the state’s mineral heartland. The company has struck a deal with Emergent Metals Corp. (TSXV: EMR) to acquire the Golden Arrow Gold and Silver Project, a transaction that delivers Fairchild full ownership of a property rich with resources, exploration upside, and a coveted position in one of America’s most productive mineral belts.

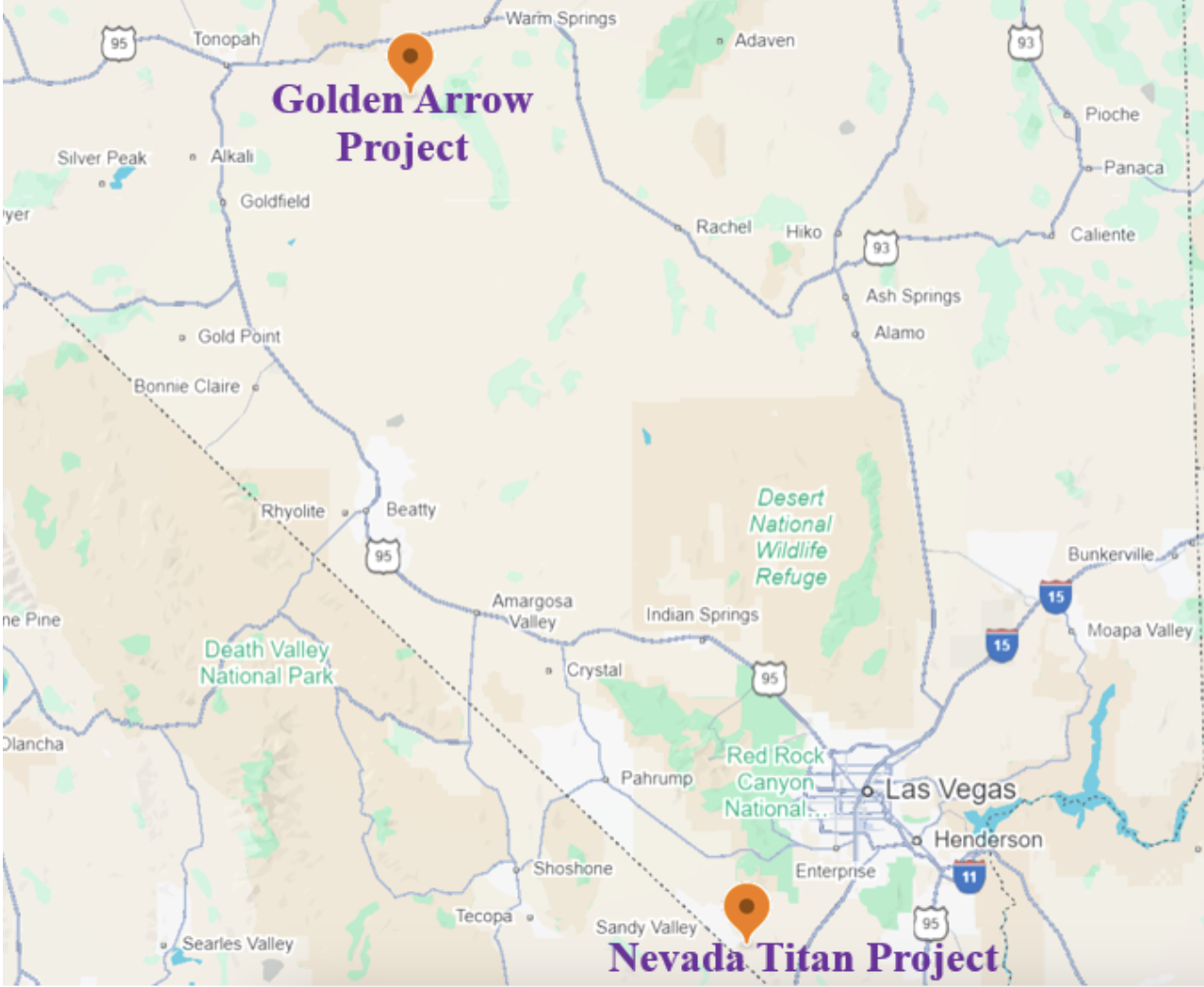

Golden Arrow lies some forty miles east of Tonopah, within reach of Kinross Gold’s Round Mountain mine, which has already yielded over fifteen million ounces of gold. To Fairchild executives, geography itself is strategy. With Golden Arrow only 165 miles from its flagship Nevada Titan project, the acquisition secures both scale and diversity across two of the state’s prominent mineralized trends.

The property is vast, 10,000 acres threaded together from seventeen patented claims and nearly five hundred unpatented claims. The distinction carries weight in mining circles. Patented claims give Fairchild outright ownership of land and mineral rights, with no government restrictions. Unpatented claims, by contrast, are staked on federal ground, where companies stay bound to Bureau of Land Management oversight and annual fee obligations. Since federal authorities ceased approving new patents decades ago, Golden Arrow’s mix provides Fairchild both security and uncommon leverage across Nevada’s mining landscape.

Within that acreage, two mineral zones, Gold Coin and Hidden Hill, hold the greatest promise. A 2018 resource estimate detailed measured and indicated resources of about 296,500 ounces of gold and nearly four million ounces of silver, with another 50,400 ounces of gold and 1.25 million ounces of silver in the inferred category. Those numbers rested on a foundation of more than 360 drill holes and 200,000 feet of historic drilling, a body of evidence deep enough to attract Fairchild, but open-ended enough to leave the story unfinished. Company officials have made clear they intend to update the estimate to reflect today’s gold and silver prices and modern geological modeling.

This is not barren ground. The project sits within a volcanic field adjacent to the Kawich Caldera, a landscape shaped by fire and fractured into epithermal deposits. Both bulk-tonnage mineralization and narrower, high-grade veins have been mapped, with multiple step-out targets extending beyond the defined zones. For Fairchild, this means possibility. For investors, it means potential growth still to be quantified.

A key advantage is timing. Golden Arrow comes with advanced permits already in place, including a BLM-approved Plan of Operations covering nearly a quarter of a million feet of new drilling. In a sector where red tape can delay exploration by years, this head start could prove decisive.

The financial terms are a careful balance between cash, equity, and future obligations. Emergent Metals received a US$250,000 deposit on signing, with another US$350,000 due on exchange approval. They will also hold 12.5 million Fairchild shares, though their stake remains capped below 9.9%. Further, Emergent carries a senior secured note worth US$3.5 million at 8.5% interest, maturing in five years, alongside a 0.5% Net Smelter Royalty that Fairchild can buy back at a later date for between US$1.0 and US$1.5 million. It is a structure that ensures Emergent exits the driver’s seat but retains a lasting presence in the project’s future.

Fairchild has already moved to strengthen leadership for the task ahead. Industry veteran Guy Lauzier joins as Technical Director, bringing decades of experience from Barrick, Newmont, and Agnico Eagle. His track record spans both open-pit and underground operations, regulatory navigation, and community engagement, qualities that will prove essential as Golden Arrow transitions from historical resource into developing project.

Executive Chairman Nikolas Perrault called the acquisition an “ideal complement” to Titan, framing Golden Arrow not as an isolated win, but as a piece of Fairchild’s broader Nevada expansion. “You don’t just secure ounces underground,” he suggested. “You secure the options to grow, to adapt, and to compete among the largest producers operating in Tier 1 jurisdictions.”

Golden Arrow is more than a set of numbers on a resource chart. It is a landscape already marked by industry giants, ripe with proven ounces, and permitted for the next wave of drilling that could reshape its future. For Fairchild, it represents both immediate optionality and the long game, control of ground in Nevada, where the desert’s silence still hides veins of fortune.

Compensation Disclosure – VYRE Business News Global TV (VBNGtv) provides readers with general, non-personalized information regarding private and publicly traded companies that have retained VBNGtv to provide advertising, branding, marketing, and news syndication on their behalf. VBNGtv receives compensation from some of the companies it profiles in the form of cash, check, credit card and or wire payments. Monthly fees ranging from $3,330 to $7,500 per month have been paid to VBNGtv by Fairchild Gold Corp. for these services. This fee creates a potential conflict of interest which readers should consider. In addition, to the extent that parties, including the companies discussed, investors or others, further disseminate content or other statements provided by VBNGtv, such parties operate outside of VBNGtv’s control and such further dissemination is without the permission and authority of VBNGtv. Such further dissemination may not be accompanied by appropriate disclaimers or other disclosures, and VBNGtv assumes no responsibility for and expressly disclaims responsibility for any such statements, omissions or dissemination.

Because VBNGtv receives compensation for disseminating information, we may have a conflict of interest in terms of disseminating negative information about the companies that retain us. While we strive to present non-personalized commentary and analysis in a disinterested manner, readers should consider our arrangements in reaching their independent decision as to how to use the information contained on the VBNGtv website. It should be noted that we DO NOT (i) have authority over the funds of any of our readers, (ii) exercise decision-making authority to handle any of our readers’ portfolios or (iii) engage in individualized, investment-related interactions with subscribers.

In addition, our independent contactors, writers and editors who provide content or review content contained on VBNGtv’s website are hereby explicitly notified that they should not be buying, selling or maintain positions in securities of the companies discussed on VBNGtv’s website. Such trading, which necessarily reflects an individual’s personal resources and financial condition, may be inconsistent with statements on VBNGtv’s website. VBNGtv assumes no responsibility for and expressly disclaims responsibility for any statements or omissions about compensation to all independent contactors, writers and editors who provide or review content.

VBNGtv DOES NOT MAKE ANY WARRANTIES, EXPRESSED OR IMPLIED, AS TO RESULTS TO BE OBTAINED FROM USING THIS INFORMATION AND MAKES NO EXPRESS OR IMPLIED WARRANTIES OR FITNESS FOR A PARTICULAR USE. ANYONE USING THIS REPORT ASSUMES FULL RESPONSIBILITY FOR WHATEVER RESULTS THEY OBTAIN FROM WHATEVER USE THE INFORMATION WAS PUT TO. ALWAYS TALK TO YOUR FINANCIAL ADVISOR BEFORE YOU INVEST. WHETHER A STOCK SHOULD BE INCLUDED IN A PORTFOLIO DEPENDS ON ONE’S RISK TOLERANCE, OBJECTIVES, SITUATION, RETURN ON OTHER ASSETS, ETC. ONLY YOUR INVESTMENT ADVISOR WHO KNOWS YOUR UNIQUE CIRCUMSTANCES CAN MAKE A PROPER RECOMMENDATION AS TO THE MERIT OF ANY PARTICULAR SECURITY FOR INCLUSION IN YOUR PORTFOLIO. The information provided is solely for informative purposes and is not a solicitation or an offer to buy or sell any security. It is not intended as being a complete description of the company, industry, securities or developments referred to in the material. Any forecasts contained in this report were independently prepared unless otherwise stated and HAVE NOT BEEN endorsed by the Management of the company which is the subject of any report. ALL INFORMATION PRESENTED IS COPYRIGHT. YOU MAY NOT REDISTRIBUTE ANY OF THIS INFORMATION WITHOUT OUR PERMISSION. Please give proper credit, including citing VYRE Business News Global and/or the analyst, when quoting information presented by VBNGtv.

The information contained on the VBNGtv website is intended to be viewed only in jurisdictions where it may be legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations or which would require any registration requirement within such jurisdiction.