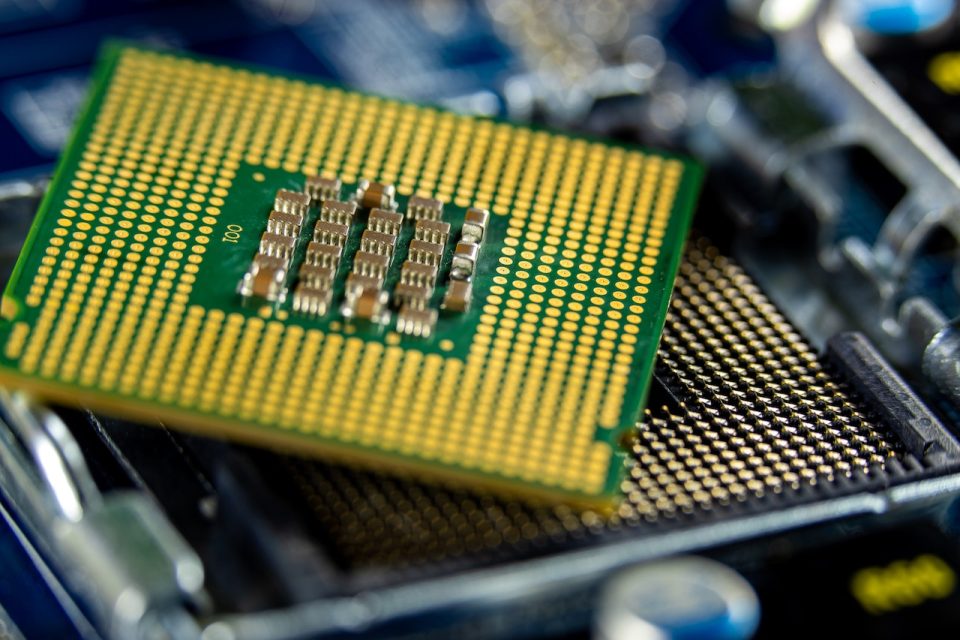

In a significant move, the Biden administration has imposed sweeping regulations, strategically aimed at severing China’s access to critical US artificial intelligence (AI) chips. Concurrently, these rules have discreetly offered a potential lifeline to major players in the US semiconductor industry, including Nvidia (NVDA), Intel (INTC), and Advanced Micro Devices (AMD), enabling them to maintain their foothold in one of the world’s largest chip markets.

Amidst the 400-plus pages of rules and regulations unveiled on Tuesday, the US Bureau of Industry and Security (BIS) revealed its willingness to engage with the semiconductor industry for input on ways to continue supplying AI chips to China, particularly for small and medium-sized systems.

The primary objective behind these rules is to curb China’s capacity to harness American chips for constructing colossal supercomputers, which could potentially be deployed in endeavors akin to OpenAI’s ChatGPT, or even for military applications, according to officials. Thomas Krueger, a former official at the US National Security Council, emphasized that the guiding principle of these regulations is to focus on capabilities that could empower Chinese military systems, rather than pursuing broad consumer applications.

US officials are soliciting proposals for a “tamperproof” method to prevent systems containing up to 256 AI chips from being aggregated into supercomputers. The BIS outlined, “This approach could constrain (controlled AI chips) from being used to train large dual-use AI foundation models with capabilities of concern, while allowing AI training capabilities at a small or medium scale.”

Nvidia, Intel, and AMD refrained from making immediate comments. Notably, Nvidia experienced a 4.67% decrease in shares following the announcement of the new regulations on Tuesday.

Additionally, US authorities have dealt a substantial blow to the most formidable Chinese competitors of Nvidia, Intel, and AMD. The new regulations are set to render it exceedingly challenging for Moore Threads and Biren, two well-funded Chinese startups established by former Nvidia personnel, to have their designs fabricated using cutting-edge chipmaking technology. Consequently, whatever Nvidia manages to sell in China is poised to become the prime legal option for Chinese buyers.

Analysts at Piper Sandler conveyed the expectation that Nvidia will swiftly redesign a chip to align with the new standards with minimal disruptions to the existing business outlook.

As part of the newly published rules slated to take effect in 30 days, US officials have targeted China’s chip manufacturers by imposing restrictions on the export of advanced chipmaking equipment, specifically the immersion deep ultraviolet (DUV) lithography machines that incorporate any American components.

Industry expert Dan Hutcheson of TechInsights stated, “What they’re really doing is closing all the doors,” underscoring that these regulations could substantially limit potential future advancements. The DUV machines are not produced by American manufacturers, but are instead manufactured by Japan’s Nikon and the Netherlands’ ASML.

The new rules regarding DUV machines formalize diplomatic efforts between the US, Japan, and the Netherlands to institute similar controls on exporting these machines to China. This was confirmed by Clete Willems, a trade and policy attorney with Akin Gump.

While immersion DUV machines may not produce state-of-the-art chips, they come close and are believed to have been recently employed by Huawei’s chip manufacturing partners in creating a new smartphone chip for its Mate 60 Pro.

Gregory Allen, a director at the Center for Strategic and International Studies, expressed that this control alone could constrain China’s capacity for advanced node semiconductor manufacturing for years. He noted, “If spare parts and components for the equipment can be effectively controlled, the new regulations may degrade the advanced node manufacturing facilities that China currently has in operation.”

Unlike the broader range of tools affected by last year’s export restrictions, this latest move specifically targets the technologies and techniques utilized in the intricate machines necessary for constructing advanced transistor designs, as detailed by David Kanter, President of Real World Insights. This narrower scope enables toolmakers to continue selling equipment designed for producing older chips without fear of contravening government restrictions.

In conclusion, these meticulously crafted rules exemplify the Biden administration’s strategic approach to safeguarding both national security and the interests of the US semiconductor industry, ensuring its resilience in an ever-evolving global technological landscape.

Source: Reuters